Question: 1- Prepare a cash flow statement directly 2- Preparing the cash flow statement by the indirect method If you have the following information about Company

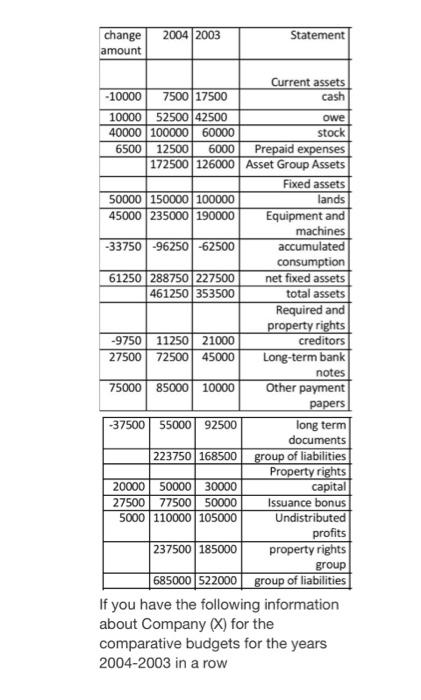

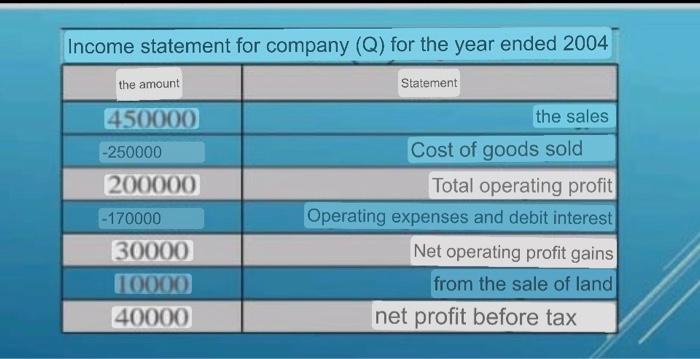

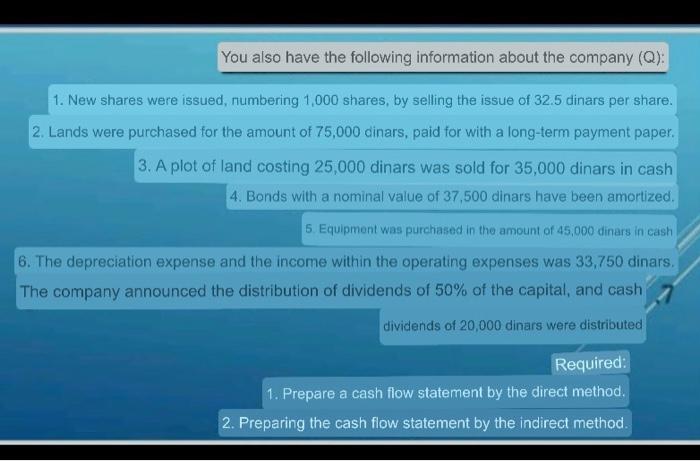

If you have the following information about Company (X) for the comparative budgets for the years 2004-2003 in a row Income statement for company (Q) for the year ended 2004 \begin{tabular}{|c|r|} \hline the amount & Statement \\ \hline 450000 & Cost of goods sold \\ \hline250000 & Total operating profit \\ \hline 200000 & Operating expenses and debit interest \\ \hline170000 & Net operating profit gains \\ \hline 30000 & from the sale of land \\ \hline 10000 & net profit before tax \\ \hline 40000 & O0. \\ \hline \end{tabular} 1. New shares were issued, numbering 1,000 shares, by selling the issue of 32.5 dinars per share. 2. Lands were purchased for the amount of 75,000 dinars, paid for with a long-term payment paper. 3. A plot of land costing 25,000 dinars was sold for 35,000 dinars in cash 4. Bonds with a nominal value of 37,500 dinars have been amortized. 6. The depreciation expense and the income within the operating expenses was 33,750 dinars. The company announced the distribution of dividends of 50% of the capital, and cash Required: If you have the following information about Company (X) for the comparative budgets for the years 2004-2003 in a row Income statement for company (Q) for the year ended 2004 \begin{tabular}{|c|r|} \hline the amount & Statement \\ \hline 450000 & Cost of goods sold \\ \hline250000 & Total operating profit \\ \hline 200000 & Operating expenses and debit interest \\ \hline170000 & Net operating profit gains \\ \hline 30000 & from the sale of land \\ \hline 10000 & net profit before tax \\ \hline 40000 & O0. \\ \hline \end{tabular} 1. New shares were issued, numbering 1,000 shares, by selling the issue of 32.5 dinars per share. 2. Lands were purchased for the amount of 75,000 dinars, paid for with a long-term payment paper. 3. A plot of land costing 25,000 dinars was sold for 35,000 dinars in cash 4. Bonds with a nominal value of 37,500 dinars have been amortized. 6. The depreciation expense and the income within the operating expenses was 33,750 dinars. The company announced the distribution of dividends of 50% of the capital, and cash Required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts