Question: 1 pts In the mean-beta relationship predicted by both CAPM and APT, suppose the market expected return is 10%, and a well-diversified portfolio's beta is

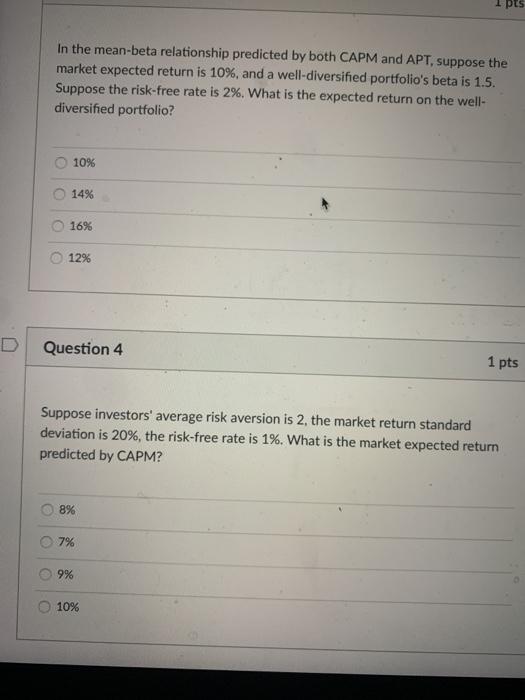

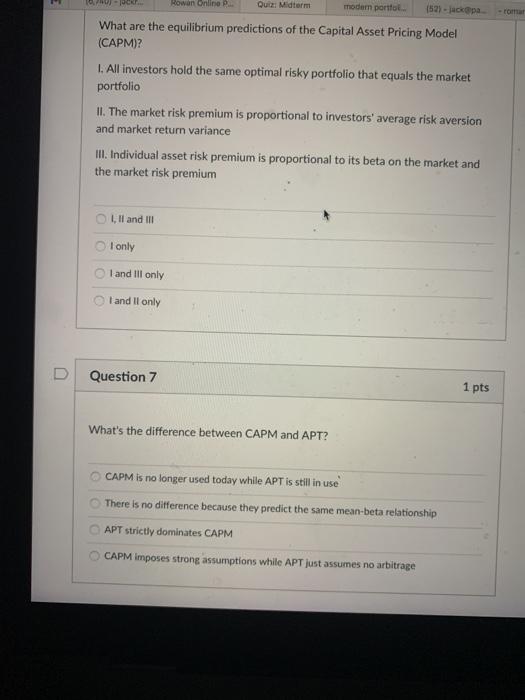

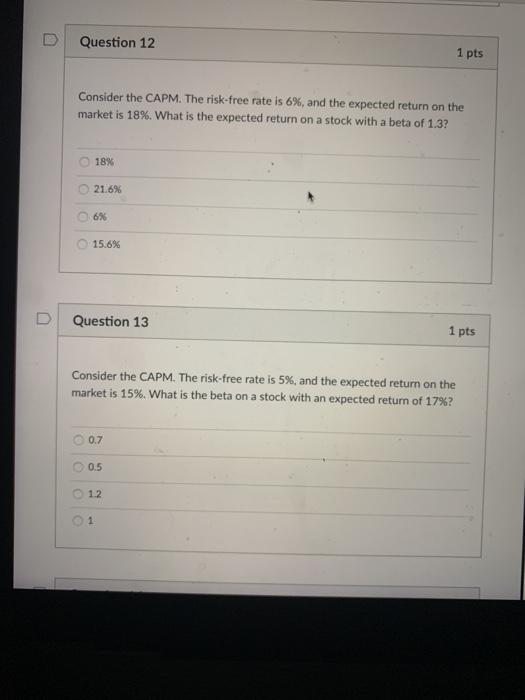

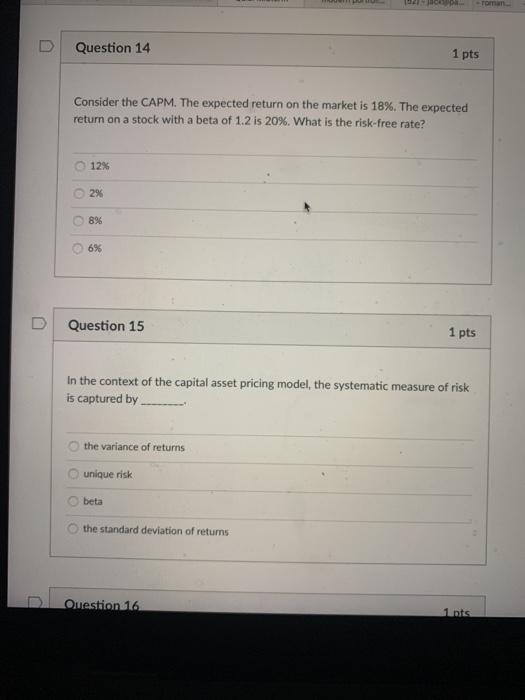

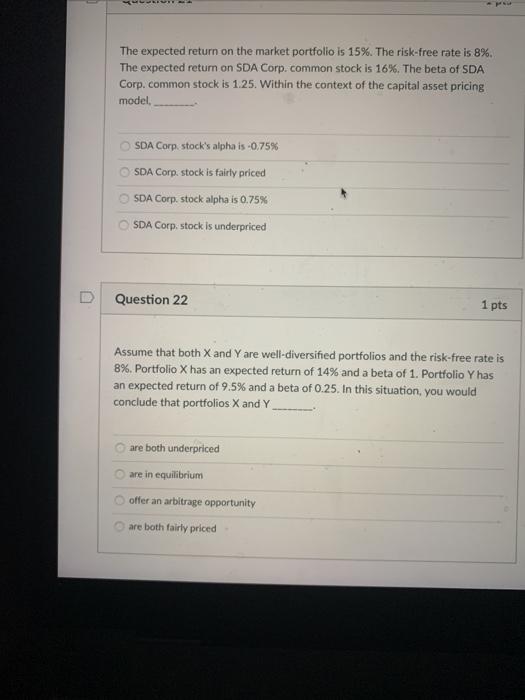

1 pts In the mean-beta relationship predicted by both CAPM and APT, suppose the market expected return is 10%, and a well-diversified portfolio's beta is 1.5. Suppose the risk-free rate is 2%. What is the expected return on the well- diversified portfolio? 10% 14% 16% 12% Question 4 1 pts Suppose investors' average risk aversion is 2, the market return standard deviation is 20%, the risk-free rate is 1%. What is the market expected return predicted by CAPM? 8% 7% 9% 10% Howon Online Quiz Midtorm modern porto (52) - Jacopa ro What are the equilibrium predictions of the Capital Asset Pricing Model (CAPM)? 1. All investors hold the same optimal risky portfolio that equals the market portfolio II. The market risk premium is proportional to investors' average risk aversion and market return variance III. Individual asset risk premium is proportional to its beta on the market and the market risk premium I, II and III I only I and Ill only I and II only Question 7 1 pts What's the difference between CAPM and APT? CAPM is no longer used today while APT is still in use There is no difference because they predict the same mean-beta relationship APT strictly dominates CAPM CAPM imposes strong assumptions while APT just assumes no arbitrage Question 12 1 pts Consider the CAPM. The risk-free rate is 6%, and the expected return on the market is 18%. What is the expected return on a stock with a beta of 1.3? 18% 21.6% 6% 15.6% D Question 13 1 pts Consider the CAPM. The risk-free rate is 5%, and the expected return on the market is 15%. What is the beta on a stock with an expected return of 17%? 0.7 0.5 12 1 Question 14 1 pts Consider the CAPM. The expected return on the market is 18%. The expected return on a stock with a beta of 1.2 is 20%. What is the risk-free rate? 12% 2% 8% 6% D Question 15 1 pts In the context of the capital asset pricing model, the systematic measure of risk is captured by the variance of returns unique risk beta the standard deviation of returns U Question 16 1nts The expected return on the market portfolio is 15%. The risk-free rate is 8%. The expected return on SDA Corp. common stock is 16%. The beta of SDA Corp.common stock is 1.25. Within the context of the capital asset pricing model SDA Corp, stock's alpha is -0.75% SDA Corp. stock is fairly priced SDA Corp. stock alpha is 0.75% SDA Corp.stock is underpriced Question 22 1 pts Assume that both X and Y are well-diversified portfolios and the risk-free rate is 8%. Portfolio X has an expected return of 14% and a beta of 1. Portfolio Y has an expected return of 9.5% and a beta of 0.25. In this situation, you would conclude that portfolios X and Y are both underpriced are in equilibrium offer an arbitrage opportunity are both fairly priced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts