Question: 1 point When using expectation theory, given future returns and states of outcomes, we can Use the AVERAGE function to find the expected return of

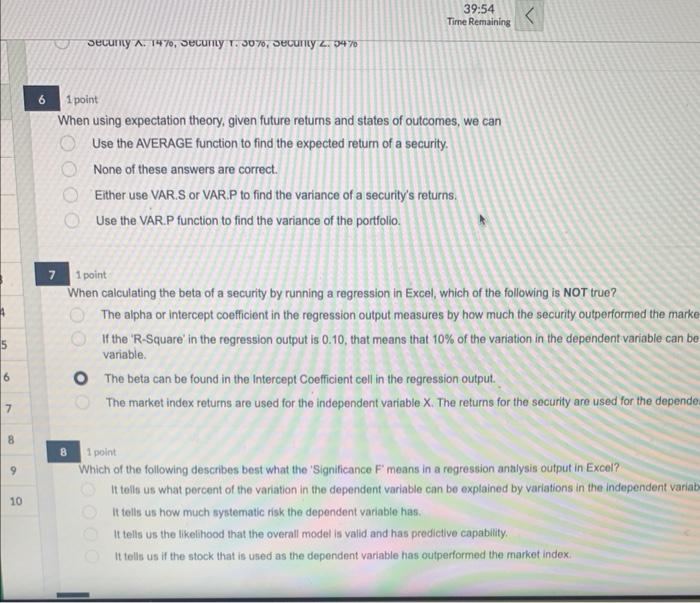

1 point When using expectation theory, given future returns and states of outcomes, we can Use the AVERAGE function to find the expected return of a security. None of these answers are correct. Either use VAR.S or VAR.P to find the variance of a security's returns. Use the VAR.P function to find the variance of the portfolio. 7 point When calculating the beta of a security by running a regression in Excel, which of the following is NOT true? The alpha or intercept coefficient in the regression output measures by how much the security outperformed the marke If the 'R-Square' in the regression output is 0.10, that means that 10% of the variation in the dependent variable can be variable. The beta can be found in the Intercept Coefficient cell in the regression output. The market index returns are used for the independent variable X. The returns for the security are used for the depende 8 i point Which of the following describes best what the 'Significance F' means in a regression analysis output in Excel? It tells us what percent of the variation in the dependent variable can be explained by variations in the independent variab It tells us how much systematic risk the dependent variable has. It tells us the likelihood that the overall model is valid and has predictive capability. It tells us if the stock that is used as the dependent variable has outperformed the market index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts