Question: (1) Preferably use Excel sheet for computations. (2) DO NOT ROUND off calculation results EXCEPT the FINAL ANSWER (e.g. if FINAL ANSWER is 69.49, then

(1) Preferably use Excel sheet for computations.

(2) DO NOT ROUND off calculation results EXCEPT the FINAL ANSWER (e.g. if FINAL ANSWER is 69.49, then INPUT 69)

(3) Refer to the table named "CALCULATION".

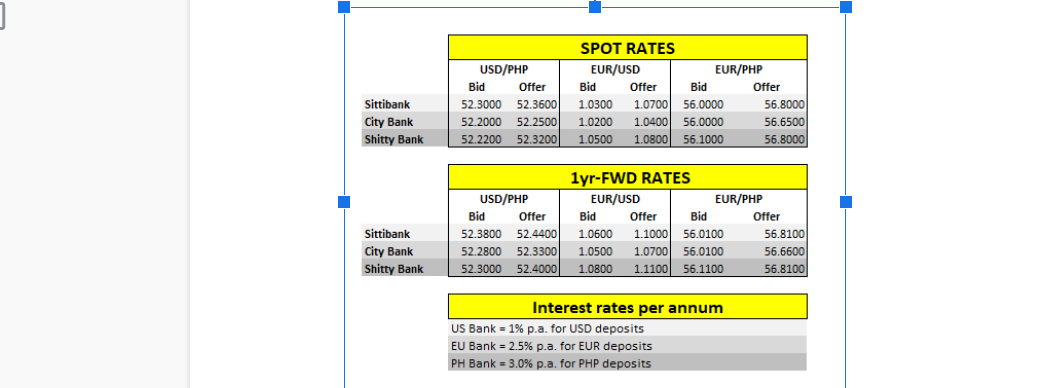

(3 points) Suppose you have USD 100,000 and you think there is a locational arbitrage in the USD/PHP spot market given quotes of the three banks. Determine the best USD gains (if any), otherwise write 0.

(3) Refer to the table named "CALCULATION".

Suppose you have USD 100,000 and since EUR and PHP deposits pay higher interest rates, you decide to convert to either EUR or PHP so you can take advantage of the higher deposit rates. Not converting the USD and investing at 1% will only yield 1,000 USD Profit. What is the best dollar profit for a Covered Interest Rate Arbitrage trade using 1yr forwards?

(3) Suppose you have 1,000,000 PHP and you enter into a 1yr USDPHP NDF forward deal with City Bank, where you buy USD at the 1yr forward rate. Suppose a year from now, USDPHP spot is at 53.50 and 1yr USDPHP forward is at 54.00. Compute for the total PHP gain you realized.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts