Question: (1 pt) A certain bond with several years to run, is currently selling for $ 920 The bond pays coupons of $ 80 every 6

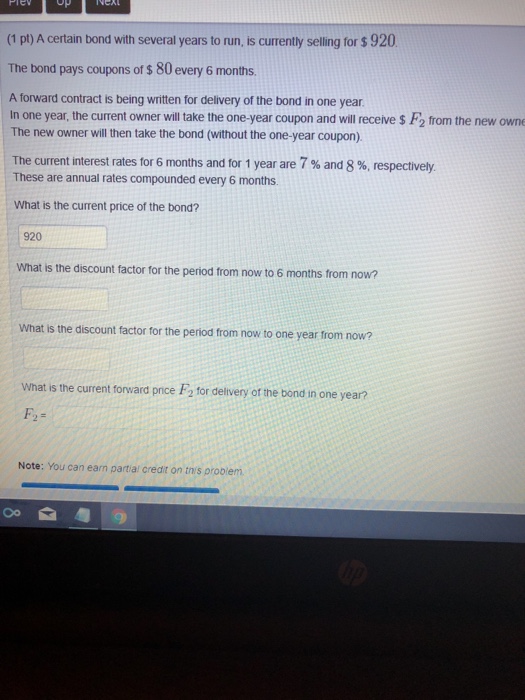

(1 pt) A certain bond with several years to run, is currently selling for $ 920 The bond pays coupons of $ 80 every 6 months. A forward contract is being written for delivery of the bond in one year in one year, the current owner will take the one-year coupon and will receive s F2 from the new owne The new owner will then take the bond (without the one-year coupon). The current interest rates for 6 months and for 1 year are 7 % and 8 %, respectively. These are annual rates compounded every 6 months. What is the current price of the bond? 920 What is the discount factor for the period from now to 6 months from now? What is the discount factor for the period from now to one year from now? What is the current forward price F2 for delivery of the bond in one year? Note: You can earn partial credit on this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts