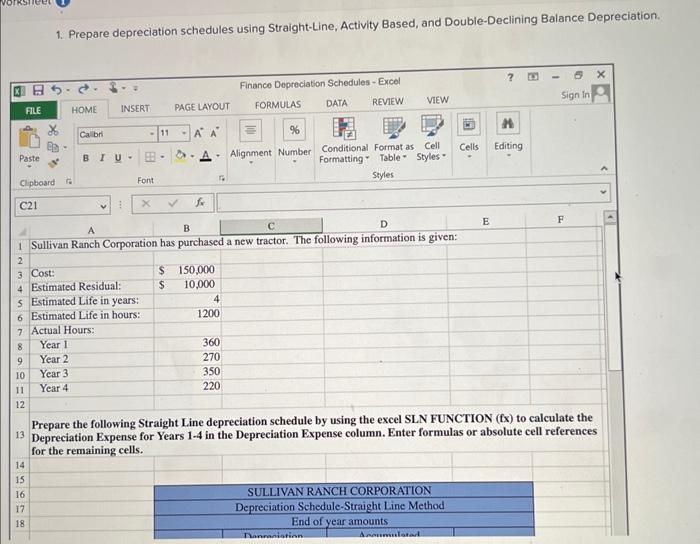

Question: 1. Prepare depreciation schedules using Straight-Line, Activity Based, and Double-Declining Balance Depreciation. 1. Prepare depreciation schedules using Straight-Line, Activity Based, and Double-Declining Balance Depreciatic Prepare

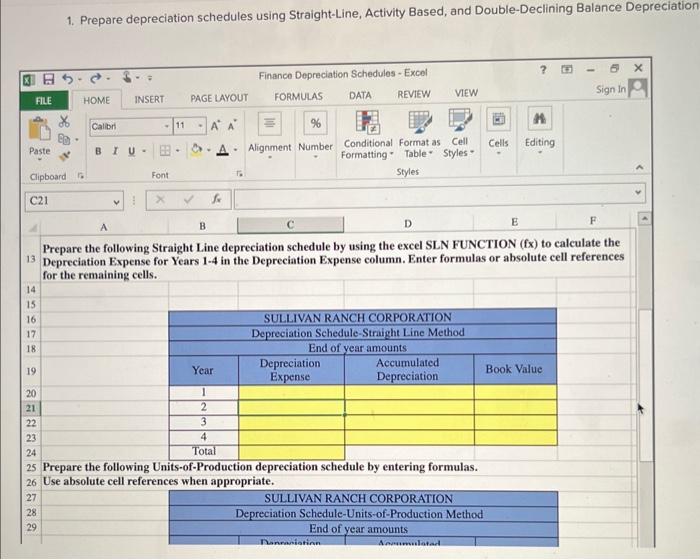

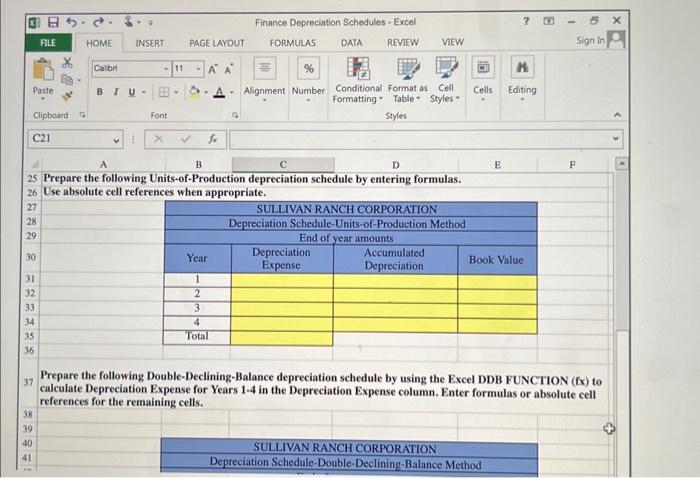

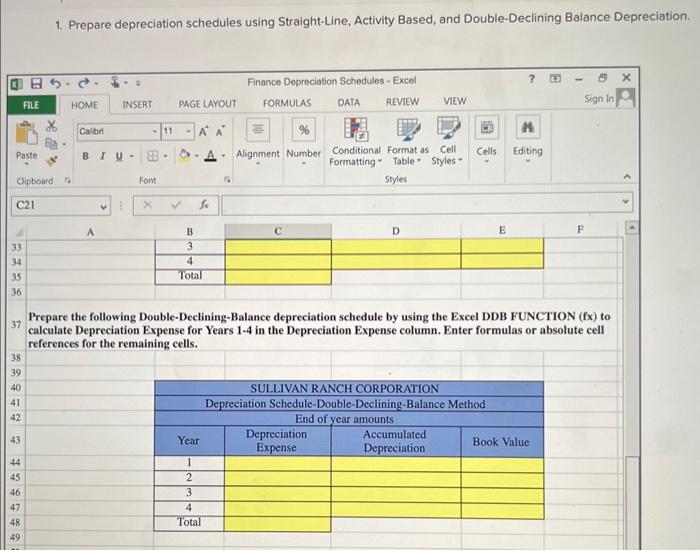

1. Prepare depreciation schedules using Straight-Line, Activity Based, and Double-Declining Balance Depreciation. 1. Prepare depreciation schedules using Straight-Line, Activity Based, and Double-Declining Balance Depreciatic Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (fx) to calculate the Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. Prepare the following Units-of-Production depreciation schedule by entering formulas. Use absolute cell references when appropriate. 5 Prepare the following Units-of-Production depreciation schedule by entering formulas. Use absolute cell references when appropriate. Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to calculate Depreciation Expense for Years 1.4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 1. Prepare depreciation schedules using Straight-Line, Activity Based, and Double-Declining Balance Depreciation Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts