Question: (1 pt) This problem establishes a lower bound on Euro call option values by using a no-arbitrage argument. An asset has value So at t

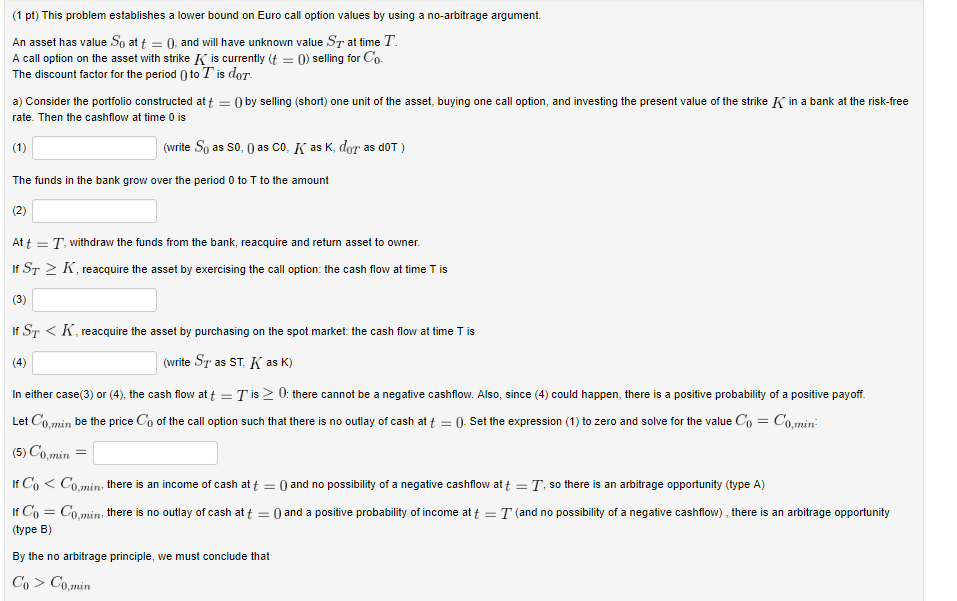

(1 pt) This problem establishes a lower bound on Euro call option values by using a no-arbitrage argument. An asset has value So at t 0, and will have unknown value r at time T A call option on the asset with strike Kis currently 0) selling for Co- The discount factor for the period 0to T is dor a) Consider the portfolio constructed at t0 by selling (short) one unit of the asset, buying one call option, and investing the present value of the strike K in a bank at the risk-free rate. Then the cashflow at time 0 is (write So as so, 0 as co, K as K, dor as doT) The funds in the bank grow over the period 0 to T to the amount Att T, withdraw the funds from the bank, reacquire and return asset to owner If ST K reacquire the asset by exercising the call option: the cash flow at time T is If ST Co,min (1 pt) This problem establishes a lower bound on Euro call option values by using a no-arbitrage argument. An asset has value So at t 0, and will have unknown value r at time T A call option on the asset with strike Kis currently 0) selling for Co- The discount factor for the period 0to T is dor a) Consider the portfolio constructed at t0 by selling (short) one unit of the asset, buying one call option, and investing the present value of the strike K in a bank at the risk-free rate. Then the cashflow at time 0 is (write So as so, 0 as co, K as K, dor as doT) The funds in the bank grow over the period 0 to T to the amount Att T, withdraw the funds from the bank, reacquire and return asset to owner If ST K reacquire the asset by exercising the call option: the cash flow at time T is If ST Co,min

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts