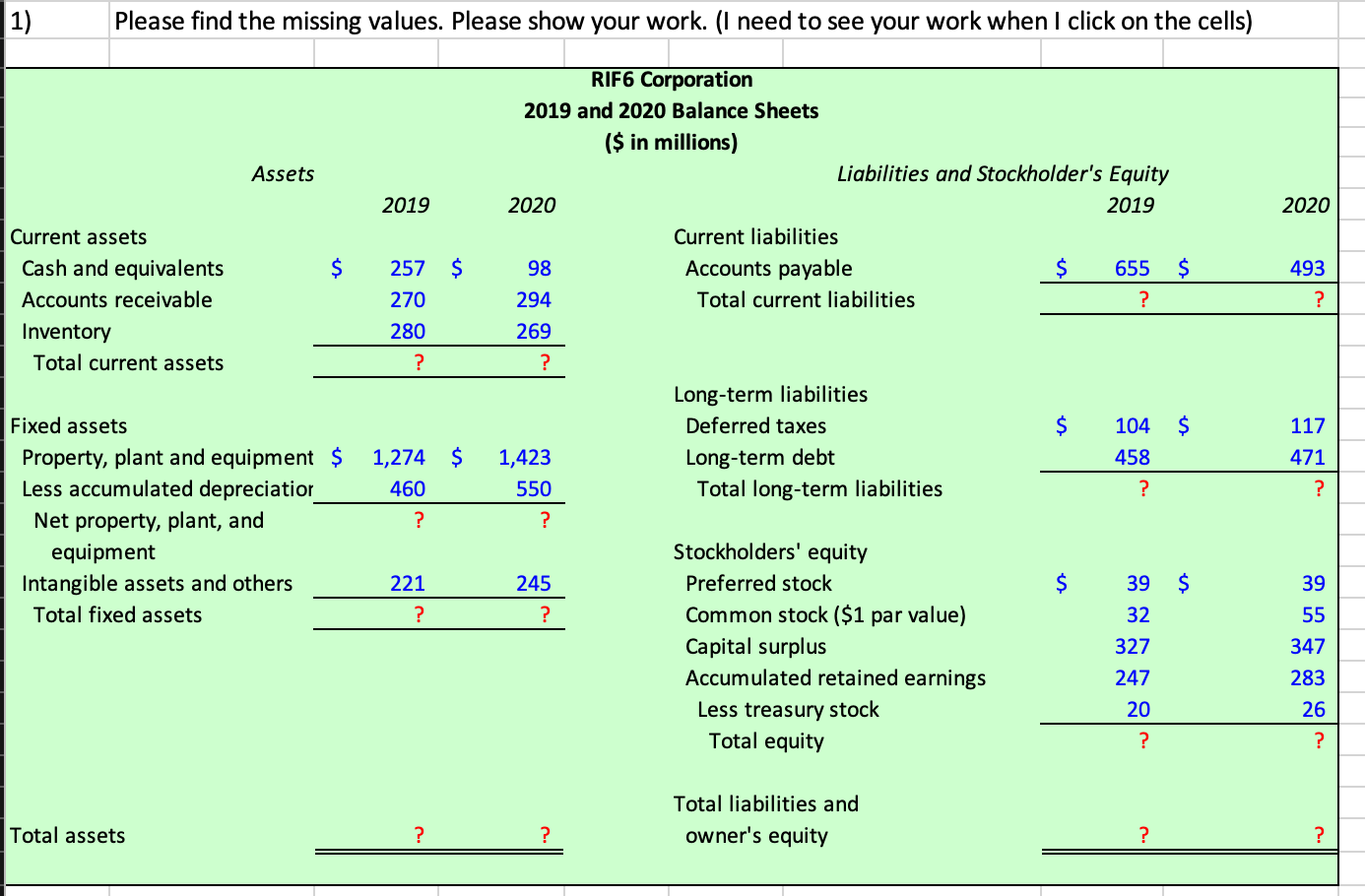

Question: 1) Please find the missing values. Please show your work. (I need to see your work when I click on the cells) Assets 2019 2020

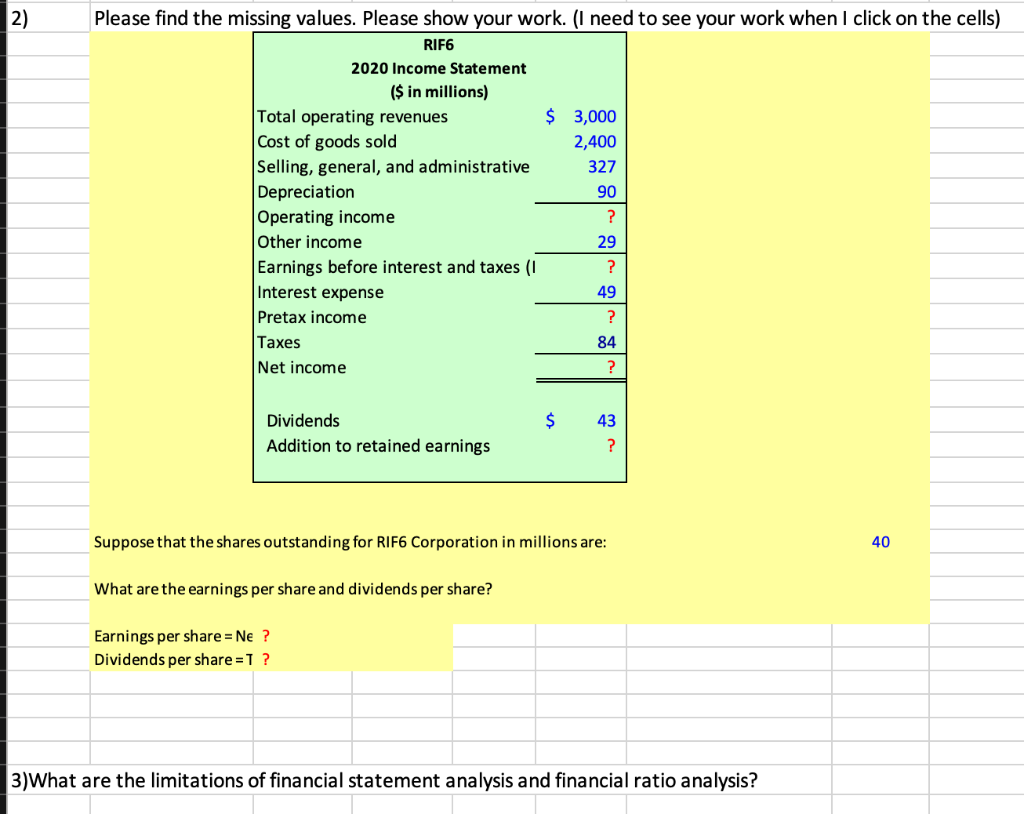

1) Please find the missing values. Please show your work. (I need to see your work when I click on the cells) Assets 2019 2020 $ Current assets Cash and equivalents Accounts receivable Inventory Total current assets 493 ? 257 $ 270 280 ? RIF6 Corporation 2019 and 2020 Balance Sheets ($ in millions) Liabilities and Stockholder's Equity 2020 2019 Current liabilities 98 Accounts payable $ 655 $ 294 Total current liabilities ? 269 ? Long-term liabilities Deferred taxes $ 104 $ 1,423 Long-term debt 458 550 Total long-term liabilities ? ? Stockholders' equity 245 Preferred stock $ 39 $ ? Common stock ($1 par value) 32 Capital surplus 327 Accumulated retained earnings 247 Less treasury stock 20 Total equity ? 117 471 1,274 $ 460 ? Fixed assets Property, plant and equipment $ Less accumulated depreciatior Net property, plant, and equipment Intangible assets and others Total fixed assets ? 221 39 ? 55 347 283 26 ? Total liabilities and owner's equity Total assets ? ? ? ? 2) Please find the missing values. Please show your work. (I need to see your work when I click on the cells) RIF6 2020 Income Statement ($ in millions) Total operating revenues $ 3,000 Cost of goods sold 2,400 Selling, general, and administrative 327 Depreciation 90 Operating income ? Other income 29 Earnings before interest and taxes (1 ? Interest expense 49 Pretax income ? Taxes 84 Net income ? $ Dividends Addition to retained earnings 43 ? Suppose that the shares outstanding for RIF6 Corporation in millions are: 40 What are the earnings per share and dividends per share? Earnings per share = Ne ? Dividends per share=T? 3) What are the limitations of financial statement analysis and financial ratio analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts