Question: #1 - SECOND TRY The company has received a special order for 30,000 suitcases at a price of $250 per case. It will not have

#1 - SECOND TRY

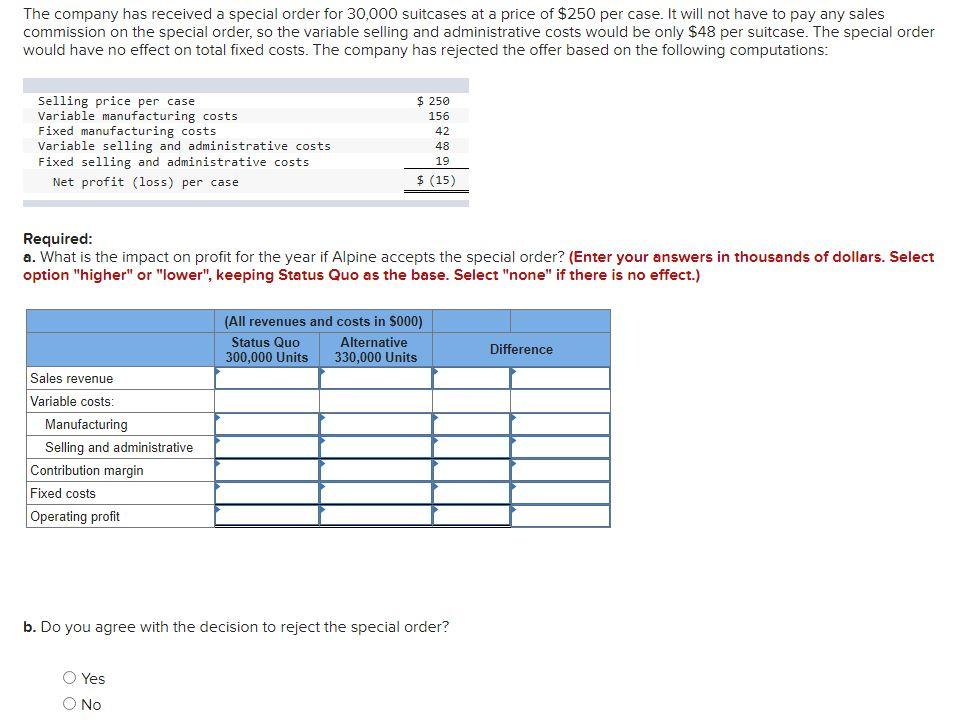

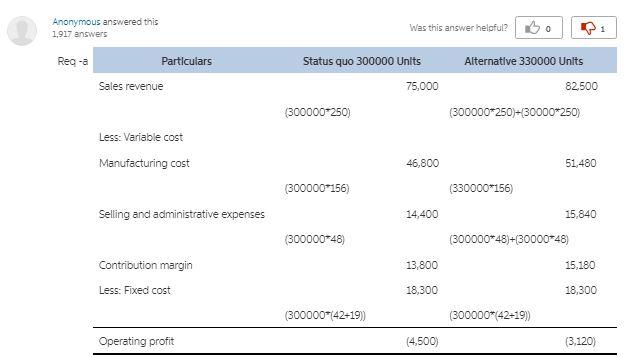

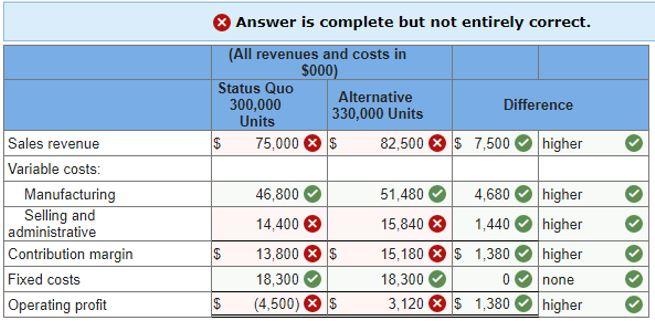

The company has received a special order for 30,000 suitcases at a price of $250 per case. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $48 per suitcase. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Net profit (loss) per case $ 250 156 42 48 19 $ (15) Required: a. What is the impact on profit for the year if Alpine accepts the special order? (Enter your answers in thousands of dollars. Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) (All revenues and costs in S000) Status Quo Alternative 300,000 Units 330,000 Units Difference Sales revenue Variable costs: Manufacturing Selling and administrative Contribution margin Fixed costs Operating profit b. Do you agree with the decision to reject the special order? Yes Anonymous answered this 1,917 answers Was this answer helpful? 1 Reg-a Particulars Sales revenue Status quo 300000 Units 75,000 (300000-250) Alternative 330000 Units 82,500 (300000*250-30000*250) Less: Variable cost Manufacturing cost 46,800 51,480 (300000=156) (330000*156) Selling and administrative expenses 14,400 15.840 (300000*48) (300000*48)+(30000-48) 13,800 15,180 Contribution margin Less: Fixed cost 18,300 18,300 (300000*(42+19) (300000*42-19)) Operating profit (4.500) (3.120) Answer is complete but not entirely correct. (All revenues and costs in $000) Status Quo Alternative 300,000 Difference Units 330,000 Units 75,000 $ 82,500 $ 7,500 higher $ Sales revenue Variable costs: Manufacturing Selling and administrative Contribution margin Fixed costs Operating profit 46,800 14,400 higher higher higher $ 51,480 4,680 15,840 1,440 15.180 $ 1,380 18,300 0 3.120 $ 1,380 13,800 $ 18,300 (4,500) X $ none S higher The company has received a special order for 30,000 suitcases at a price of $250 per case. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $48 per suitcase. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Net profit (loss) per case $ 250 156 42 48 19 $ (15) Required: a. What is the impact on profit for the year if Alpine accepts the special order? (Enter your answers in thousands of dollars. Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) (All revenues and costs in S000) Status Quo Alternative 300,000 Units 330,000 Units Difference Sales revenue Variable costs: Manufacturing Selling and administrative Contribution margin Fixed costs Operating profit b. Do you agree with the decision to reject the special order? Yes Anonymous answered this 1,917 answers Was this answer helpful? 1 Reg-a Particulars Sales revenue Status quo 300000 Units 75,000 (300000-250) Alternative 330000 Units 82,500 (300000*250-30000*250) Less: Variable cost Manufacturing cost 46,800 51,480 (300000=156) (330000*156) Selling and administrative expenses 14,400 15.840 (300000*48) (300000*48)+(30000-48) 13,800 15,180 Contribution margin Less: Fixed cost 18,300 18,300 (300000*(42+19) (300000*42-19)) Operating profit (4.500) (3.120) Answer is complete but not entirely correct. (All revenues and costs in $000) Status Quo Alternative 300,000 Difference Units 330,000 Units 75,000 $ 82,500 $ 7,500 higher $ Sales revenue Variable costs: Manufacturing Selling and administrative Contribution margin Fixed costs Operating profit 46,800 14,400 higher higher higher $ 51,480 4,680 15,840 1,440 15.180 $ 1,380 18,300 0 3.120 $ 1,380 13,800 $ 18,300 (4,500) X $ none S higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts