Question: 1) P&G electric is considering rerouting a high-voltage power line. The proposed route will have a capital cost of $2.2 million with an annual maintenance

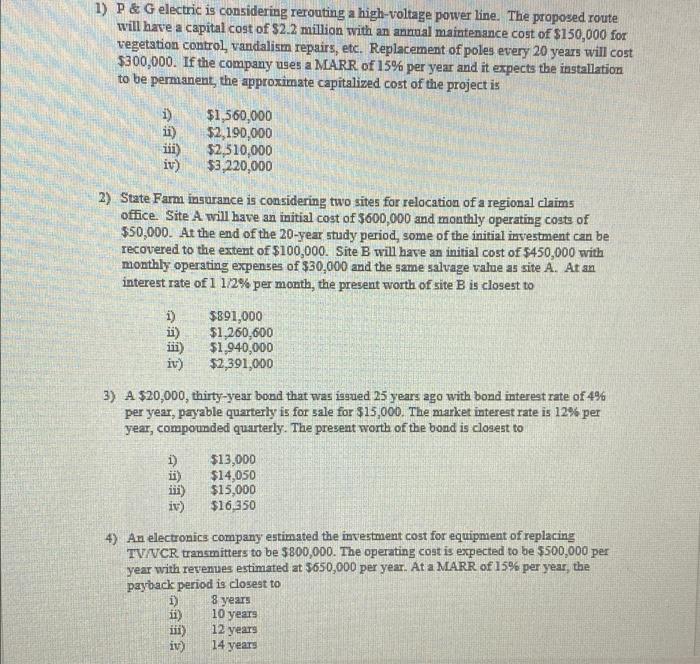

1) P&G electric is considering rerouting a high-voltage power line. The proposed route will have a capital cost of $2.2 million with an annual maintenance cost of $150,000 for vegetation control, vandalism repairs, etc. Replacement of poles every 20 years will cost $300,000. If the company uses a MARR of 15% per year and it expects the installation to be permanent, the approximate capitalized cost of the project is i) ii) iii) iv) $1,560,000 $2,190,000 $2,510,000 $3,220,000 2) State Farm insurance is considering two sites for relocation of a regional claims office. Site A will have an initial cost of $600,000 and monthly operating costs of $50,000. At the end of the 20-year study period, some of the initial investment can be recovered to the extent of $100,000. Site B will have an initial cost of $450,000 with monthly operating expenses of $30,000 and the same salvage value as site A. At an interest rate of 1 1/2% per month, the present worth of site B is closest to 1) ) iii) iv) $891,000 $1,260,600 $1,940,000 $2,391,000 3) A $20,000, thirty-year bond that was issued 25 years ago with bond interest rate of 496 per year, payable quarterly is for sale for $15,000. The market interest rate is 12% per year, compounded quarterly. The present worth of the bond is closest to $13,000 i) $14,050 iii) $15,000 iv) $16,350 4) An electronics company estimated the investment cost for equipment of replacing TV/VCR transmitters to be $800,000. The operating cost is expected to be $500,000 per year with revenues estimated at 5650,000 per year. At a MARR of 15% per year, the payback period is closest to 1) 11) iii) iv) 8 years 10 years 12 years 14 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts