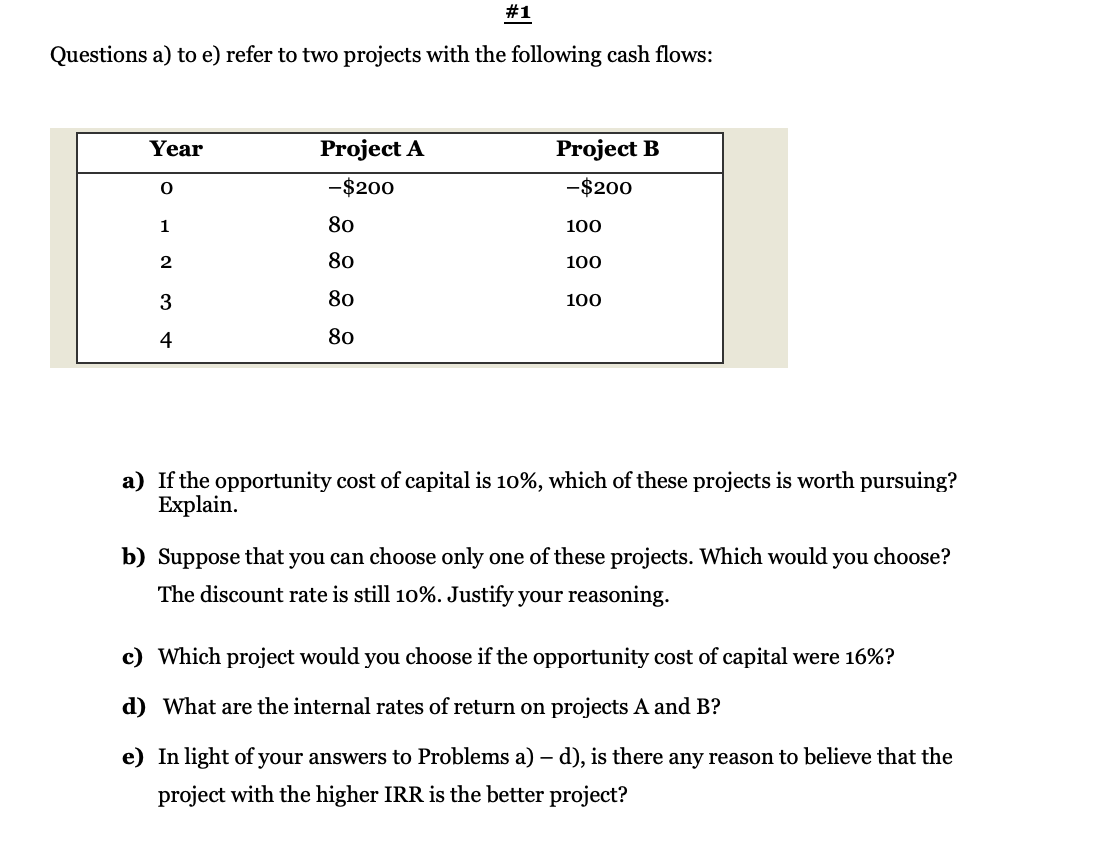

Question: #1 Questions a) to e) refer to two projects with the following cash flows: Year Project B Project A -$200 -$200 80 100 100 100

#1 Questions a) to e) refer to two projects with the following cash flows: Year Project B Project A -$200 -$200 80 100 100 100 a) If the opportunity cost of capital is 10%, which of these projects is worth pursuing? Explain. b) Suppose that you can choose only one of these projects. Which would you choose? The discount rate is still 10%. Justify your reasoning. c) Which project would you choose if the opportunity cost of capital were 16%? d) What are the internal rates of return on projects A and B? e) In light of your answers to Problems a) - d), is there any reason to believe that the project with the higher IRR is the better project? #2 An investment under consideration has a payback of six years and a cost of $573,000. If the required return is 12 percent, what is the worst-case NPV? The best-case NPV? Explain. Assume the cash flows are conventional

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts