Question: 1 point) In this chapter, assume the log-normal model. Unless otherwise stated, assume no arbitrage opportunities The current spot price of a stock is $30.00,

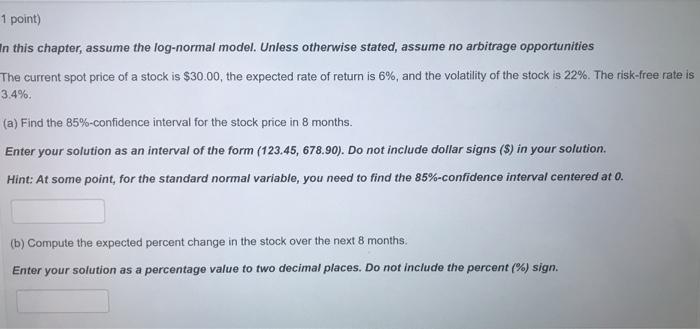

1 point) In this chapter, assume the log-normal model. Unless otherwise stated, assume no arbitrage opportunities The current spot price of a stock is $30.00, the expected rate of return is 6%, and the volatility of the stock is 22%. The risk-free rate is 3.4% (a) Find the 85%-confidence interval for the stock price in 8 months. Enter your solution as an interval of the form (123.45, 678.90). Do not include dollar signs ($) in your solution. Hint: At some point, for the standard normal variable, you need to find the 85%-confidence interval centered at 0. (b) Compute the expected percent change in the stock over the next 8 months. Enter your solution as a percentage value to two decimal places. Do not include the percent (%) sign. 1 point) In this chapter, assume the log-normal model. Unless otherwise stated, assume no arbitrage opportunities The current spot price of a stock is $30.00, the expected rate of return is 6%, and the volatility of the stock is 22%. The risk-free rate is 3.4% (a) Find the 85%-confidence interval for the stock price in 8 months. Enter your solution as an interval of the form (123.45, 678.90). Do not include dollar signs ($) in your solution. Hint: At some point, for the standard normal variable, you need to find the 85%-confidence interval centered at 0. (b) Compute the expected percent change in the stock over the next 8 months. Enter your solution as a percentage value to two decimal places. Do not include the percent (%) sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts