Question: . . . 1. Suppose that three factors have been identified for the U.S. economy: Expected inflation rate (IR) is +2.00% Expected 10-year Treasury yield

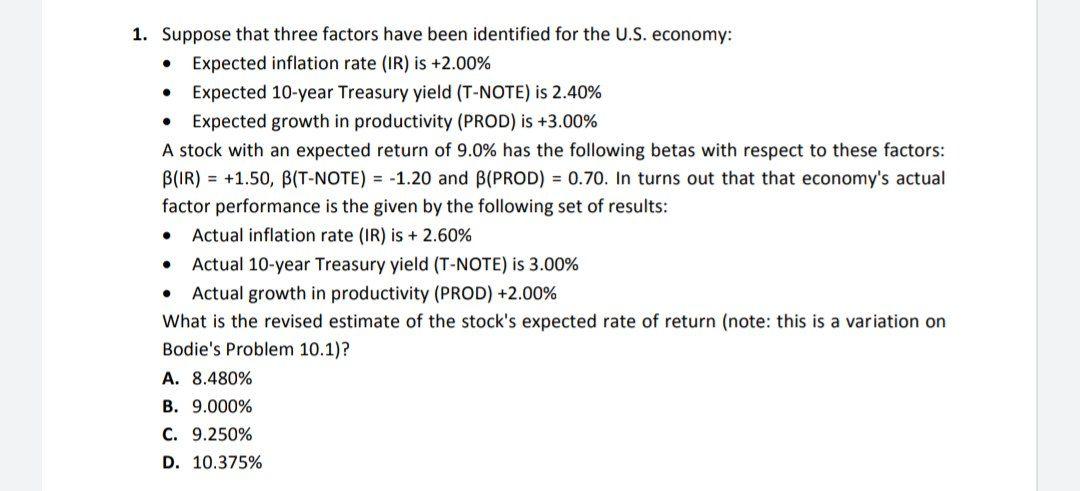

. . . 1. Suppose that three factors have been identified for the U.S. economy: Expected inflation rate (IR) is +2.00% Expected 10-year Treasury yield (T-NOTE) is 2.40% Expected growth in productivity (PROD) is +3.00% A stock with an expected return of 9.0% has the following betas with respect to these factors: B(IR) = +1.50, B(T-NOTE) = -1.20 and B(PROD) = 0.70. In turns out that that economy's actual factor performance is the given by the following set of results: Actual inflation rate (IR) is + 2.60% Actual 10-year Treasury yield (T-NOTE) is 3.00% Actual growth in productivity (PROD) +2.00% What is the revised estimate of the stock's expected rate of return (note: this is a variation on Bodie's Problem 10.1)? A. 8.480% B. 9.000% C. 9.250% D. 10.375%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts