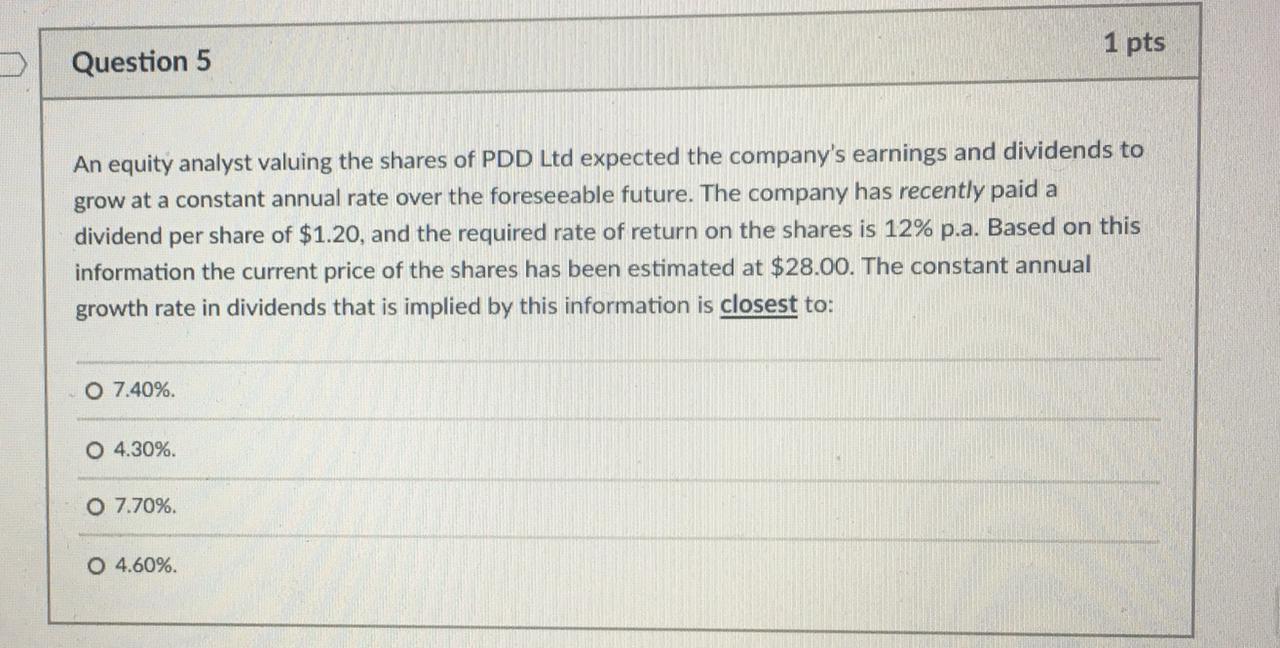

Question: 1 pts Question 5 An equity analyst valuing the shares of PDD Ltd expected the company's earnings and dividends to grow at a constant annual

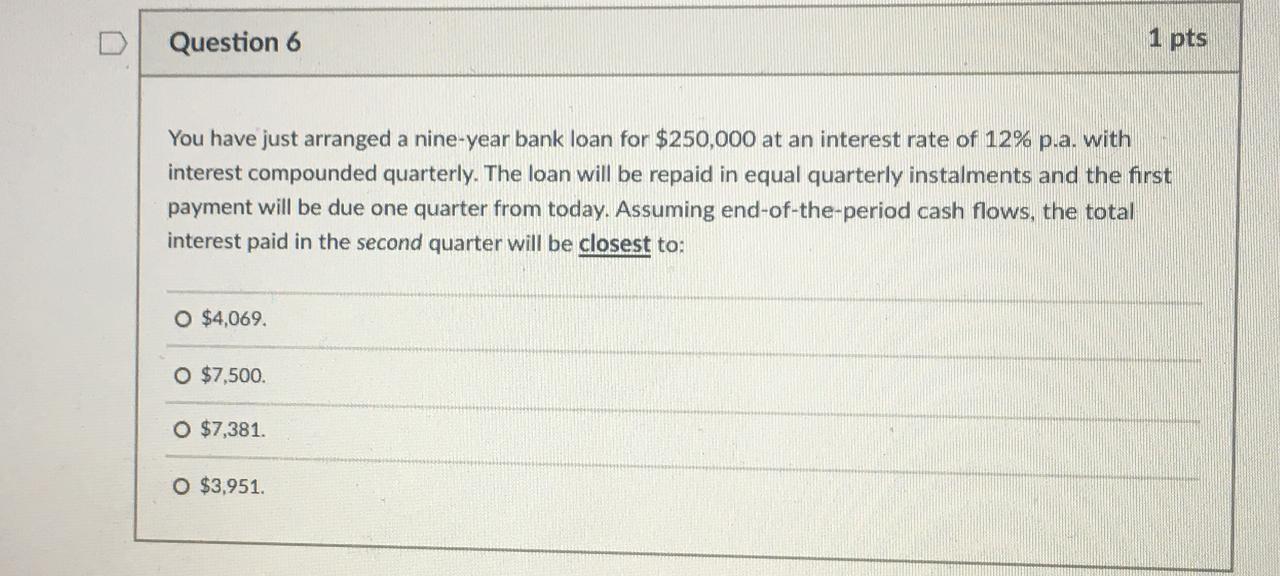

1 pts Question 5 An equity analyst valuing the shares of PDD Ltd expected the company's earnings and dividends to grow at a constant annual rate over the foreseeable future. The company has recently paid a dividend per share of $1.20, and the required rate of return on the shares is 12% p.a. Based on this information the current price of the shares has been estimated at $28.00. The constant annual growth rate in dividends that is implied by this information is closest to: O 7.40% O 4.30% O 7.70%. 0 4.60%. Question 6 1 pts You have just arranged a nine-year bank loan for $250,000 at an interest rate of 12% p.a. with interest compounded quarterly. The loan will be repaid in equal quarterly instalments and the first payment will be due one quarter from today. Assuming end-of-the-period cash flows, the total interest paid in the second quarter will be closest to: O $4,069. O $7,500 O $7,381. O $3,951

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts