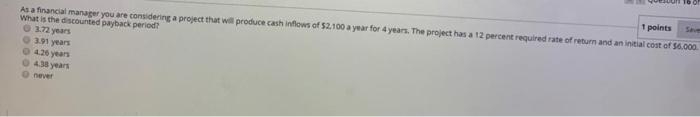

Question: 1 points As a financial manager you are considering a project that will produce cash inflows of 52.100 a year for 4 years. The project

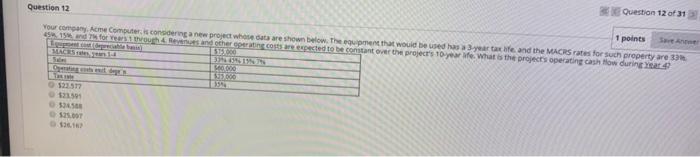

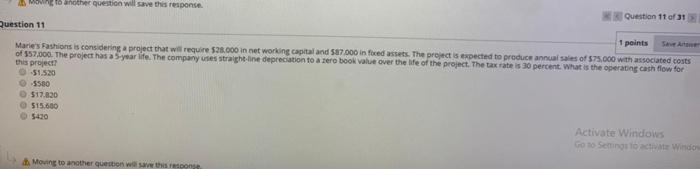

1 points As a financial manager you are considering a project that will produce cash inflows of 52.100 a year for 4 years. The project has a 12 percent required rate of return and an initial cost of $6.000 What is the discounted payback period? 3.72 years 391 years 425 years 435 years never Question 12 of 31 Question 12 1 points Your company Ace Computer is considering a new project who are shown below. Then that would be used as 3y taxi and the MACRS rates for such property are 33 15 and for years and other perspected to be convert projects to year what is the projects operating cash flow during Law MOOOO 95000 354 123.517 5. Moto another question will save this response Question 11 of 1 Question 11 1 points SA Marles Fashions is considering project that will require 528.000 in networking capital and 587.000 in foxed assets. The project is expected to produce annual sales of $75.000 with associated costs of 357,000. The project has a 5-year life. The company uses straight line depreciation to a zero book value over the life of the project. The tax rate is 30 percent. What is the operating cash flow for this project! 31.520 0 5500 517.820 515.600 Activate Windows Como Senting bac Windos Moving to another question with respons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts