Question: 1. Perform write-off 2. Calculate balance after write-off 3. Apply 2 step process to determine required adjusted journal entry As of 12/31/7, Chase Company had

1. Perform write-off

2. Calculate balance after write-off

3. Apply 2 step process to determine required adjusted journal entry

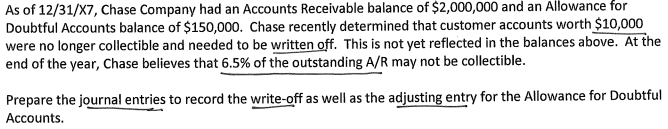

As of 12/31/7, Chase Company had an Accounts Receivable balance of $2,000,000 and an Allowance for Doubtful Accounts balance of $150,000. Chase recently determined that customer accounts worth $10,000 were no longer collectible and needed to be written off. This is not yet reflected in the balances above. At the end of the year, Chase believes that 6.5% of the outstanding A/R may not be collectible. Prepare the journal entries to record the write-off as well as the adjusting entry for the Allowance for Doubtful Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts