Question: 1. Please also share how you solved it Case 1 (capital budgeting, 2.75 points) There are two mutually exclusive projects with cash flows as follows:

1. Please also share how you solved it

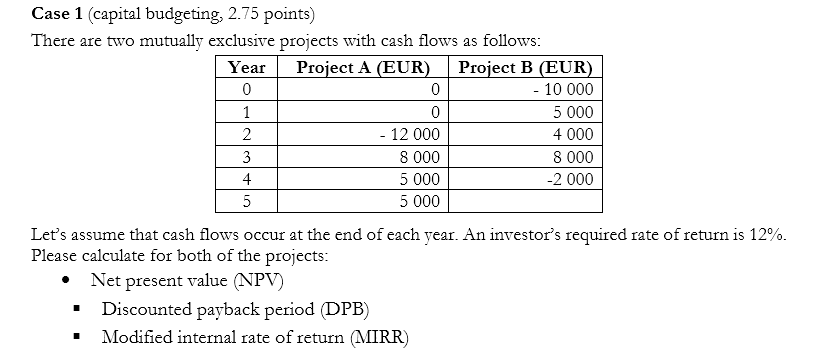

Case 1 (capital budgeting, 2.75 points) There are two mutually exclusive projects with cash flows as follows: Year Project A (EUR) Project B (EUR) 0 0 - 10 000 1 0 5 000 2 - 12 000 4 000 3 8 000 8 000 4 5 000 -2000 5 5 000 Let's assume that cash flows occur at the end of each year. An investor's required rate of return is 12%. Please calculate for both of the projects: Net present value (NPV) Discounted payback period (DPB) Modified internal rate of return (MIRR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts