Question: 1. Please answer with excel formulas 2. Create a common size income statement for 2017 and 2018 for Home Depot 3. Perform ratio analysis on

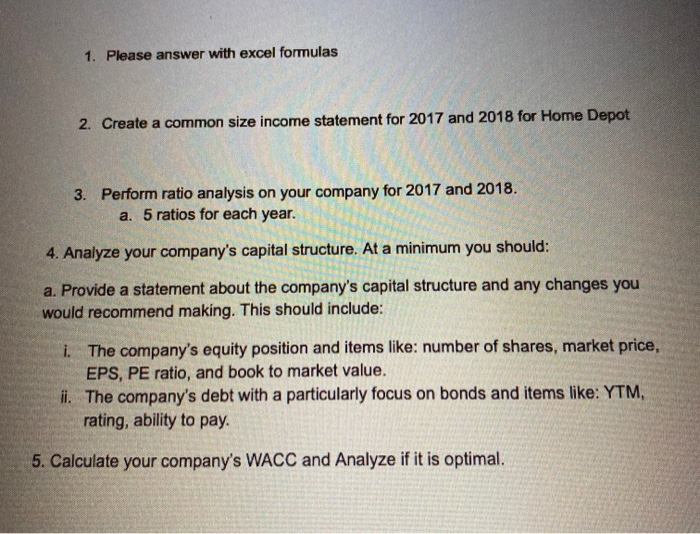

1. Please answer with excel formulas 2. Create a common size income statement for 2017 and 2018 for Home Depot 3. Perform ratio analysis on your company for 2017 and 2018. a. 5 ratios for each year. 4. Analyze your company's capital structure. At a minimum you should: a. Provide a statement about the company's capital structure and any changes you would recommend making. This should include: 1. The company's equity position and items like: number of shares, market price, EPS, PE ratio, and book to market value. ii. The company's debt with a particularly focus on bonds and items like: YTM rating, ability to pay. 5. Calculate your company's WACC and Analyze if it is optimal. 1. Please answer with excel formulas 2. Create a common size income statement for 2017 and 2018 for Home Depot 3. Perform ratio analysis on your company for 2017 and 2018. a. 5 ratios for each year. 4. Analyze your company's capital structure. At a minimum you should: a. Provide a statement about the company's capital structure and any changes you would recommend making. This should include: 1. The company's equity position and items like: number of shares, market price, EPS, PE ratio, and book to market value. ii. The company's debt with a particularly focus on bonds and items like: YTM rating, ability to pay. 5. Calculate your company's WACC and Analyze if it is optimal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts