Question: 1. Static GAP analysis is useful for a) highlighting re-pricing mismatches on an FI's balance sheet, b) Constructing a fully immunized bond portfolio, c) measuring

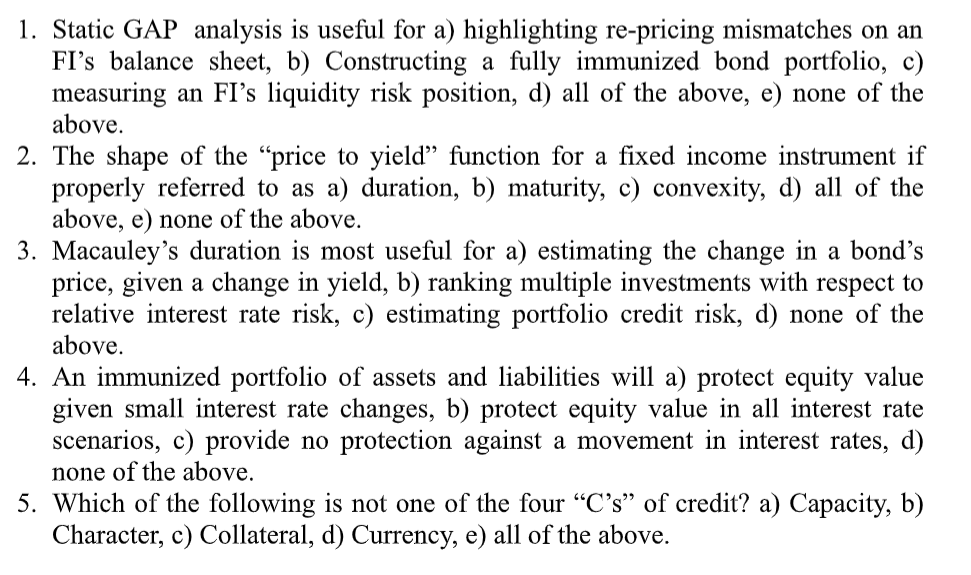

1. Static GAP analysis is useful for a) highlighting re-pricing mismatches on an FI's balance sheet, b) Constructing a fully immunized bond portfolio, c) measuring an FI's liquidity risk position, d) all of the above, e) none of the above. 2. The shape of the "price to yield" function for a fixed income instrument if properly referred to as a) duration, b) maturity, c) convexity, d) all of the above, e) none of the above. 3. Macauley's duration is most useful for a) estimating the change in a bond's price, given a change in yield, b) ranking multiple investments with respect to relative interest rate risk, c) estimating portfolio credit risk, d) none of the above. 4. An immunized portfolio of assets and liabilities will a) protect equity value given small interest rate changes, b) protect equity value in all interest rate scenarios, c) provide no protection against a movement in interest rates, d) none of the above. 5. Which of the following is not one of the four "C's" of credit? a) Capacity, b) Character, c) Collateral, d) Currency, e) all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts