Question: (1 point) Consider a 2-year $4500 par value bond that pays semi-annual coupons at a rate of c(2)=3%. Suppose that the bond was purchased for

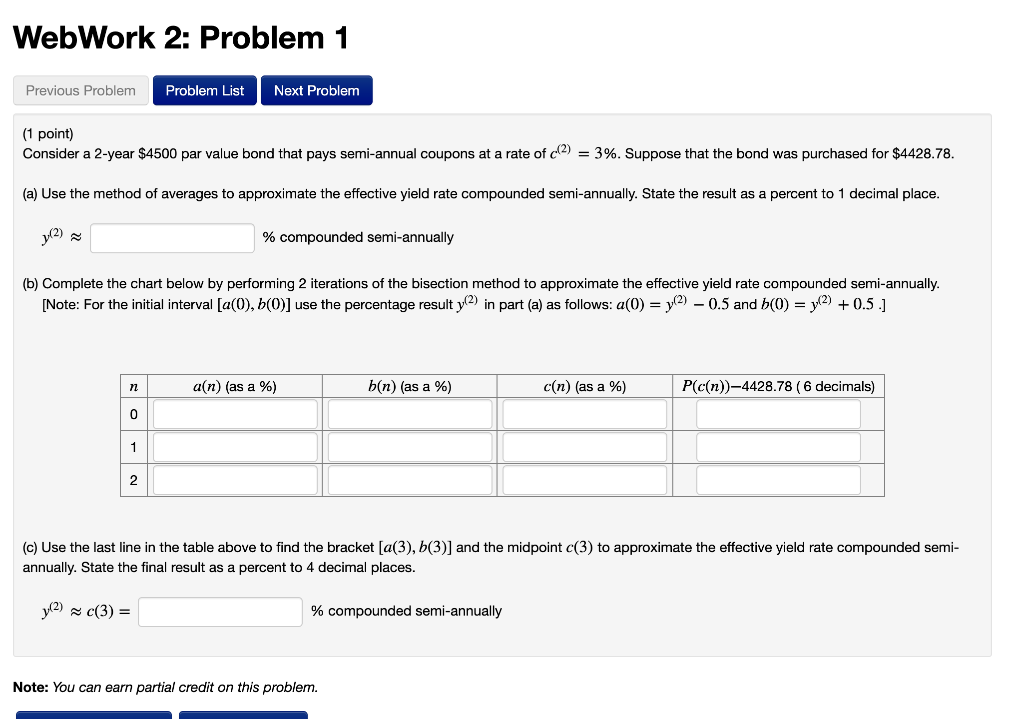

(1 point) Consider a 2-year $4500 par value bond that pays semi-annual coupons at a rate of c(2)=3%. Suppose that the bond was purchased for $4428.78. (a) Use the method of averages to approximate the effective yield rate compounded semi-annually. State the result as a percent to 1 decimal place. y(2) % compounded semi-annually (b) Complete the chart below by performing 2 iterations of the bisection method to approximate the effective yield rate compounded semi-annually. [Note: For the initial interval [a(0),b(0)] use the percentage result y(2) in part (a) as follows: a(0)=y(2)0.5 and b(0)=y(2)+0.5 .] n a(n) (as a %) b(n) (as a %) c(n) (as a %) P(c(n))4428.78 ( 6 decimals) 0 1 2 (c) Use the last line in the table above to find the bracket [a(3),b(3)] and the midpoint c(3) to approximate the effective yield rate compounded semi-annually. State the final result as a percent to 4 decimal places. y(2)c(3)= % compounded semi-annually.

WebWork 2: Problem 1 Previous Problem Problem List Next Problem (1 point) Consider a 2-year $4500 par value bond that pays semi-annual coupons at a rate of c(2) = 3%. Suppose that the bond was purchased for $4428.78. (a) Use the method of averages to approximate the effective yield rate compounded semi-annually. State the result as a percent to 1 decimal place. y (2) % compounded semi-annually (b) Complete the chart below by performing 2 iterations of the bisection method to approximate the effective yield rate compounded semi-annually. [Note: For the initial interval [a(0), 5(0)] use the percentage result y() in part (a) as follows: a(0) = y(2) - 0.5 and (0) = y(2) +0.5.] n an) (as a %) b(n) (as a %) c(n) (as a %) P(c(n))-4428.78 ( 6 decimals) 0 1 2 (C) Use the last line in the table above to find the bracket [a(3), b(3)] and the midpoint c(3) to approximate the effective yield rate compounded semi- annually. State the final result as a percent to 4 decimal places. y(2) c(3) = % compounded semi-annually Note: You can earn partial credit on this problem. WebWork 2: Problem 1 Previous Problem Problem List Next Problem (1 point) Consider a 2-year $4500 par value bond that pays semi-annual coupons at a rate of c(2) = 3%. Suppose that the bond was purchased for $4428.78. (a) Use the method of averages to approximate the effective yield rate compounded semi-annually. State the result as a percent to 1 decimal place. y (2) % compounded semi-annually (b) Complete the chart below by performing 2 iterations of the bisection method to approximate the effective yield rate compounded semi-annually. [Note: For the initial interval [a(0), 5(0)] use the percentage result y() in part (a) as follows: a(0) = y(2) - 0.5 and (0) = y(2) +0.5.] n an) (as a %) b(n) (as a %) c(n) (as a %) P(c(n))-4428.78 ( 6 decimals) 0 1 2 (C) Use the last line in the table above to find the bracket [a(3), b(3)] and the midpoint c(3) to approximate the effective yield rate compounded semi- annually. State the final result as a percent to 4 decimal places. y(2) c(3) = % compounded semi-annually Note: You can earn partial credit on this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts