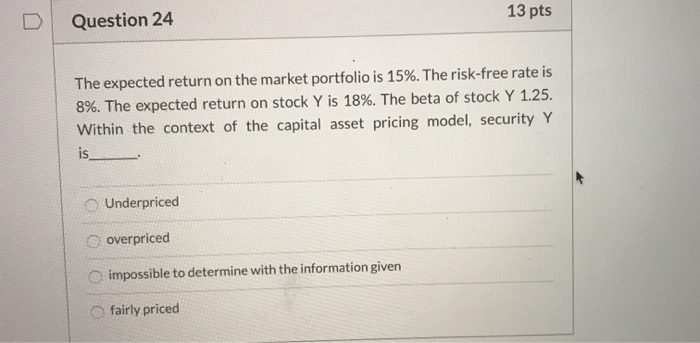

Question: 13 pts Question 24 The expected return on the market portfolio is 15%. The risk-free rate is 8%. The expected return on stock Y is

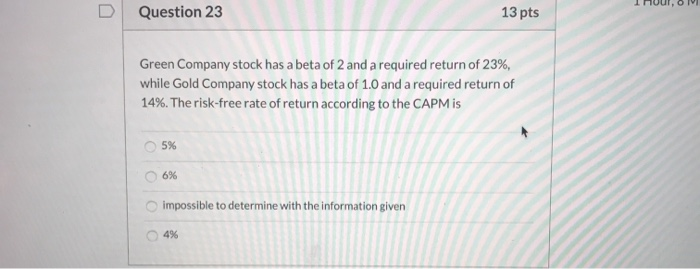

13 pts Question 24 The expected return on the market portfolio is 15%. The risk-free rate is 8%. The expected return on stock Y is 18%. The beta of stock Y 1.25. Within the context of the capital asset pricing model, security Y is__ Underpriced overpriced impossible to determine with the information given fairly priced U Question 23 13 pts Green Company stock has a beta of 2 and a required return of 23%, while Gold Company stock has a beta of 1.0 and a required return of 14%. The risk-free rate of return according to the CAPM is 5% 6% impossible to determine with the information given

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock