Question: Please only answer T-Accounts and a Cash Flow Statement! 352 AW) Dal Mon Accounts Receivable Homework week M Problem 112 NI- 39,13 -6,8,120 Total A=558,2200k

Please only answer T-Accounts and a Cash Flow Statement!

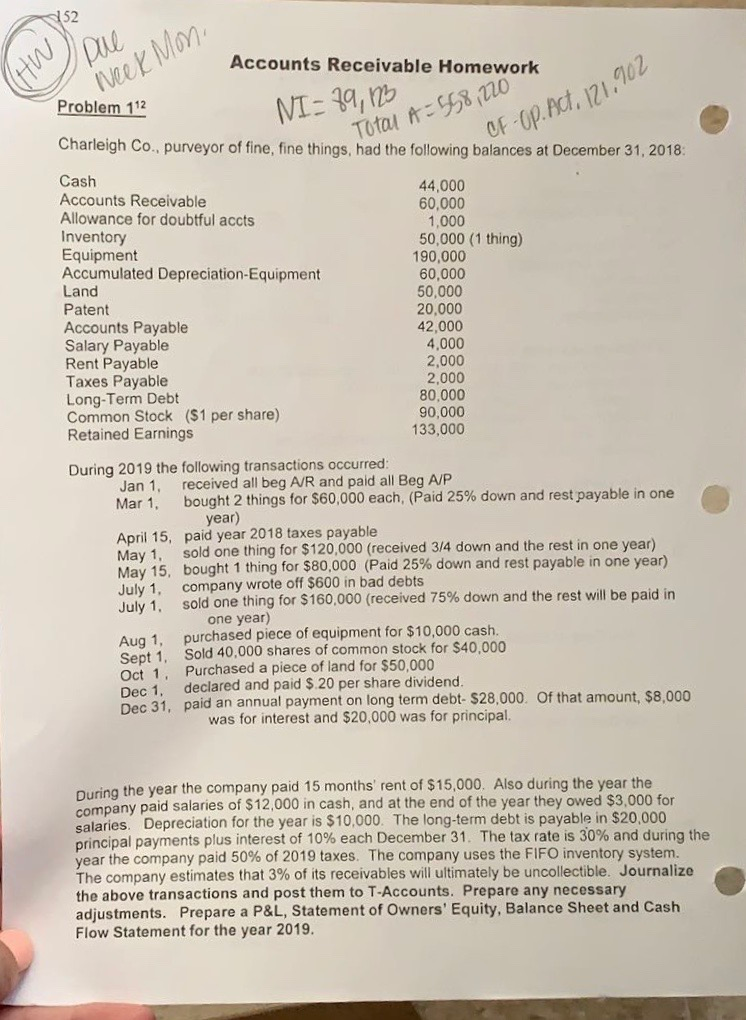

352 AW) Dal Mon Accounts Receivable Homework week M Problem 112 NI- 39,13 -6,8,120 Total A=558,2200k CF-op. Act, 121,902 Charleigh Co., purveyor of fine, fine things, had the following balances at December 31, 2018 Cash Accounts Receivable Allowance for doubtful accts Inventory Equipment Accumulated Depreciation Equipment Land Patent Accounts Payable Salary Payable Rent Payable Taxes Payable Long-Term Debt Common Stock ($1 per share) Retained Earnings 44,000 60,000 1,000 50,000 (1 thing) 190,000 60,000 50,000 20,000 42,000 4,000 2,000 2.000 80,000 90,000 133,000 During 2019 the following transactions occurred: Jan 1, received all beg A/R and paid all Beg A/P Mar 1. bought 2 things for $60,000 each, (Paid 25% down and rest payable in one year) April 15, paid year 2018 taxes payable May 1, sold one thing for $120,000 (received 3/4 down and the rest in one year) May 15, bought 1 thing for $80,000 (Paid 25% down and rest payable in one year) July 1, company wrote off $600 in bad debts July 1, sold one thing for $160,000 (received 75% down and the rest will be paid in one year) Aug 1, purchased piece of equipment for $10,000 cash. Sept 1. Sold 40,000 shares of common stock for $40,000 Oct 1, Purchased a piece of land for $50,000 Dec 1, declared and paid $.20 per share dividend. Dec 31, paid an annual payment on long term debt-$28,000. Of that amount, $8,000 was for interest and $20,000 was for principal. During the year the company paid 15 months' rent of $15,000. Also during the year the company paid salaries of $12,000 in cash, and at the end of the year they owed $3,000 for salaries. Depreciation for the year is $10,000. The long-term debt is payable in $20,000 principal payments plus interest of 10% each December 31. The tax rate is 30% and during the year the company paid 50% of 2019 taxes. The company uses the FIFO inventory system. The company estimates that 3% of its receivables will ultimately be uncollectible. Journalize the above transactions and post them to T-Accounts. Prepare any necessary adjustments. Prepare a P&L, Statement of Owners' Equity, Balance Sheet and Cash Flow Statement for the year 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts