Question: (1 point) A stock with current value (0) = 100 has an expected growth rate of its logarithm of v = 0.12 and a volatility

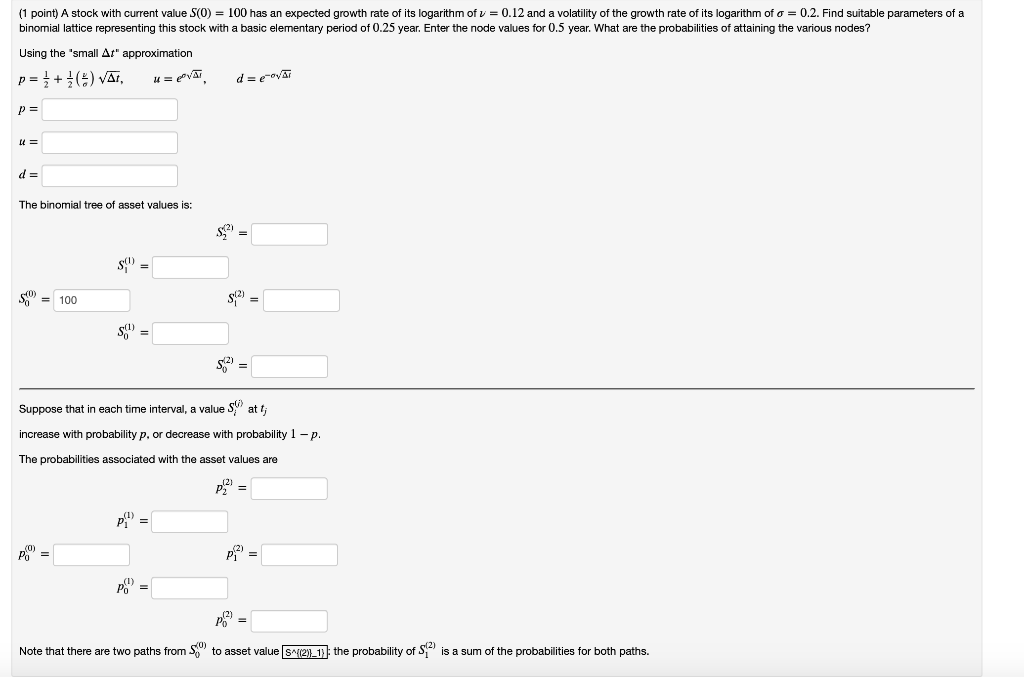

(1 point) A stock with current value (0) = 100 has an expected growth rate of its logarithm of v = 0.12 and a volatility of the growth rate of its logarithm of o = 0.2. Find suitable parameters of a binomial lattice representing this stock with a basic elementary period of 0.25 year. Enter the node values for 0.5 year. What are the probabilities of attaining the various nodes? Using the 'small At" approximation p=+) Vr, u= eva dreva P= = d = The binomial tree of asset values is: SV = 100 52) = SI) = 52) = Suppose that in each time interval, value at 1; increase with probability p, or decrease with probability 1-p. The probabilities associated with the asset values are p2 = pe" = p" = p2 Note that there are two paths from 5 to asset value 511(2)_13] the probability of 5) is a sum of the probabilities for both paths. (1 point) A stock with current value (0) = 100 has an expected growth rate of its logarithm of v = 0.12 and a volatility of the growth rate of its logarithm of o = 0.2. Find suitable parameters of a binomial lattice representing this stock with a basic elementary period of 0.25 year. Enter the node values for 0.5 year. What are the probabilities of attaining the various nodes? Using the 'small At" approximation p=+) Vr, u= eva dreva P= = d = The binomial tree of asset values is: SV = 100 52) = SI) = 52) = Suppose that in each time interval, value at 1; increase with probability p, or decrease with probability 1-p. The probabilities associated with the asset values are p2 = pe" = p" = p2 Note that there are two paths from 5 to asset value 511(2)_13] the probability of 5) is a sum of the probabilities for both paths

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts