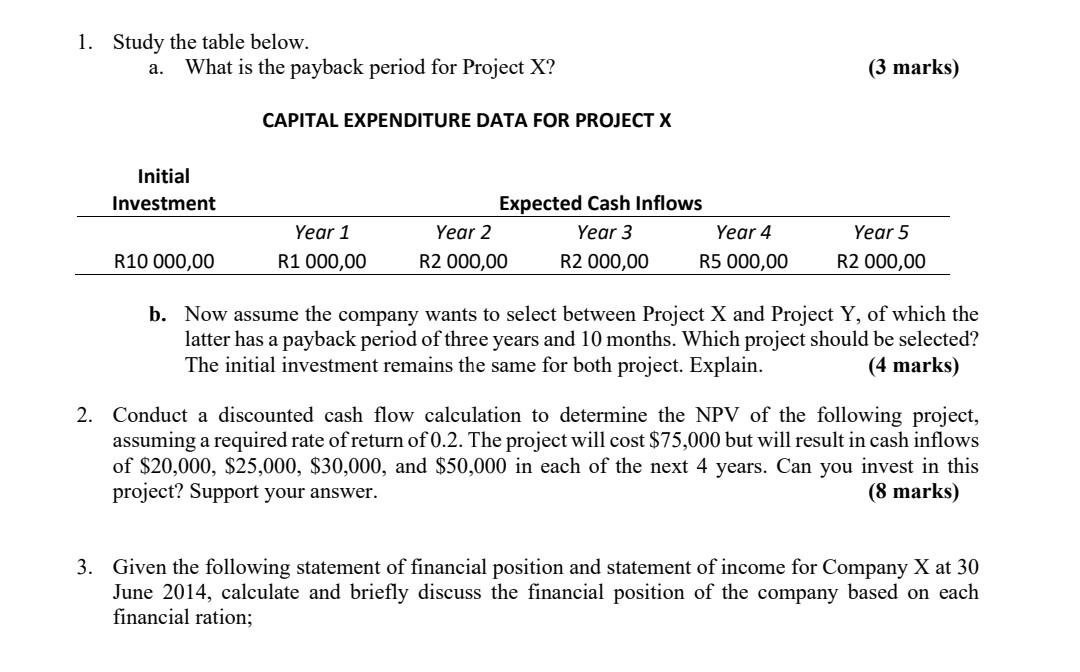

Question: 1. Study the table below. What is the payback period for Project X? a. (3 marks) CAPITAL EXPENDITURE DATA FOR PROJECT X Initial Investment Year

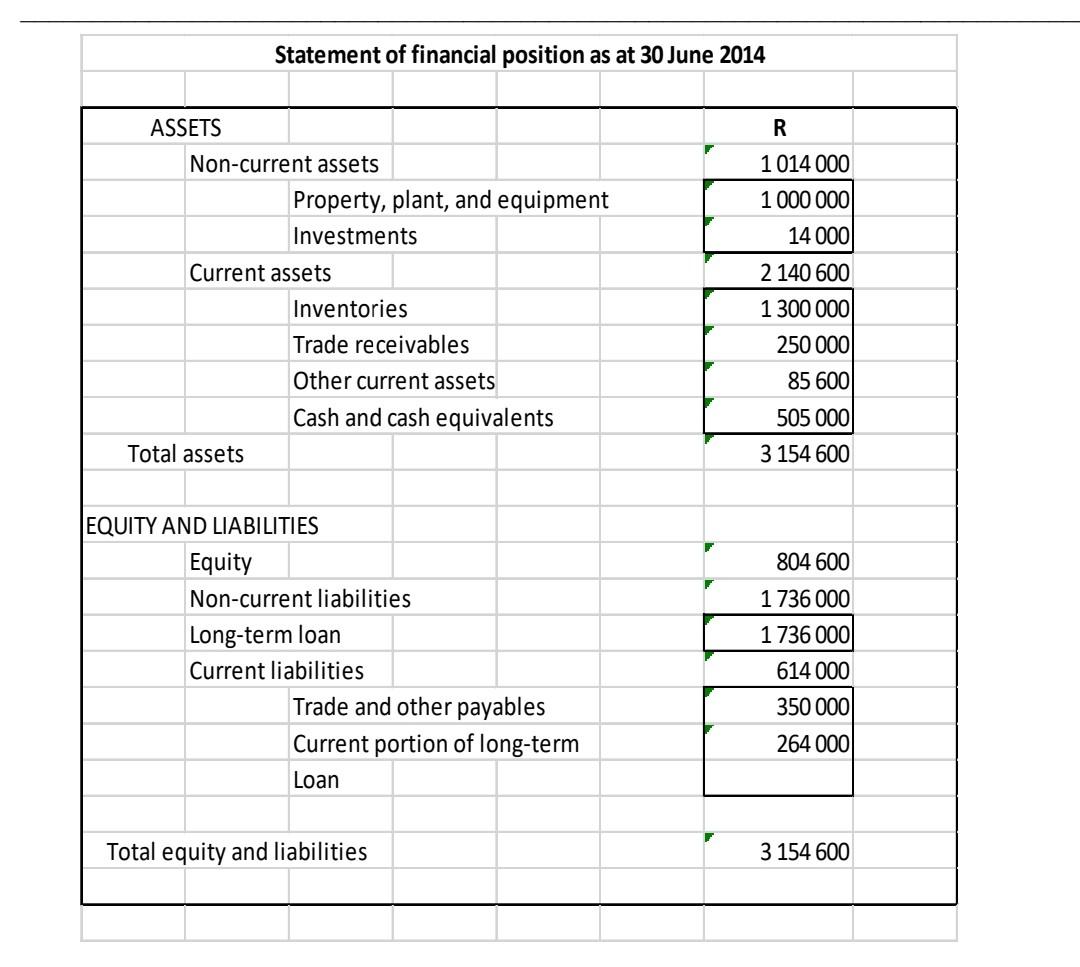

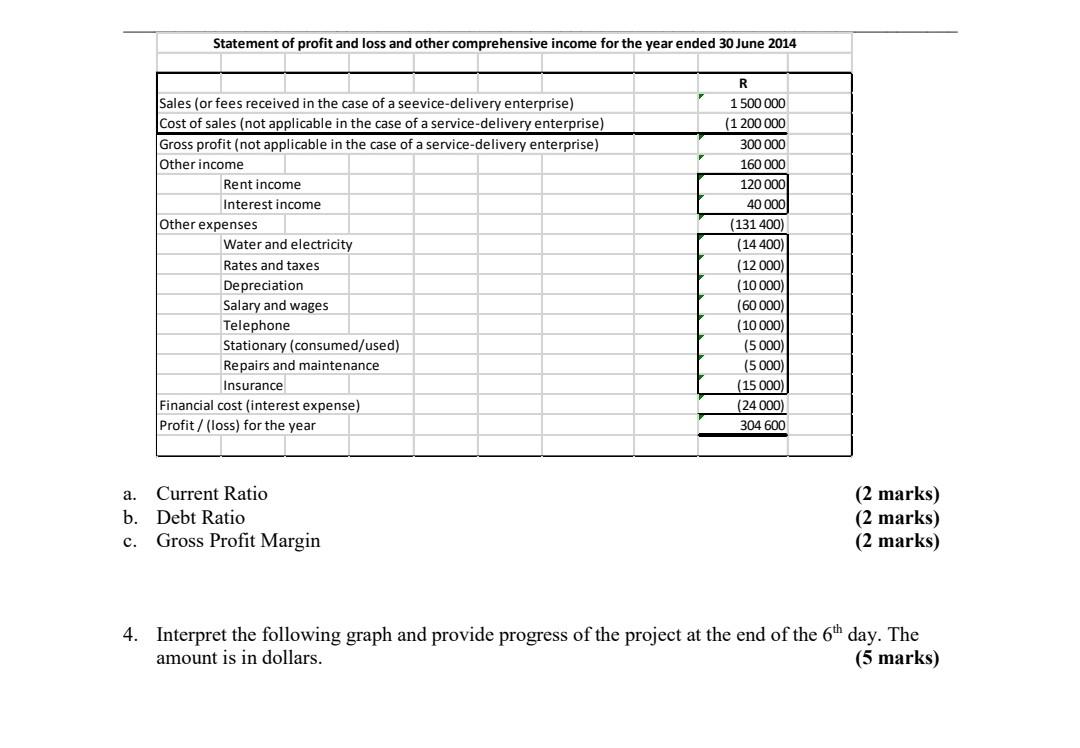

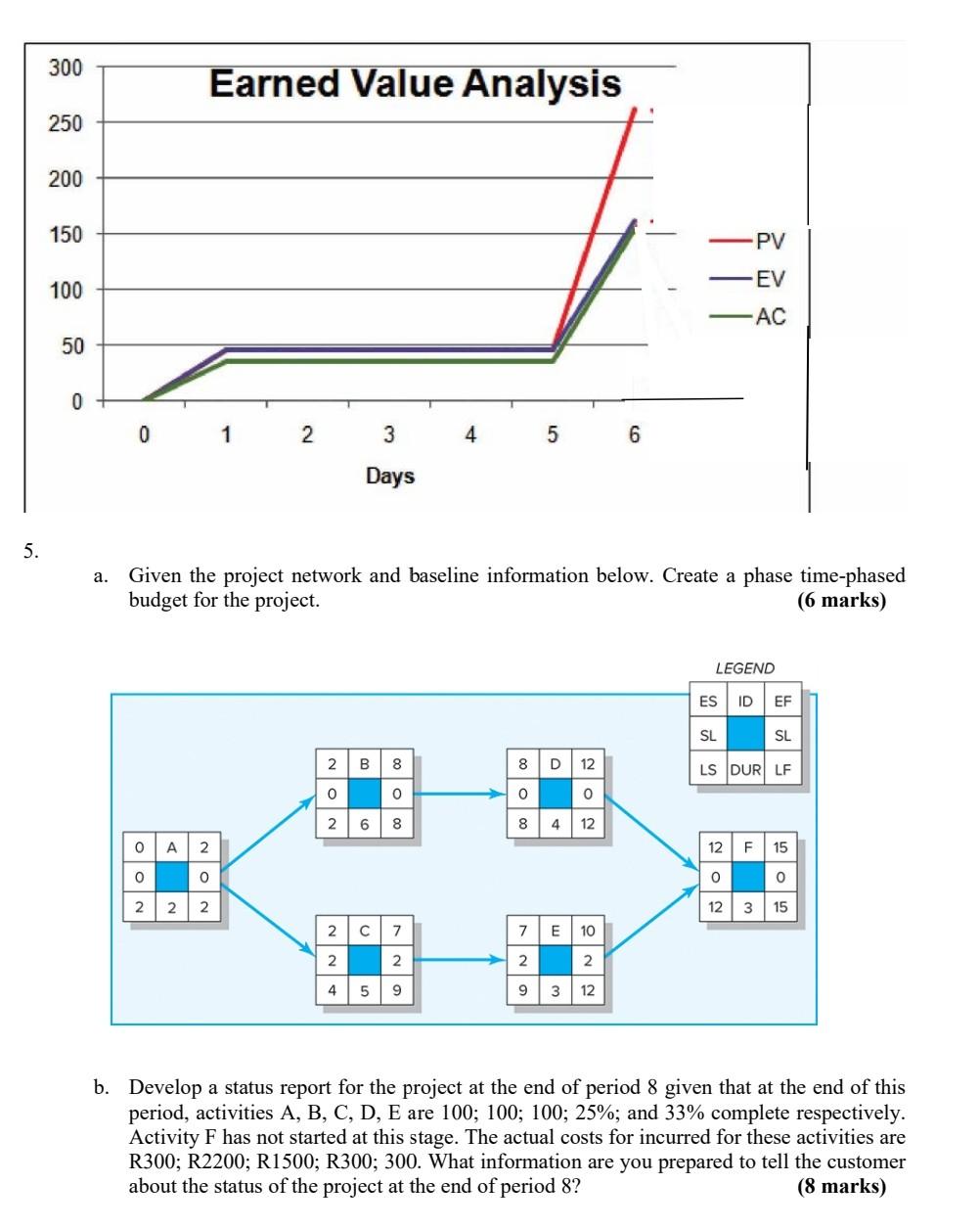

1. Study the table below. What is the payback period for Project X? a. (3 marks) CAPITAL EXPENDITURE DATA FOR PROJECT X Initial Investment Year 1 R1 000,00 Expected Cash Inflows Year 2 Year 3 Year 4 R2 000,00 R2 000,00 R5 000,00 Year 5 R2 000,00 R10 000,00 b. Now assume the company wants to select between Project X and Project Y, of which the latter has a payback period of three years and 10 months. Which project should be selected? The initial investment remains the same for both project. Explain. (4 marks) 2. Conduct a discounted cash flow calculation to determine the NPV of the following project, assuming a required rate of return of 0.2. The project will cost $75,000 but will result in cash inflows of $20,000, $25,000, $30,000, and $50,000 in each of the next 4 years. Can you invest in this project? Support your answer. (8 marks) 3. Given the following statement of financial position and statement of income for Company X at 30 June 2014, calculate and briefly discuss the financial position of the company based on each financial ration; Statement of financial position as at 30 June 2014 ASSETS R 1014 000 1 000 000 14 000 Non-current assets Property, plant, and equipment Investments Current assets Inventories Trade receivables Other current assets Cash and cash equivalents Total assets 2 140 600 1 300 000 250 000 85 600 505 000 3 154 600 EQUITY AND LIABILITIES Equity Non-current liabilities Long-term loan Current liabilities Trade and other payables Current portion of long-term Loan 804 600 1 736 000 1 736 000 614 000 350 000 264 000 Total equity and liabilities 3 154 600 Statement of profit and loss and other comprehensive income for the year ended 30 June 2014 Sales (or fees received in the case of a seevice-delivery enterprise) Cost of sales (not applicable in the case of a service delivery enterprise) Gross profit (not applicable in the case of a service delivery enterprise) Other income Rent income Interest income Other expenses Water and electricity Rates and taxes Depreciation Salary and wages Telephone Stationary (consumed/used) Repairs and maintenance Insurance Financial cost interest expense) Profit/(loss) for the year R 1 500 000 (1 200 000 300 000 160 000 120 000 40 000 (131 400) (14 400) (12 000) (10 000) (60 000) (10 000) (5000) (5000) (15 000) (24 000) 304 600 a. Current Ratio b. Debt Ratio c. Gross Profit Margin (2 marks) (2 marks) (2 marks) 4. Interpret the following graph and provide progress of the project at the end of the 6th day. The amount is in dollars. (5 marks) 300 Earned Value Analysis 250 200 150 PV -EV 100 - AC 50 0 0 1 2 3 4 5 6 Days 5. a. Given the project network and baseline information below. Create a phase time-phased budget for the project. (6 marks) LEGEND ES ID EF SL SL 2 B 8 D 12 LS DUR LF 0 00 000 0 000 2. 6 4 12 0 A 2 12 F 15 0 0 0 O 2 2 2 12 3 15 2 7 7 E 10 2 2 2 2 4 5 9 9 3 12 b. Develop a status report for the project at the end of period 8 given that at the end of this period, activities A, B, C, D, E are 100; 100; 100; 25%; and 33% complete respectively. Activity F has not started at this stage. The actual costs for incurred for these activities are R300; R2200; R1500; R300; 300. What information are you prepared to tell the customer about the status of the project at the end of period 8? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock