Question: 1 Problem 2 (25 points) 2 You just bouglt 200 shares of Ford stock for $5 a share. You do not anticipate the stock price

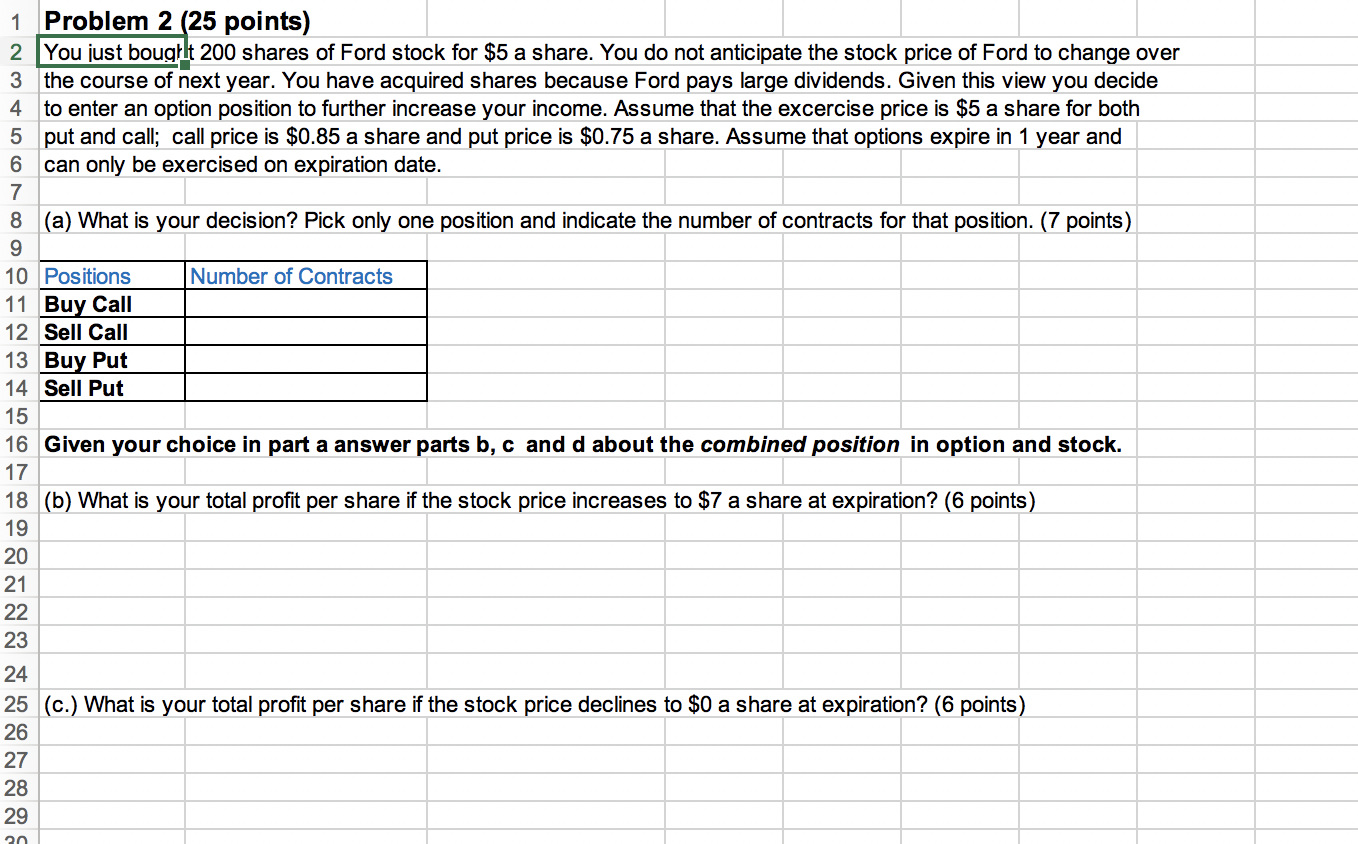

1 Problem 2 (25 points) 2 You just bouglt 200 shares of Ford stock for $5 a share. You do not anticipate the stock price of Ford to change over 3 the course of next year. You have acquired shares because Ford pays large dividends. Given this view you decide 4 to enter an option position to further increase your income. Assume that the excercise price is $5 a share for both 5 put and call; call price is $0.85 a share and put price is $0.75 a share. Assume that options expire in 1 year and 6 can only be exercised on expiration date. 7 8 (a) What is your decision? Pick only one position and indicate the number of contracts for that position. (7 points) 9 10 Positions Number of Contracts 11 Buy Call 12 Sell Call 13 Buy Put 14 Sell Put 15 16 Given your choice in part a answer parts b, c and d about the combined position in option and stock. 17 18 (b) What is your total profit per share if the stock price increases to $7 a share at expiration? (6 points) 19 20 21 22 23 24 25 (c.) What is your total profit per share if the stock price declines to $0 a share at expiration? (6 points) 26 27 28 29 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts