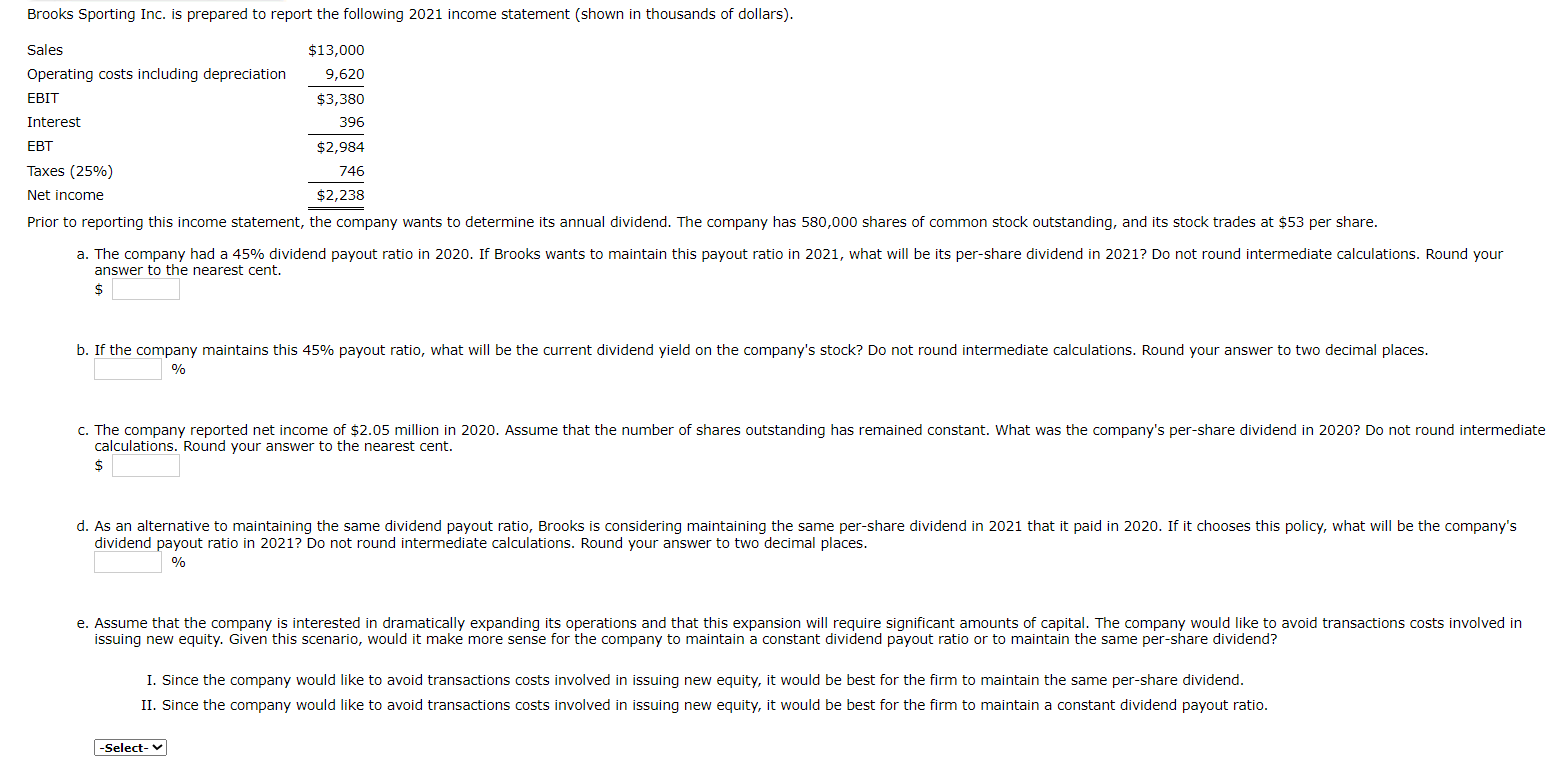

Question: answer to the nearest cent. $ % calc. Ilations. Round your answer to the nearest cent. $ dividend vayout ratio in 2021 ? Do not

answer to the nearest cent. $ % calc. Ilations. Round your answer to the nearest cent. $ dividend vayout ratio in 2021 ? Do not round intermediate calculations. Round your answer to two decimal places. % issuing new equity. Given this scenario, would it make more sense for the company to maintain a constant dividend payout ratio or to maintain the same per-share dividend? I. Since the company would like to avoid transactions costs involved in issuing new equity, it would be best for the firm to maintain the same per-share dividend. II. Since the company would like to avoid transactions costs involved in issuing new equity, it would be best for the firm to maintain a constant dividend payout ratio. answer to the nearest cent. $ % calc. Ilations. Round your answer to the nearest cent. $ dividend vayout ratio in 2021 ? Do not round intermediate calculations. Round your answer to two decimal places. % issuing new equity. Given this scenario, would it make more sense for the company to maintain a constant dividend payout ratio or to maintain the same per-share dividend? I. Since the company would like to avoid transactions costs involved in issuing new equity, it would be best for the firm to maintain the same per-share dividend. II. Since the company would like to avoid transactions costs involved in issuing new equity, it would be best for the firm to maintain a constant dividend payout ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts