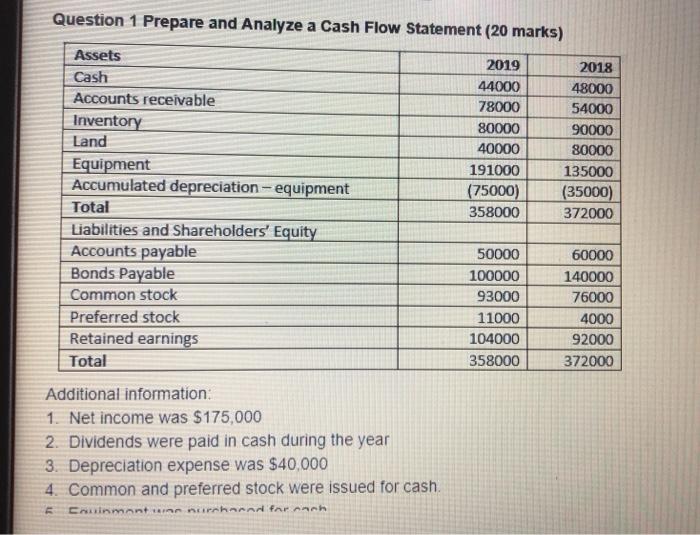

Question: 1 Prepare and Analyze a Cash Flow Statement (20 marks) Assets Cash Accounts receivable Inventory 2019 2018 44000 48000 78000 54000 80000 90000 Land 40000

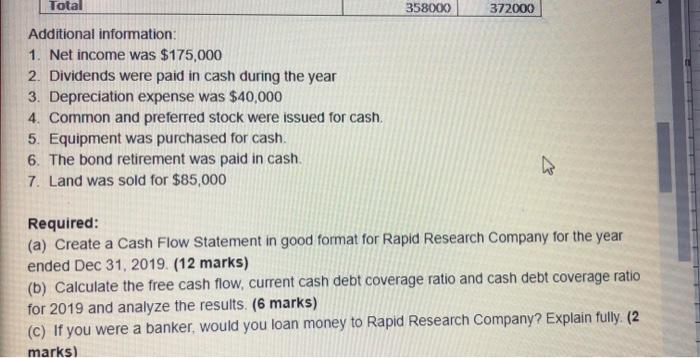

1 Prepare and Analyze a Cash Flow Statement (20 marks) Assets Cash Accounts receivable Inventory 2019 2018 44000 48000 78000 54000 80000 90000 Land 40000 80000 Equipment 191000 135000 Accumulated depreciation-equipment (75000) (35000) Total 358000 372000 Liabilities and Shareholders' Equity Accounts payable 50000 60000 Bonds Payable 100000 140000 Common stock Preferred stock Retained earnings Total Additional information: 1. Net income was $175,000 2. Dividends were paid in cash during the year 3. Depreciation expense was $40,000 4. Common and preferred stock were issued for cash. Cauinmant une nurchand for each 93000 76000 11000 4000 104000 92000 358000 372000 Total Additional information: 1. Net income was $175,000 2. Dividends were paid in cash during the year 3. Depreciation expense was $40,000 4. Common and preferred stock were issued for cash. 5. Equipment was purchased for cash. 6. The bond retirement was paid in cash. 7. Land was sold for $85,000 Required: 358000 372000 (a) Create a Cash Flow Statement in good format for Rapid Research Company for the year ended Dec 31, 2019. (12 marks) (b) Calculate the free cash flow, current cash debt coverage ratio and cash debt coverage ratio for 2019 and analyze the results. (6 marks) (c) If you were a banker, would you loan money to Rapid Research Company? Explain fully. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts