Question: 1 st read the picture 2 nd read the remaining assignment: The new packaging would require the purchase of molds and assembly equipment ( useful

st read the picture

nd read the remaining assignment:

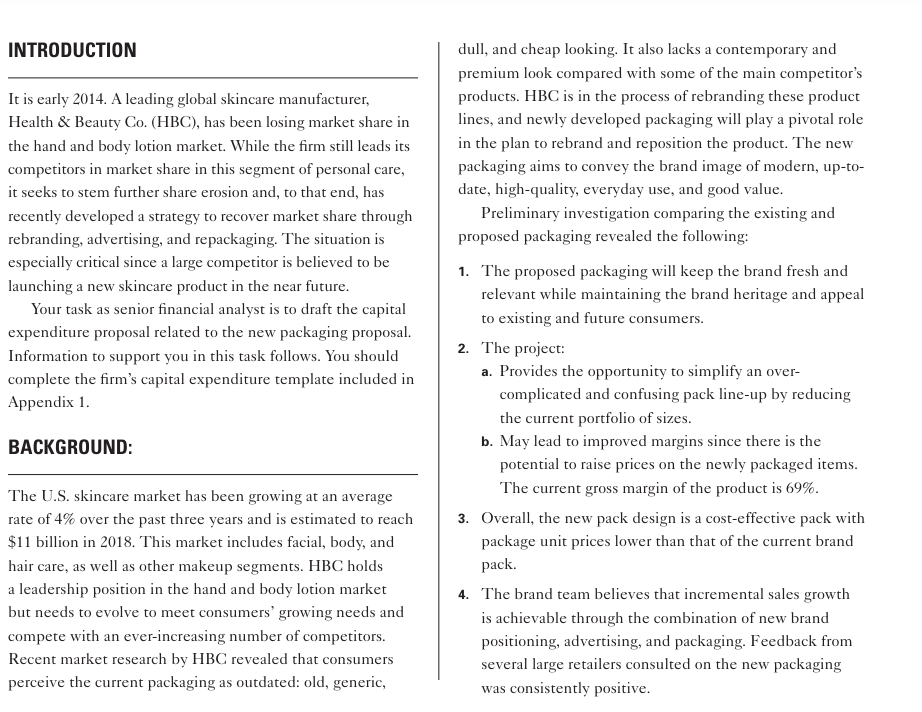

The new packaging would require the purchase of molds and assembly equipment useful life of six years on all as follows: CapPump molds $ Change part Pump assembly In addition, the firm will incur startup expenses related to partial case returns and other items. It is assumed that major customers will be able to manage down their inventory levels with the assistance of the transitions team. Minimal returns will come from large retailers including WalMart and Kmart due to their quick inventory turnover. It is anticipated that most returns will come from drug retailers as they shift products to the new packaging and remove unsold product from the shelves. Partial case returns net of salvage value $ Label conversion costs Freight chargelaunch year expenses Other miscellaneous The redesign calls for cutting SKUs from to No volume loss is anticipated from this since the transition team will actively manage shelf space on a customerbycustomer basis to minimize loss of shelf presence. The SKU reduction is estimated at $ per year since the new package design is less expensive per unit. The brands current longterm strategic role is to maintain share and grow at category levels. Sales in the most recent year were $ million. Without the redesign, sales are forecast to remain flat at historic levels. With the redesign, management believes that sales can grow at the rate of the skincare categoryforecast at per year for the next five yearsand there will also be incremental growth related to recovery of market share of in Year in Year in Year and thereafter. The gross margin will remain at of net sales. The incremental marketing and development cost is a onetime $ for market research and development. Management thought the project should be evaluated using a discount rate of based on the firms weighted average cost of capital WACC and the perceived riskiness of the project. The tax rate is ASSIGNMENT QUESTION: As the accounting financial analyst supporting the brand, the CFO assigns you the project of completing a capital expenditure proposal for the repackaging. You must complete the template in Appendix

Capital Expenditure Proposal Template This form should be used for the approval of capital expenditures costing greater than $ with a useful life of more than one year that are capitalized on the balance sheet as fixed assets. Capital Expenditure Proposal

Section : Background Describe here the project background, description, timeline, strategic rationale, and expected impact.

Section : Financial analysis Identify and calculate the key metrics that will be used to analyze the decision. This might include proforma financials, NPV IRR, Payback, ROIC, breakeven, andor other measures

Section : Risks Outline the financial and nonfinancial risks associated with the project. Analyze the impact of the risks outlined above through sensitivity and scenario analyses. You should include tables summarizing the results.

Section : Ethical considerations Identify ethics issues of repackagingrebranding a product without improving it Also, consider if it is ethical to increase the price without improving the productINTRODUCTION

It is early A leading global skincare manufacturer,

Health & Beauty CoHBC has been losing market share in

the hand and body lotion market. While the firm still leads its

competitors in market share in this segment of personal care,

it seeks to stem further share erosion and, to that end, has

recently developed a strategy to recover market share through

rebranding, advertising, and repackaging. The situation is

especially critical since a large competitor is believed to be

launching a new skincare product in the near future.

Your task as senior financial analyst is to draft the capital

expenditure proposal related to the new packaging proposal.

Information to support you in this task follows. You should

complete the firm's capital expenditure template included in

Appendix

BACKGROUND:

The US skincare market has been growing at an average

rate of over the past three years and is estimated to reach

$ billion in This market includes facial, body, and

hair care, as well as other makeup segments. HBC holds

a leadership position in the hand and body lotion market

but needs to evolve to meet consumers' growing needs and

compete with an everincreasing number of competitors.

Recent market research by HBC revealed that consumers

perceive the current packaging as outdated: old, generic,

dull, and cheap looking. It also lacks a contemporary and

premium look compared with some of the main competitor's

products. HBC is in the process of rebranding these product

lines, and newly developed packaging will play a pivotal role

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock