Question: --/1 Question 1 View Policies Current Attempt in Progress On March 1, 2022, Carla Vista Co. acquired real estate, on which it planned to construct

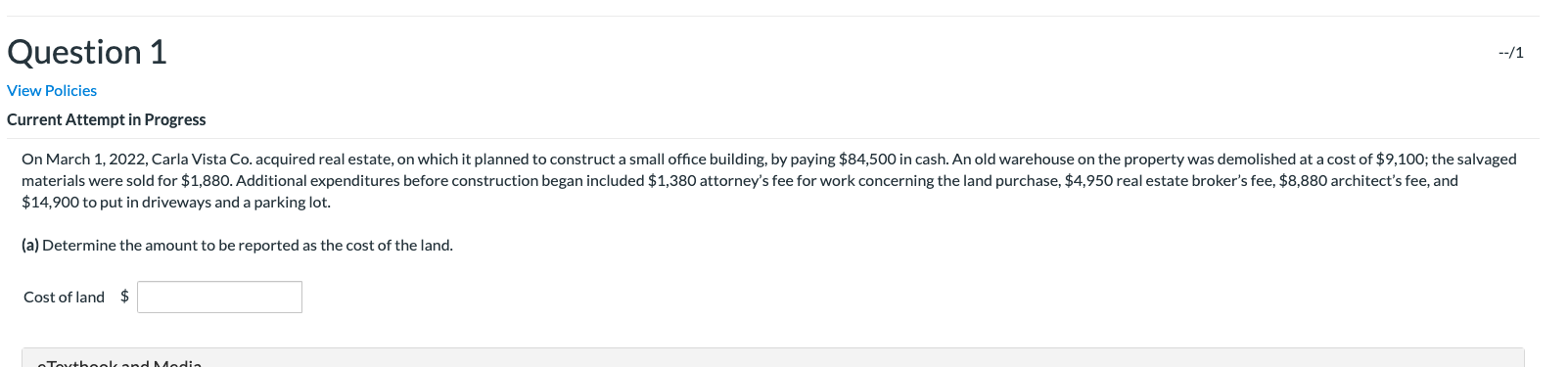

--/1 Question 1 View Policies Current Attempt in Progress On March 1, 2022, Carla Vista Co. acquired real estate, on which it planned to construct a small office building, by paying $84,500 in cash. An old warehouse on the property was demolished at a cost of $9,100; the salvaged materials were sold for $1,880. Additional expenditures before construction began included $1,380 attorney's fee for work concerning the land purchase, $4,950 real estate broker's fee, $8,880 architect's fee, and $14,900 to put in driveways and a parking lot. (a) Determine the amount to be reported as the cost of the land. Cost of land $ Touthool and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts