Question: 1 Problem 2 (25 points) 2 You just bought 200 shares of Ford stock for $5 a share. You do not anticipate the stock price

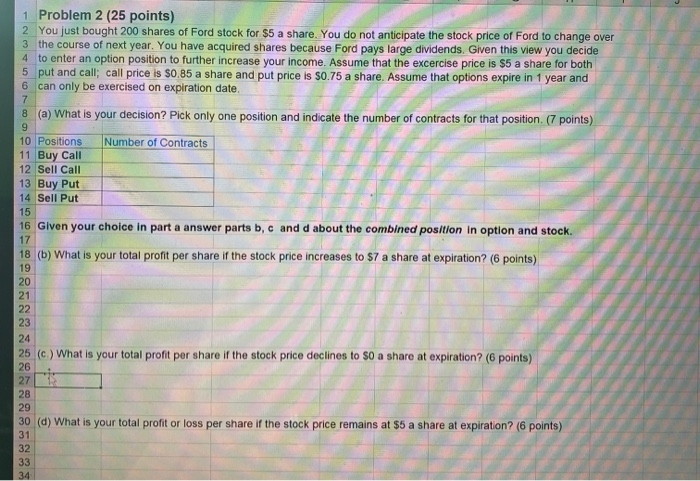

1 Problem 2 (25 points) 2 You just bought 200 shares of Ford stock for $5 a share. You do not anticipate the stock price of Ford to change over 3 the course of next year. You have acquired shares because Ford pays large dividends. Given this view you decide 4 to enter an option position to further increase your income. Assume that the excercise price is $5 a share for both 5 put and call; call price is $0.85 a share and put price is $0.75 a share. Assume that options expire in 1 year and 6 can only be exercised on expiration date. 8 (a) What is your decision? Pick only one position and indicate the number of contracts for that position. (7 points) Number of Contracts ber of Contracts 10 Positions 11 Buy Call 12 Sell Call 13 Buy Put 14 Sell Put 16 Given your choice in part a answer parts b, c and d about the combined position in option and stock. 18 (b) What is your total profit per share if the stock price increases to $7 a share at expiration? (6 points) 25 (c) What is your total profit per share if the stock price declines to $0 a share at expiration? (6 points) 30 (d) What is your total profit or loss per share if the stock price remains at $6 a share at expiration? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts