Question: (1 pt) Instructions: Write your work on your own paper. Put your name on all papers. You will need to submit a scan of your

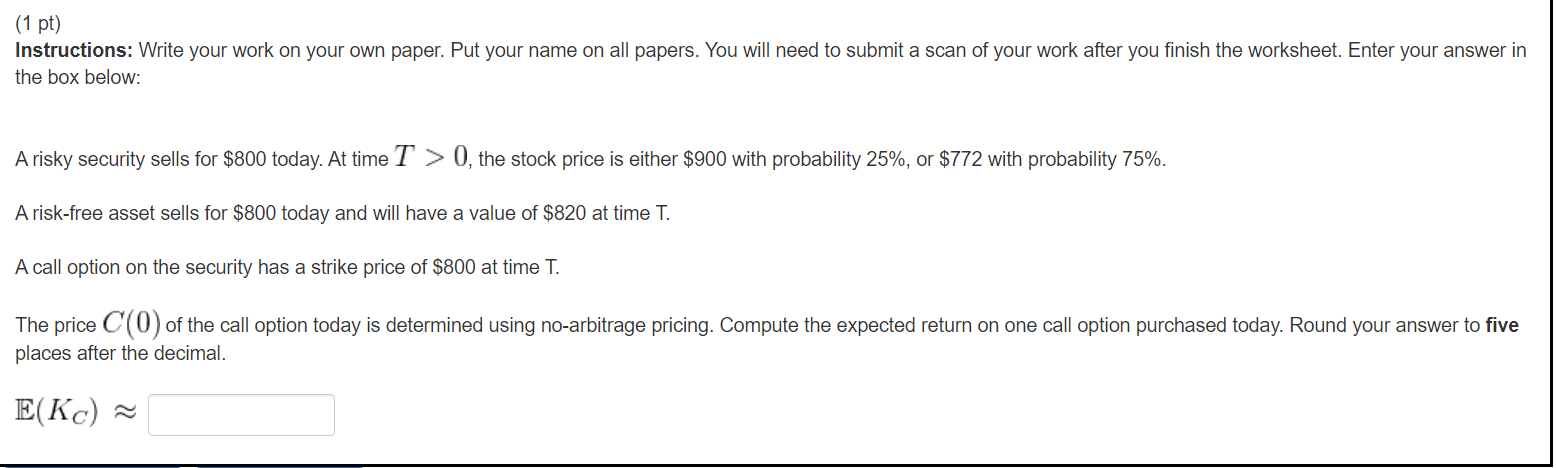

(1 pt) Instructions: Write your work on your own paper. Put your name on all papers. You will need to submit a scan of your work after you finish the worksheet. Enter your answer in the box below: A risky security sells for $800 today. At time T > 0, the stock price is either $900 with probability 25%, or $772 with probability 75%. A risk-free asset sells for $800 today and will have a value of $820 at time T. A call option on the security has a strike price of $800 at time T. The price C(0) of the call option today is determined using no-arbitrage pricing. Compute the expected return on one call option purchased today. Round your answer to five places after the decimal. E(KC) (1 pt) Instructions: Write your work on your own paper. Put your name on all papers. You will need to submit a scan of your work after you finish the worksheet. Enter your answer in the box below: A risky security sells for $800 today. At time T > 0, the stock price is either $900 with probability 25%, or $772 with probability 75%. A risk-free asset sells for $800 today and will have a value of $820 at time T. A call option on the security has a strike price of $800 at time T. The price C(0) of the call option today is determined using no-arbitrage pricing. Compute the expected return on one call option purchased today. Round your answer to five places after the decimal. E(KC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts