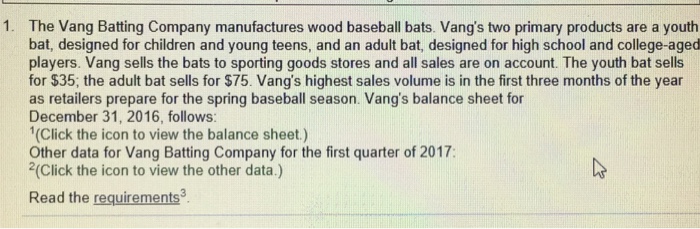

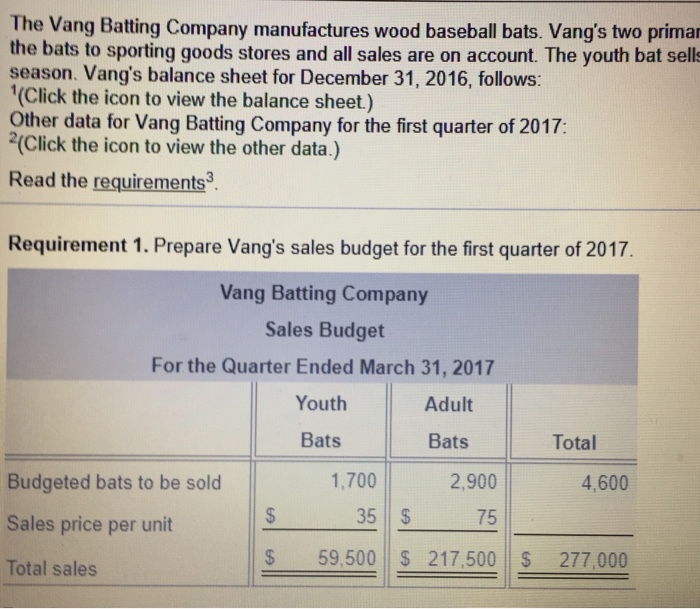

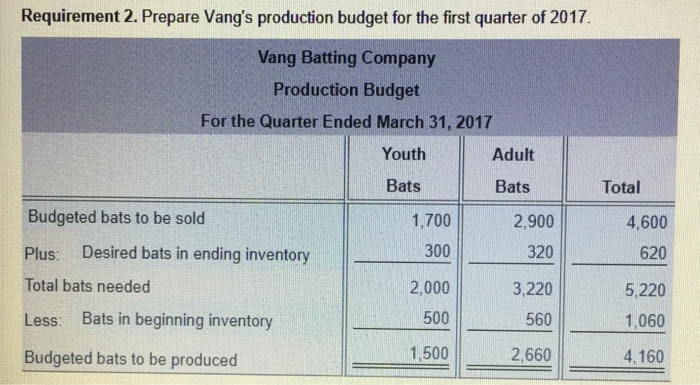

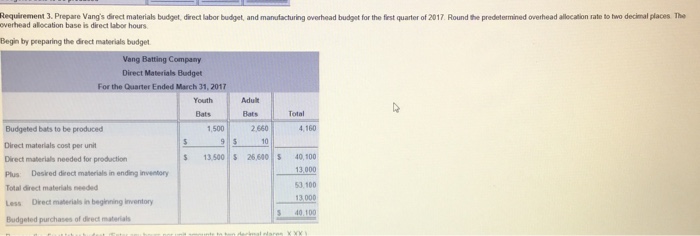

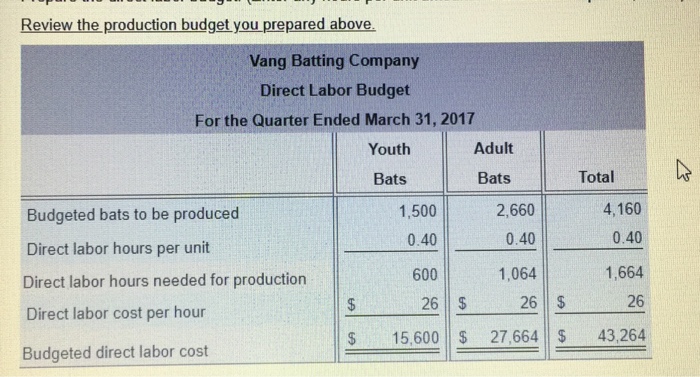

Question: 1. On requirement 3 - I need to know how the predetermined overhead allocation rate is calculated? 2. Complete Requirement 4 w/ instructions. 3. Complete

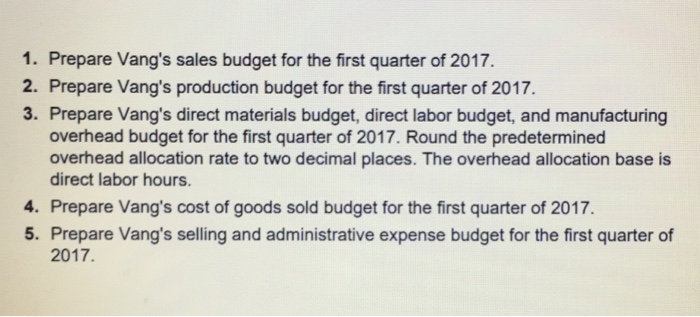

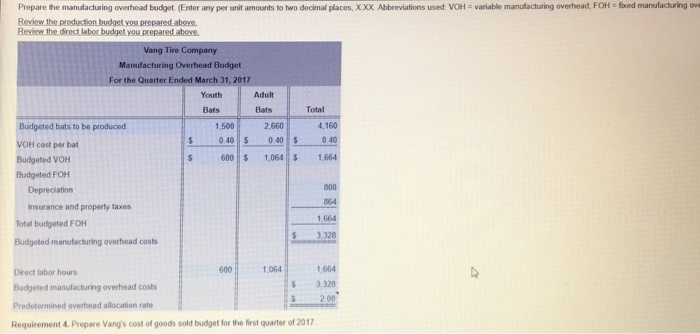

1. On requirement 3 - I need to know how the predetermined overhead allocation rate is calculated?

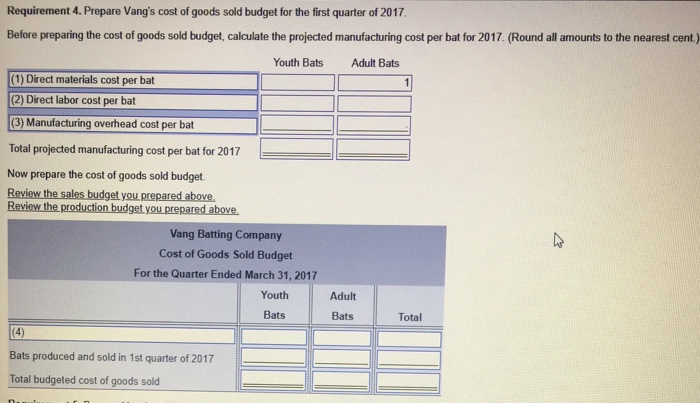

2. Complete Requirement 4 w/ instructions.

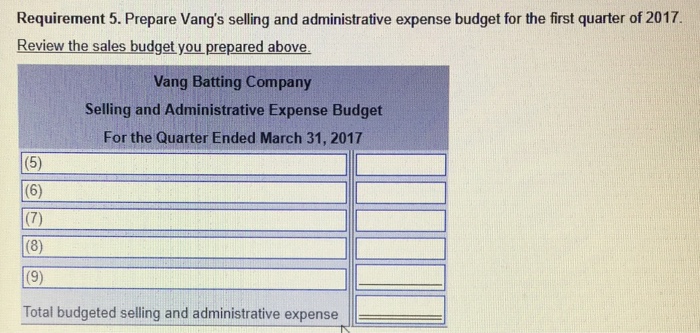

3. Complete Requirement 5 w/ instructions.

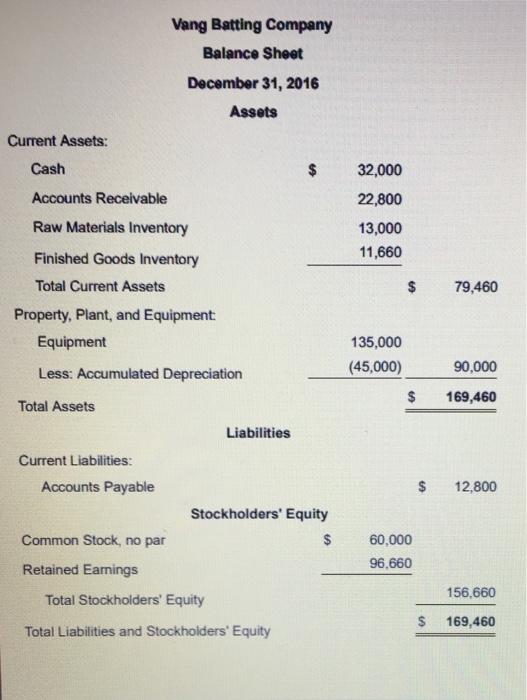

Vang Batting Company Balance Sheet December 31, 2016 Assets Current Assets: Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory Total Current Assets $ 32,000 22,800 13,000 11,660 $ 79,460 Property, Plant, and Equipment 35,000 (45,000) Equipment 90,000 Less: Accumulated Depreciation S 169,460 Total Assets Liabilities Current Liabilities: Accounts Payable $ 12,800 Stockholders' Equity s Common Stock, no par 60,000 96,660 Retained Eanings 156,660 Total Stockholders' Equity $ 169,460 Total Liabilities and Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock