Question: help please ASAP! Please. I appreciate your help Question 1 (0.2 points) Saved Investors require a 3 percent return on risk-free investments. On a particular

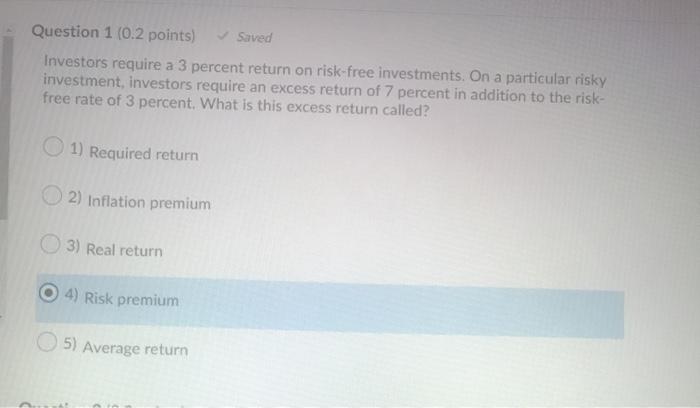

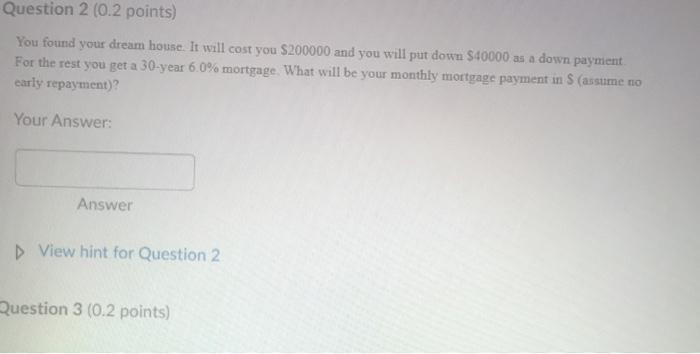

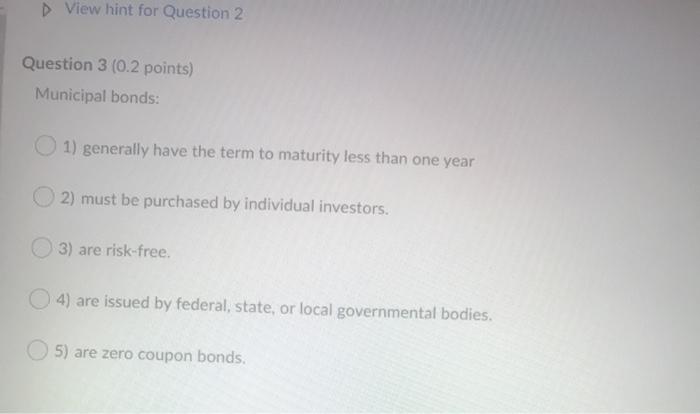

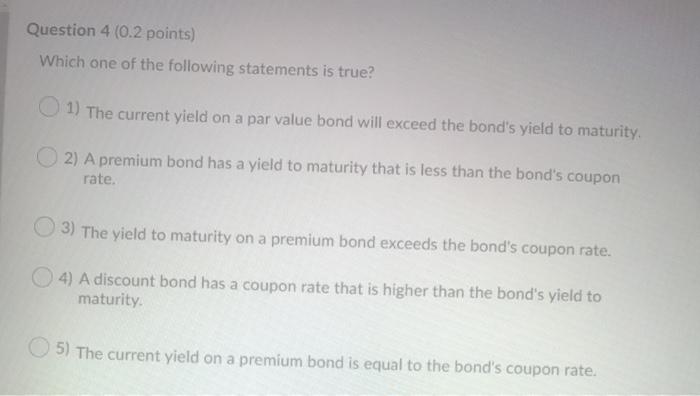

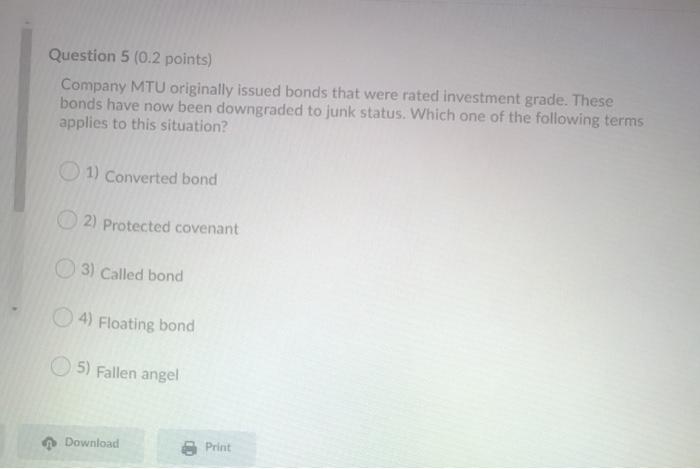

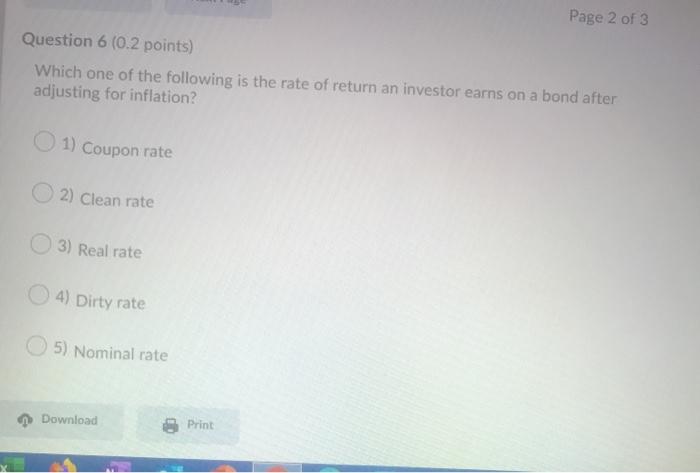

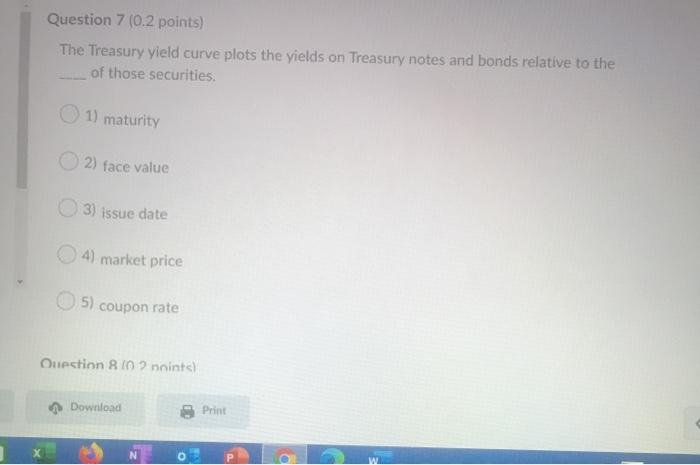

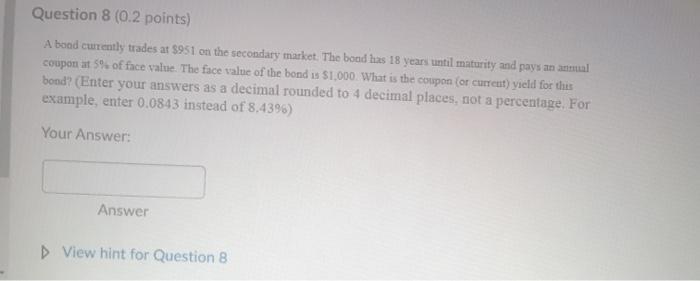

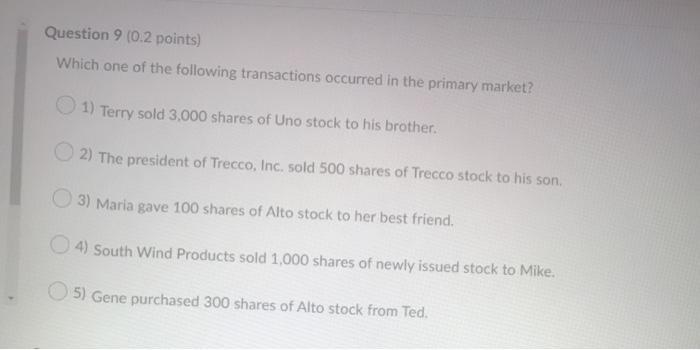

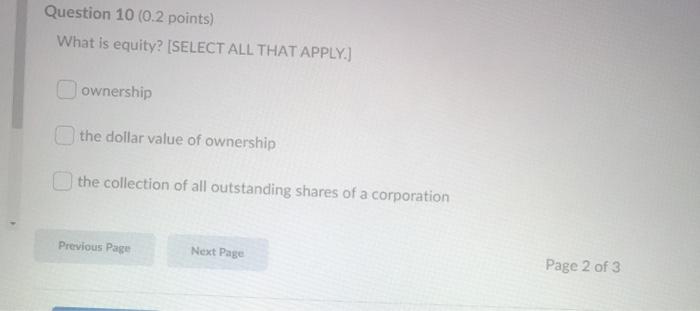

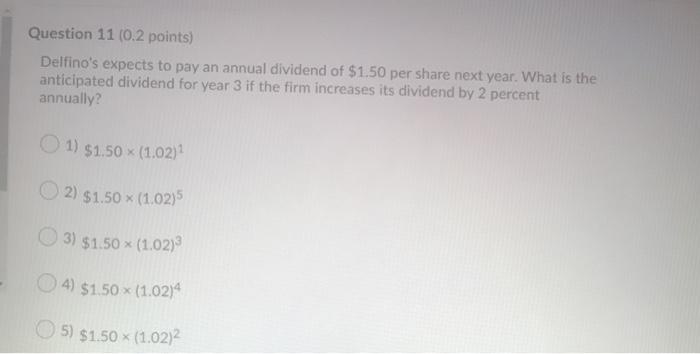

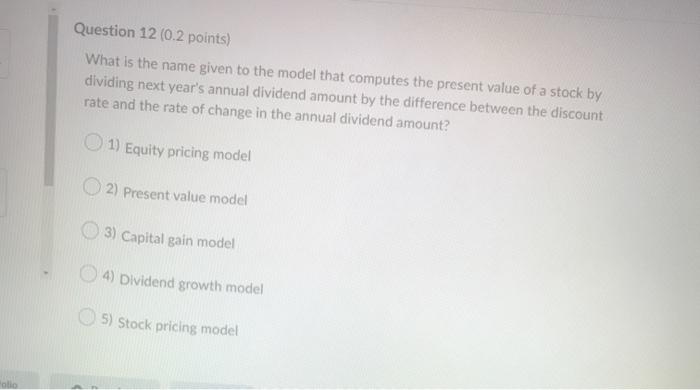

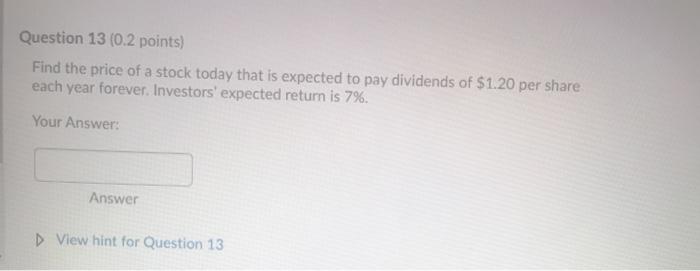

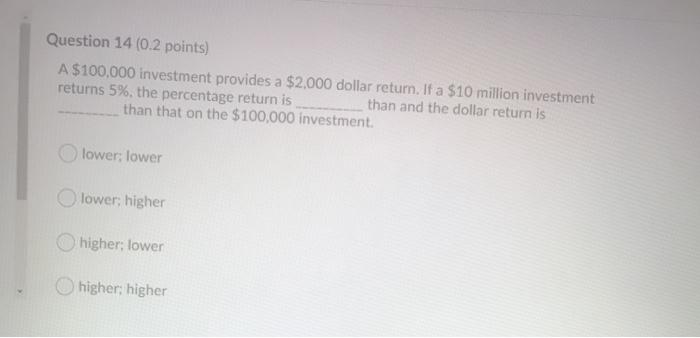

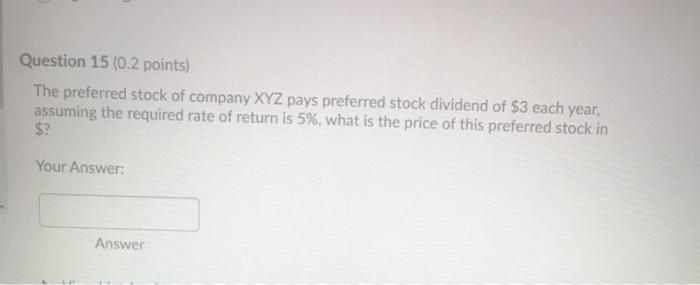

Question 1 (0.2 points) Saved Investors require a 3 percent return on risk-free investments. On a particular risky investment, investors require an excess return of 7 percent in addition to the risk- free rate of 3 percent. What is this excess return called? 1) Required return 2) Inflation premium 3) Real return 4) Risk premium 5) Average return Question 2 (0.2 points) You found your dream house. It will cost you S200000 and you will put down $40000 as a down payment For the rest you get a 30-year 6.0% mortgage What will be your monthly mortgage payment in S (assume no early repayment)? Your Answer: Answer View hint for Question 2 Question 3 (0.2 points) D View hint for Question 2 Question 3 (0.2 points) Municipal bonds: 1) generally have the term to maturity less than one year 2) must be purchased by individual investors. 3) are risk-free. 4) are issued by federal, state, or local governmental bodies. 5) are zero coupon bonds. Question 4 (0.2 points) Which one of the following statements is true? 1) The current yield on a par value bond will exceed the bond's yield to maturity. 2) A premium bond has a yield to maturity that is less than the bond's coupon rate. 3) The yield to maturity on a premium bond exceeds the bond's coupon rate. 4) A discount bond has a coupon rate that is higher than the bond's yield to maturity. 5) The current yield on a premium bond is equal to the bond's coupon rate. Question 5 (0.2 points) Company MTU originally issued bonds that were rated investment grade. These bonds have now been downgraded to junk status. Which one of the following terms applies to this situation? 1) Converted bond 2) Protected covenant 3) Called bond 4) Floating bond 5) Fallen angel Download Print Page 2 of 3 Question 6 (0.2 points) Which one of the following is the rate of return an investor earns on a bond after adjusting for inflation? 1) Coupon rate 2) Clean rate 3) Real rate 4) Dirty rate 5) Nominal rate Download Print Question 7 (0.2 points) The Treasury yield curve plots the yields on Treasury notes and bonds relative to the of those securities. 1) maturity 2) face value 3) issue date 4) market price 5) coupon rate Question 8102 noints) Download Print Question 8 (0.2 points) Abood currently trades at $951 on the secondary market. The bood has 18 years until maturity and pays an ammal coupon at 5% office value. The face value of the bond is $1,000. What is the coupon (or current) yield for this bond? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8,4396) Your Answer: Answer View hint for Question 8 Question 9 (0.2 points) Which one of the following transactions occurred in the primary market? 1) Terry sold 3,000 shares of Uno stock to his brother. 2) The president of Trecco, Inc. sold 500 shares of Trecco stock to his son. 3) Maria gave 100 shares of Alto stock to her best friend. 4) South Wind Products sold 1,000 shares of newly issued stock to Mike. 5) Gene purchased 300 shares of Alto stock from Ted. Question 10 (0.2 points) What is equity? (SELECT ALL THAT APPLY.) ownership the dollar value of ownership the collection of all outstanding shares of a corporation Previous Page Next Page Page 2 of 3 Question 11 (0.2 points) Delfino's expects to pay an annual dividend of $1.50 per share next year. What is the anticipated dividend for year 3 if the firm increases its dividend by 2 percent annually? 1) $1.50 X (1.02) 2) $1.50 X (1.02) 3) $1.50 (1.02) 4) $1.50 x (1.02) 5) $1.50 (1.02) Question 12 (0.2 points) What is the name given to the model that computes the present value of a stock by dividing next year's annual dividend amount by the difference between the discount rate and the rate of change in the annual dividend amount? 1) Equity pricing model 2) Present value model 3) Capital gain model 4) Dividend growth model 5) Stock pricing model Question 13 (0.2 points) Find the price of a stock today that is expected to pay dividends of $1.20 per share each year forever. Investors' expected return is 7%. Your Answer: Answer D View hint for Question 13 Question 14 (0.2 points) A $100,000 investment provides a $2,000 dollar return. If a $10 million investment returns 5%, the percentage return is than and the dollar return is than that on the $100,000 investment. lower; lower lower, higher higher; lower higher; higher Question 15 (0.2 points) The preferred stock of company XYZ pays preferred stock dividend of $3 each year, assuming the required rate of return is 5%, what is the price of this preferred stock in $? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts