Question: 1. Shaar (see CFA Problem 10) has revised slightly her estimated earnings growth rate for Rio National and, using normalized (underlying trend) EPS, which is

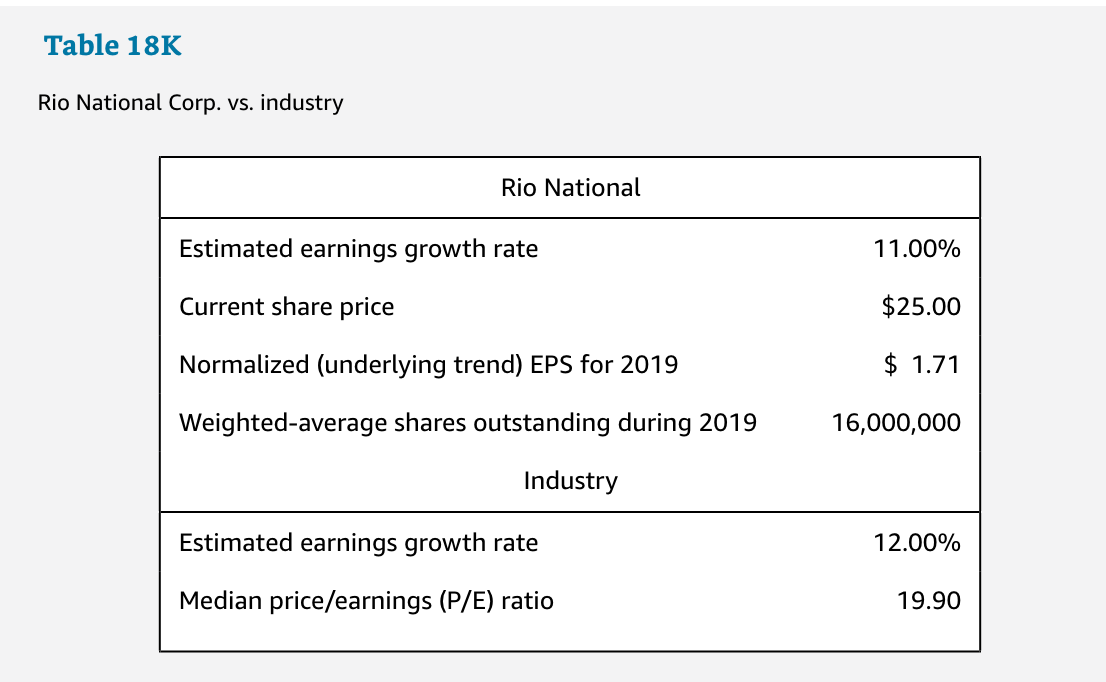

1. Shaar (see CFA Problem 10) has revised slightly her estimated earnings growth rate for Rio National and, using normalized (underlying trend) EPS, which is adjusted for temporary impacts on earnings, now wants to compare the current value of Rio National's equity to that of the industry, on a growth-adjusted basis. Selected information about Rio National and the industry is given in Table 18K. Compared to the industry, is Rio National's equity overvalued or undervalued on a P/ E-to-growth (PEG) basis, using normalized (underlying trend) earnings per share? Assume that the risk of Rio National is similar to the risk of the industry. Rio National Corp. vs. industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts