Question: 1.) Ruth and Steve will file a joint return. During the year, they received dividends from a mutual fund investment, and they received a 2019

1.) Ruth and Steve will file a joint return. During the year, they received dividends from a mutual fund investment, and they received a 2019 Form 1099-DIV reporting a distribution of $1,000 in total ordinary dividends, shown in box 1, and qualified dividends of $1,000, shown in box 2. Their only other income was from wages. Their taxable income for the year was $86,500. How much tax will they pay on their dividend income?

A. $150

B.$200

C.$220

D.$300

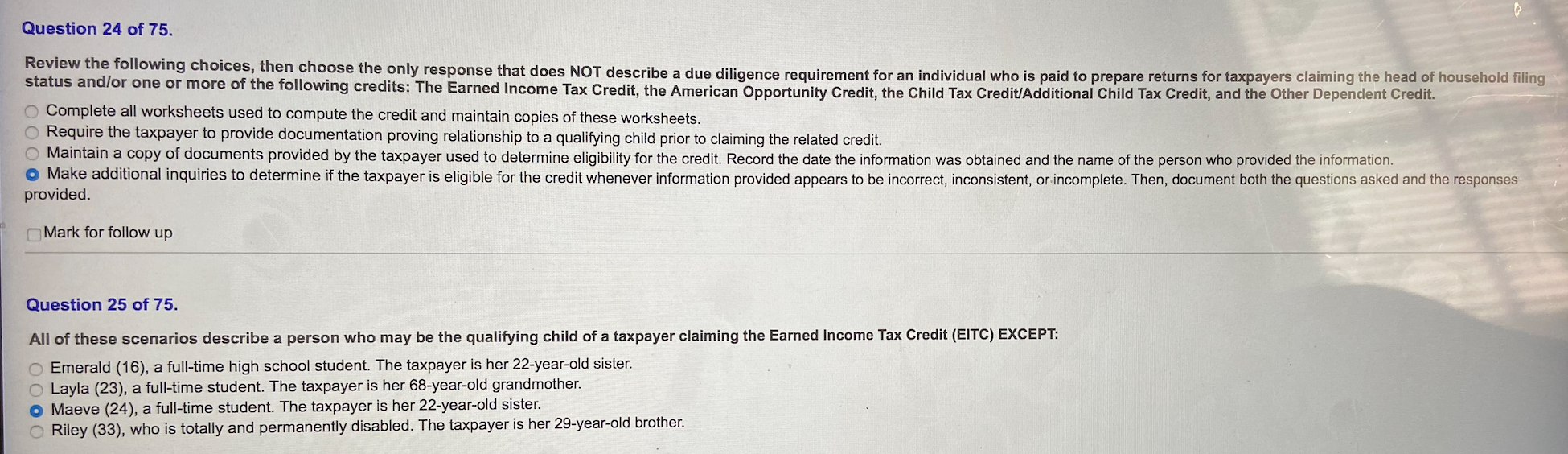

Question 24 of 75. Review the following choices, then choose the only response that does NOT describe a due diligence requirement for an individual who is paid to prepare returns for taxpayers claiming the head of household filing status and/or one or more of the following credits: The Earned Income Tax Credit, the American Opportunity Credit, the Child Tax Credit Additional Child Tax Credit, and the Other Dependent Credit. Complete all worksheets used to compute the credit and maintain copies of these worksheets. Require the taxpayer to provide documentation proving relationship to a qualifying child prior to claiming the related credit. Maintain a copy of documents provided by the taxpayer used to determine eligibility for the credit. Record the date the information was obtained and the name of the person who provided the information. Make additional inquiries to determine if the taxpayer is eligible for the credit whenever information provided appears to be incorrect, inconsistent, or incomplete. Then, document both the questions asked and the responses provided Mark for follow up Question 25 of 75. All of these scenarios describe a person who may be the qualifying child of a taxpayer claiming the Earned Income Tax Credit (EITC) EXCEPT: Emerald (16), a full-time high school student. The taxpayer is her 22-year-old sister. Layla (23), a full-time student. The taxpayer her 68-year-old grandmother. o Maeve (24), a full-time student. The taxpayer is her 22-year-old sister. O Riley (33), who is totally and permanently disabled. The taxpayer is her 29-year-old brother

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts