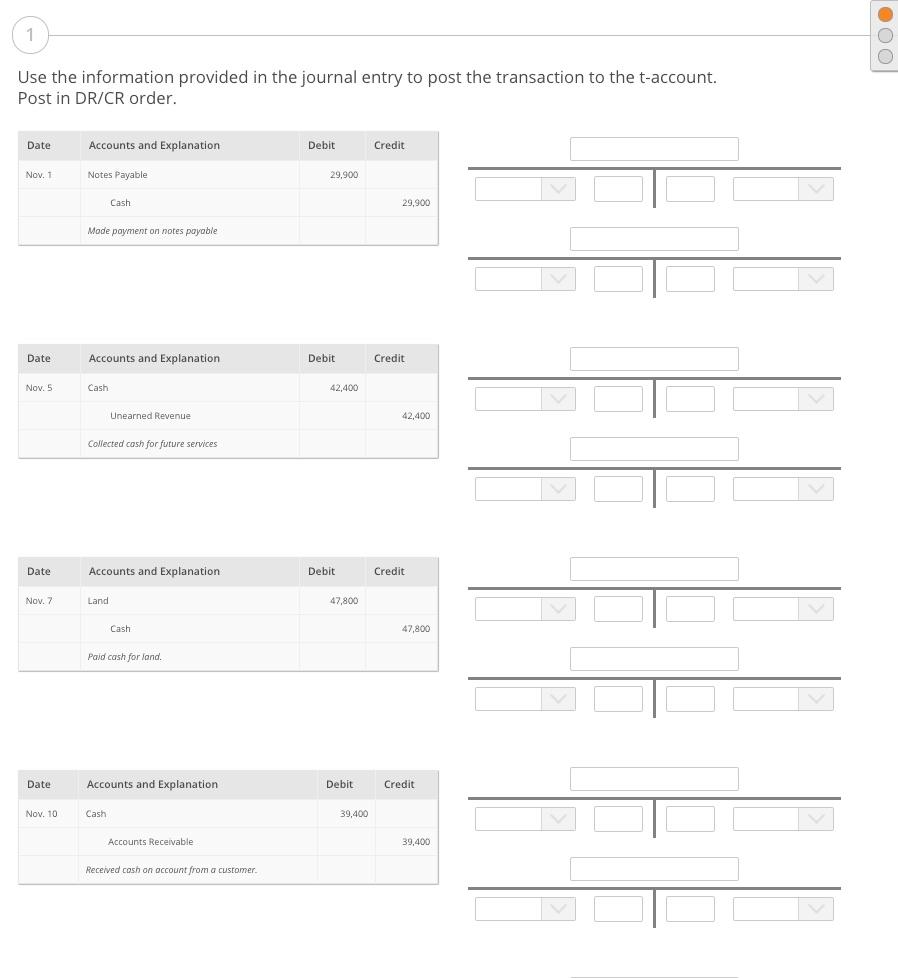

Question: 1 OOO Use the information provided in the journal entry to post the transaction to the t-account. Post in DR/CR order. Date Accounts and Explanation

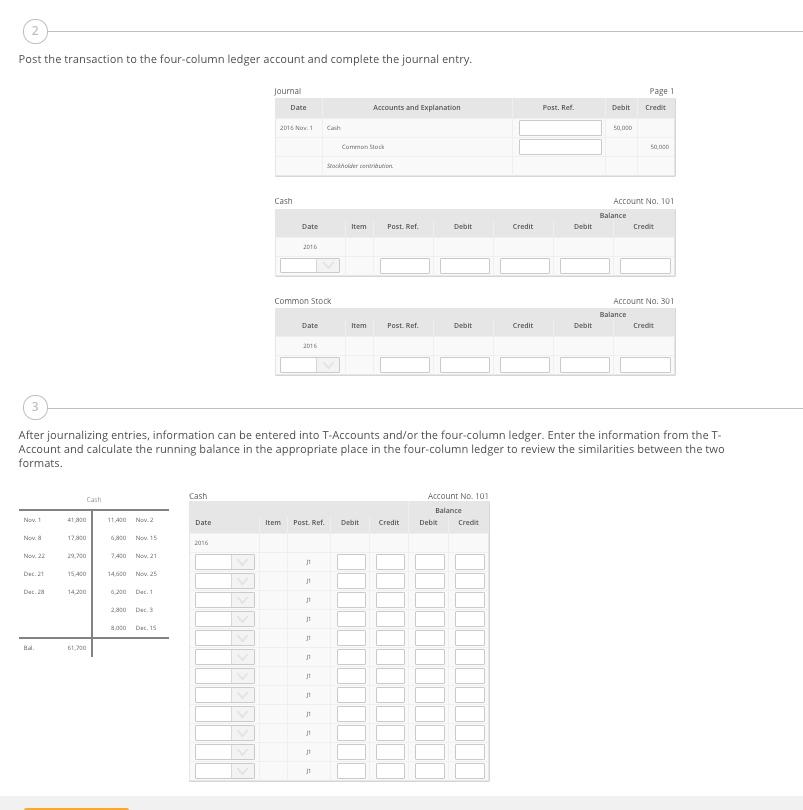

1 OOO Use the information provided in the journal entry to post the transaction to the t-account. Post in DR/CR order. Date Accounts and Explanation Debit Credit Nov. 1 Notes Payable 29,900 Cash 29,900 Mode payment on notes payable Date Accounts and Explanation Debit Credit Nov. 5 Cash 42.400 Unearned Revenue 42,400 Collected cash for future services Date Accounts and explanation Debit Credit Nov. 7 Land 47,800 Cash 47,800 Paid cash for land. Date Accounts and Explanation Debit Credit Nov. 10 Cash 39,400 Accounts Receivable 39,400 Received cash on account from a customer. Post the transaction to the four-column ledger account and complete the journal entry. Journal Date Page 1 Credit Accounts and explanation Post. Ret Debit 2016 50 000 Commons 50.000 Stockholour contribution Cash Account No. 101 Balance Credit Date Item Post. Ref Debit Credit Debit 2016 Common Stock Account No. 301 Balance Credit Date Item Post. Ref. Debit Credit Debit 2016 After journalizing entries, information can be entered into T-Accounts and/or the four-column ledger. Enter the information from the T- Account and calculate the running balance in the appropriate place in the four-column ledger to review the similarities between the two formats. Cash Account No. 101 Balance Debit Credit No.1 Nov. 2 Date Item Post. Ref. Debit Credit Nowa 12800 6.200 Nov 15 2016 Nov 22 29.00 Nov. 21 1 15400 14.000 Nov 25 0.200 11 2.800 De J1 2.000 De 15 11 Hall 6700 JI 11 1 11 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts