Question: --/15 Question 5 View Policies Current Attempt in Progress On March 1, 2022, Pharoah Company acquired real estate, on which it planned to construct a

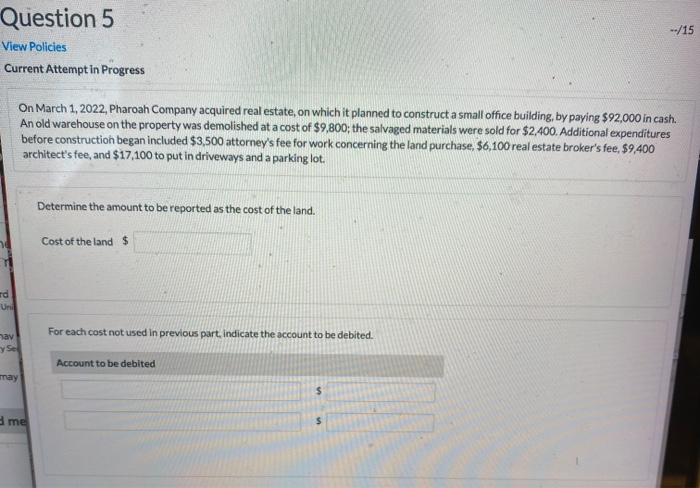

--/15 Question 5 View Policies Current Attempt in Progress On March 1, 2022, Pharoah Company acquired real estate, on which it planned to construct a small office building, by paying $92,000 in cash. An old warehouse on the property was demolished at a cost of $9,800; the salvaged materials were sold for $2,400. Additional expenditures before construction began included $3,500 attorney's fee for work concerning the land purchase. $6,100 real estate broker's fee, $9.400 architect's fee, and $17,100 to put in driveways and a parking lot. Determine the amount to be reported as the cost of the land. Cost of the land $ For each cost not used in previous part, indicate the account to be debited. Account to be debited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts