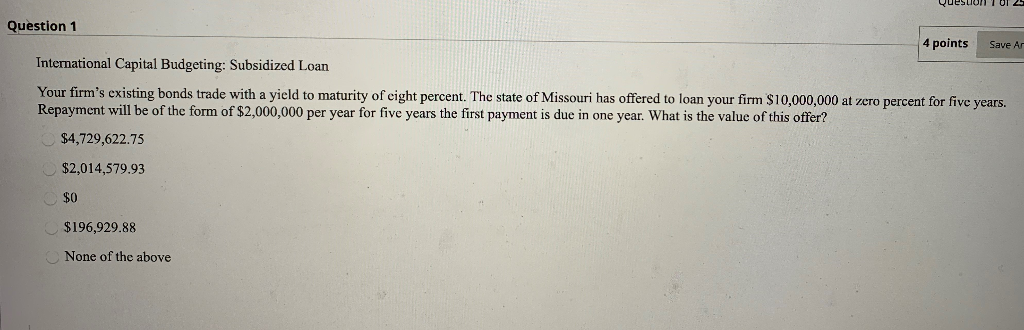

Question: 1 Question 101 Question 1 4 points Save A International Capital Budgeting: Subsidized Loan Your firm's existing bonds trade with a yield to maturity of

1

Question 101 Question 1 4 points Save A International Capital Budgeting: Subsidized Loan Your firm's existing bonds trade with a yield to maturity of eight percent. The state of Missouri has offered to loan your firm $10,000,000 at zero percent for five years. Repayment will be of the form of $2,000,000 per year for five years the first payment is due in one year. What is the value of this offer? $4,729,622.75 $2,014,579.93 $0 $196,929.88 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts