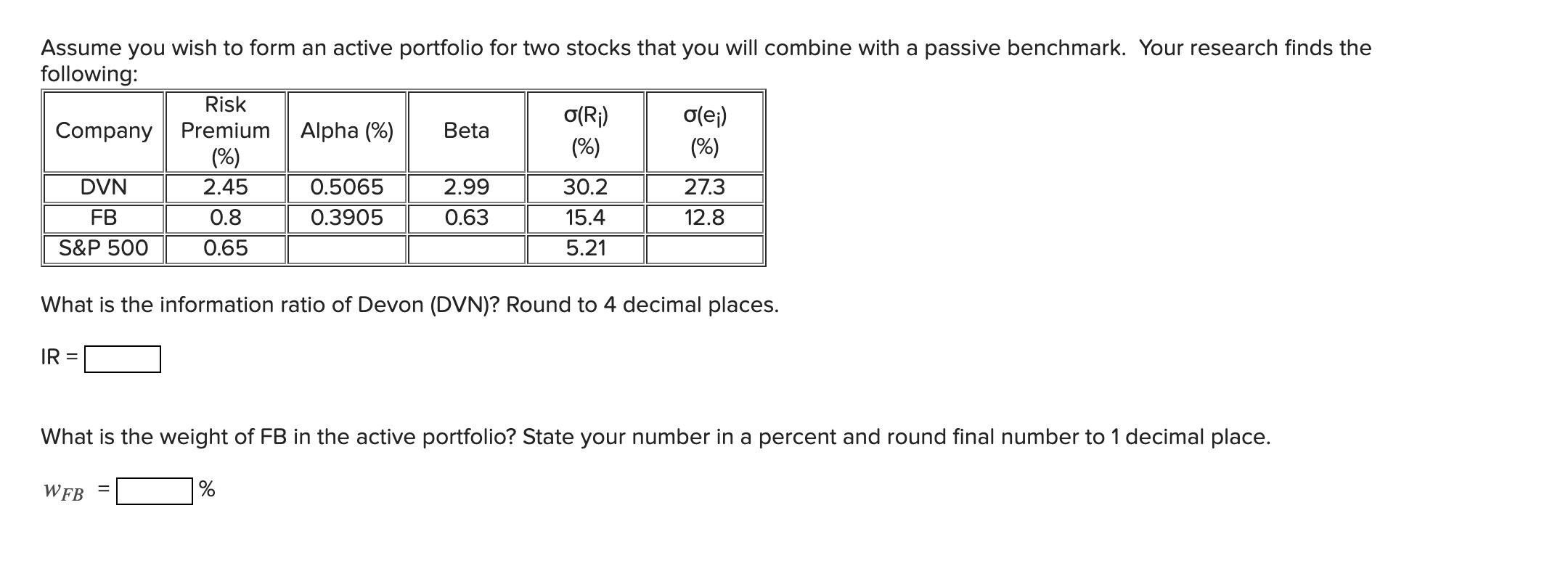

Question: Assume you wish to form an active portfolio for two stocks that you will combine with a passive benchmark. Your research finds the following:

Assume you wish to form an active portfolio for two stocks that you will combine with a passive benchmark. Your research finds the following: Risk Company Premium Alpha (%) (%) 2.45 0.8 0.65 DVN FB S&P 500 IR: = 0.5065 0.3905 WFB Beta % 2.99 0.63 o(R) (%) 30.2 15.4 5.21 What is the information ratio of Devon (DVN)? Round to 4 decimal places. o(ei) (%) 27.3 12.8 What is the weight of FB in the active portfolio? State your number in a percent and round final number to 1 decimal place.

Step by Step Solution

There are 3 Steps involved in it

ANSWER To calculate the information ratio of Devon DVN we need to use the formula IR Alpha Sigma sqr... View full answer

Get step-by-step solutions from verified subject matter experts