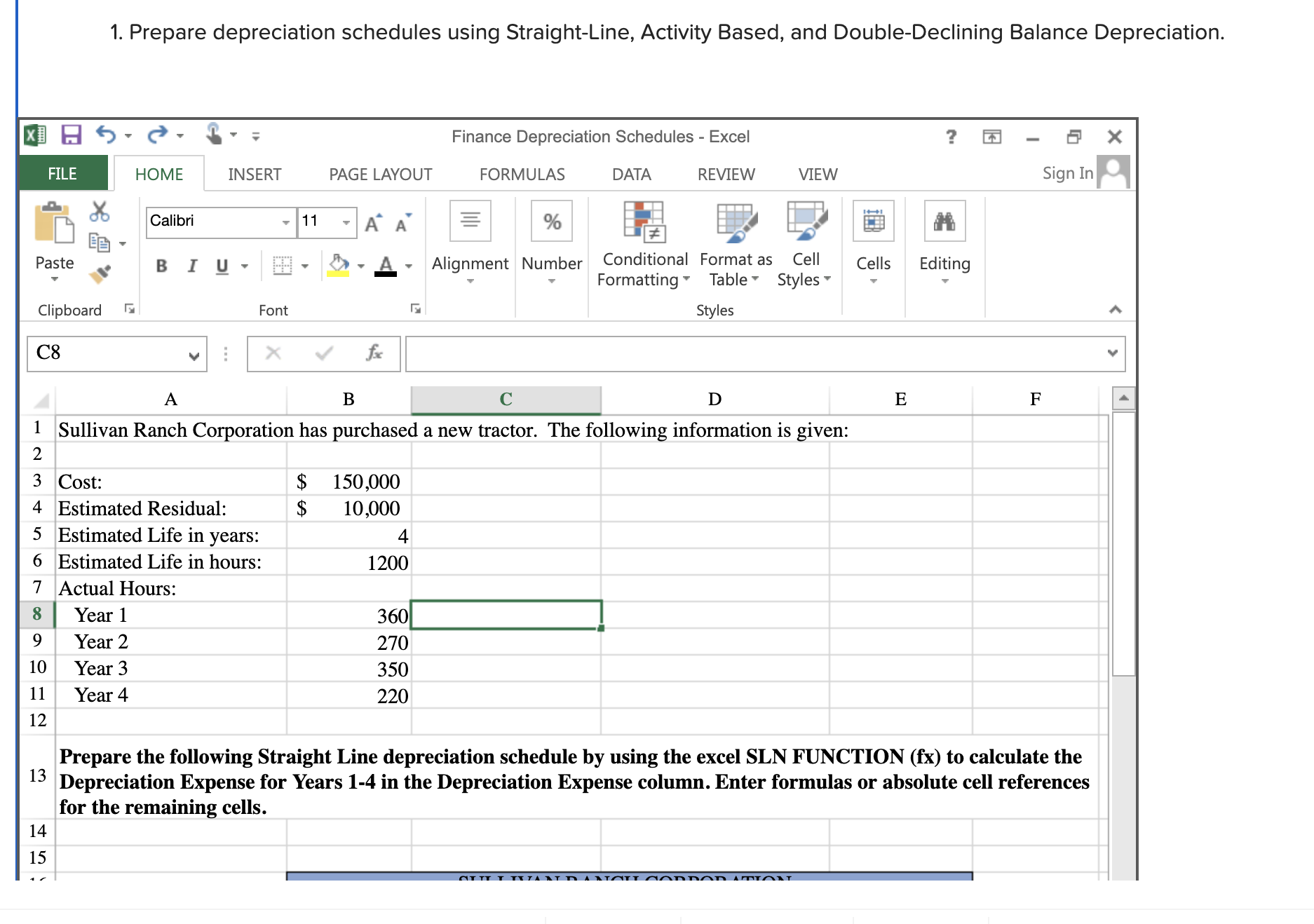

Question: 1. Prepare depreciation schedules using Straight-Line, Activity Based, and Double-Declining Balance Depreciation. Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION

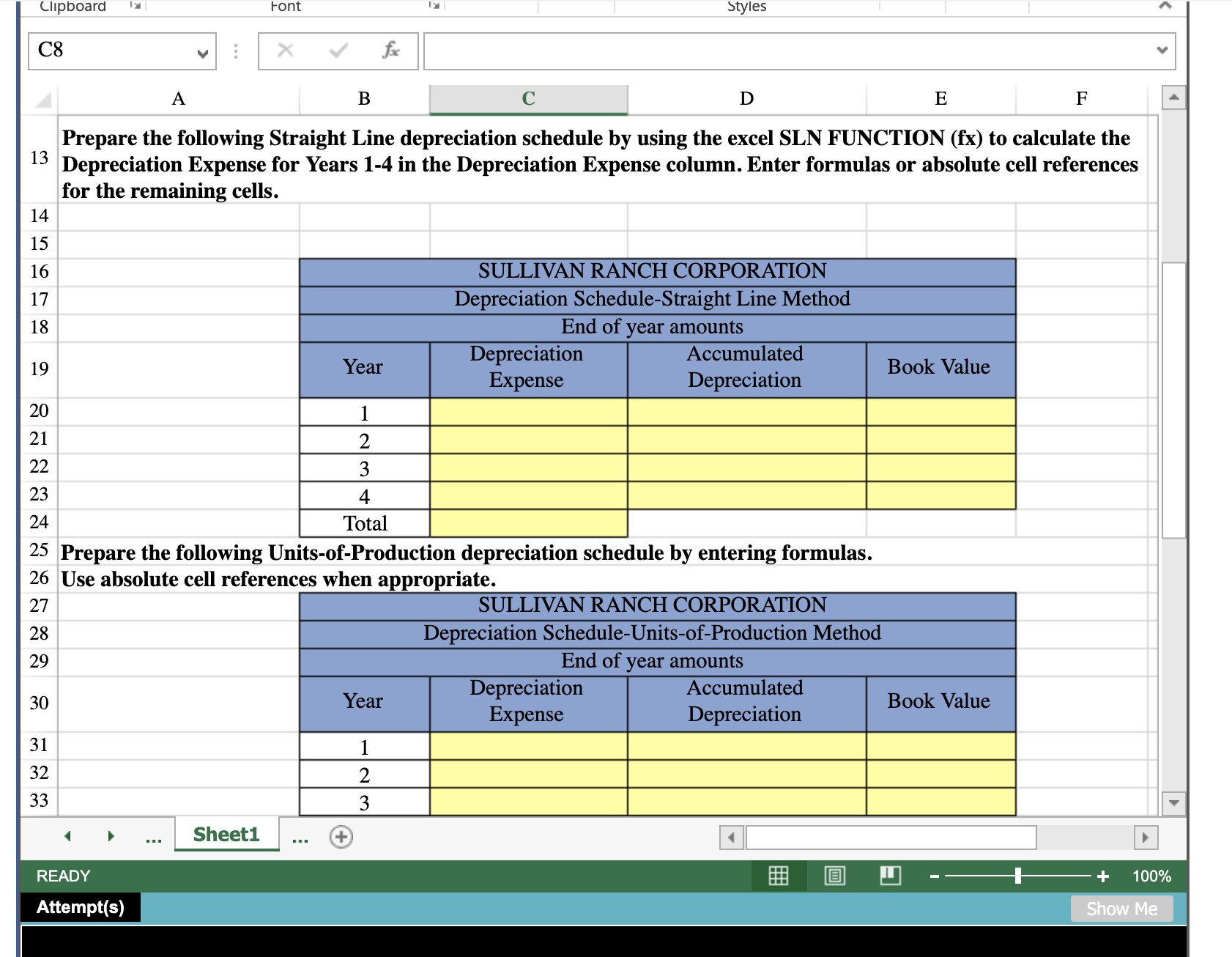

1. Prepare depreciation schedules using Straight-Line, Activity Based, and Double-Declining Balance Depreciation. Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (fx) to calculate the Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. Prepare the following Units-of-Production depreciation schedule by entering formulas. Use absolute cell references when appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts