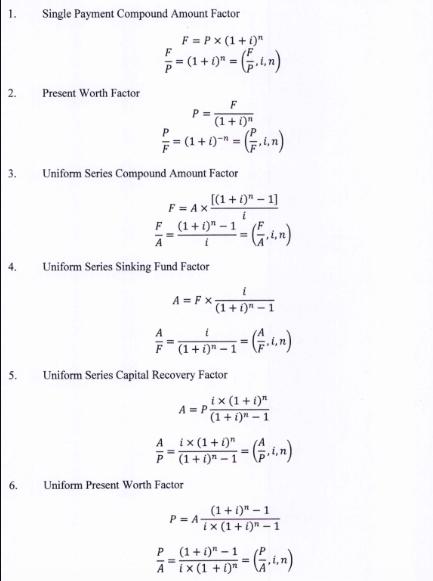

Question: 1. Single Payment Compound Amount Factor F = PX (1+0) F =(1+0)=(n) 2. Present Worth Factor F P = (1+0) =(1+0)=(in) 3. Uniform Series

![Compound Amount Factor [(1+)-1] F= Ax 5. F (1+1)-1 A i (in)](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/05/663ac6034adbe_811663ac6031cb3a.jpg)

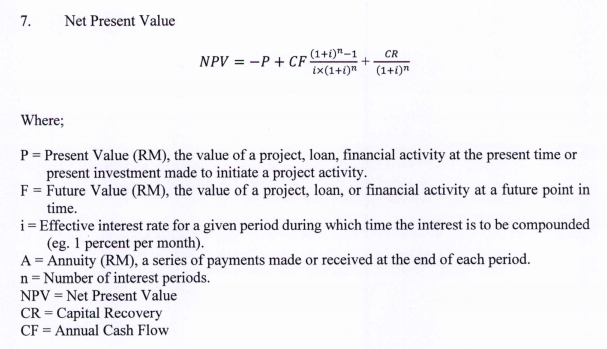

1. Single Payment Compound Amount Factor F = PX (1+0)" F =(1+0)=(n) 2. Present Worth Factor F P = (1+0)" =(1+0)=(in) 3. Uniform Series Compound Amount Factor [(1+)-1] F= Ax 5. F (1+1)-1 A i (in) Uniform Series Sinking Fund Factor A F A=FX (1+1)-1 = (1+0)-1-(n) Uniform Series Capital Recovery Factor A P. ix (1+i)" (1+)-1 A ix (1+i)" P (1+0)-1 = 6. Uniform Present Worth Factor P A (1+1)"-1 ix (1+)-1 P (1+0)-1-(in) = Aix (1+1) = 7. Net Present Value NPV-P+CF! . (1+i)"1 CR ix(1+i)" (1+1)" + Where; P = Present Value (RM), the value of a project, loan, financial activity at the present time or present investment made to initiate a project activity. F = Future Value (RM), the value of a project, loan, or financial activity at a future point in time. i = Effective interest rate for a given period during which time the interest is to be compounded (eg. 1 percent per month). A = Annuity (RM), a series of payments made or received at the end of each period. n Number of interest periods. NPV Net Present Value CR = Capital Recovery CF Annual Cash Flow a) The annual maintenance cost of a small power generator is $3,000. If a new generator bought, there will no maintenance for first 5 years due to warranty period. Then the maintenance cost will be at $1,000 per year for next 10 years and $3,000 a year thereafter. Assume the cost of money is at 5% per year. What is the maximum cost of a new generator to be purchased in order to justify for the condition above? (CO3, PO 12-10 marks) b) Colonel Khairol Bin Abdullah is considering to buy a new 2016 Toyota Camry Hybrid car priced at RM174,900 or a new 2016 Honda Accord car at RM167,500. The fuel efficiency for Toyota is rated at 16km per liter and 12km per liter for Honda. The annual maintenance for both cars are 0.5% of the car price. The fuel cost is at RM2.05 per liter. The car is expected to be driven about 30,000km per year. Colonel Khairol plans to keep his car for only eight years. At the end of eighth year, the resale value of the Toyota and Honda are depreciated 40% and 30% respectively of their original prices. Assuming, the interest rate is at 4% per annum, analyze the situation by calculating NPV and recommend which car is the better choice? (CO3, PO 12-15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts