Question: 1) Suppose we were to form a new variable x as xi=XiX,i=1,2,,225. The intercept obtained from the regression of Y on x would equal Y.

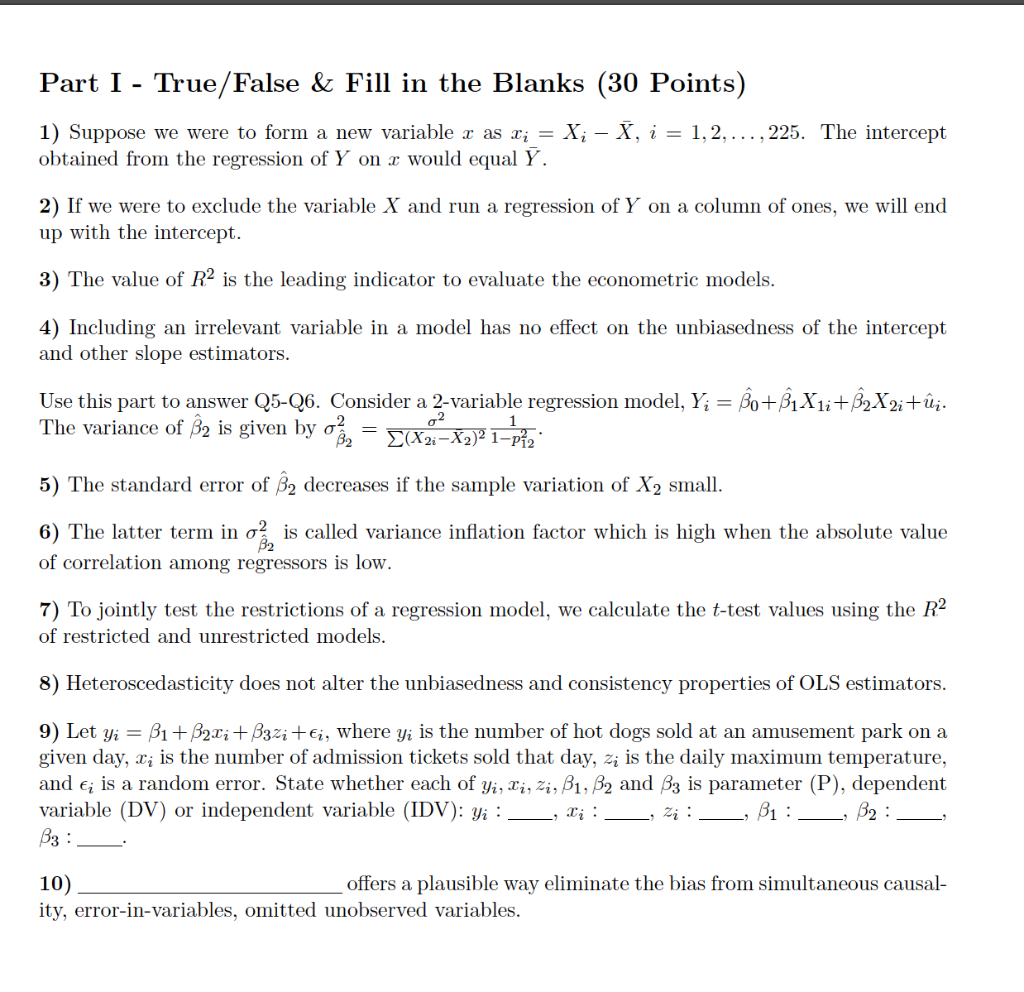

1) Suppose we were to form a new variable x as xi=XiX,i=1,2,,225. The intercept obtained from the regression of Y on x would equal Y. 2) If we were to exclude the variable X and run a regression of Y on a column of ones, we will end up with the intercept. 3) The value of R2 is the leading indicator to evaluate the econometric models. 4) Including an irrelevant variable in a model has no effect on the unbiasedness of the intercept and other slope estimators. Use this part to answer Q5-Q6. Consider a 2-variable regression model, Yi=^0+^1X1i+^2X2i+u^i. The variance of ^2 is given by ^22=(X2iX2)221p1221. 5) The standard error of ^2 decreases if the sample variation of X2 small. 6) The latter term in ^22 is called variance inflation factor which is high when the absolute value of correlation among regressors is low. 7) To jointly test the restrictions of a regression model, we calculate the t-test values using the R2 of restricted and unrestricted models. 8) Heteroscedasticity does not alter the unbiasedness and consistency properties of OLS estimators. 9) Let yi=1+2xi+3zi+i, where yi is the number of hot dogs sold at an amusement park on a given day, xi is the number of admission tickets sold that day, zi is the daily maximum temperature, and i is a random error. State whether each of yi,xi,zi,1,2 and 3 is parameter ( P), dependent variable (DV) or independent variable (IDV): yi : ,xi : zi : ,1 : 2 : 3 : 10). . offers a plausible way eliminate the bias from simultaneous causality, error-in-variables, omitted unobserved variables. 1) Suppose we were to form a new variable x as xi=XiX,i=1,2,,225. The intercept obtained from the regression of Y on x would equal Y. 2) If we were to exclude the variable X and run a regression of Y on a column of ones, we will end up with the intercept. 3) The value of R2 is the leading indicator to evaluate the econometric models. 4) Including an irrelevant variable in a model has no effect on the unbiasedness of the intercept and other slope estimators. Use this part to answer Q5-Q6. Consider a 2-variable regression model, Yi=^0+^1X1i+^2X2i+u^i. The variance of ^2 is given by ^22=(X2iX2)221p1221. 5) The standard error of ^2 decreases if the sample variation of X2 small. 6) The latter term in ^22 is called variance inflation factor which is high when the absolute value of correlation among regressors is low. 7) To jointly test the restrictions of a regression model, we calculate the t-test values using the R2 of restricted and unrestricted models. 8) Heteroscedasticity does not alter the unbiasedness and consistency properties of OLS estimators. 9) Let yi=1+2xi+3zi+i, where yi is the number of hot dogs sold at an amusement park on a given day, xi is the number of admission tickets sold that day, zi is the daily maximum temperature, and i is a random error. State whether each of yi,xi,zi,1,2 and 3 is parameter ( P), dependent variable (DV) or independent variable (IDV): yi : ,xi : zi : ,1 : 2 : 3 : 10). . offers a plausible way eliminate the bias from simultaneous causality, error-in-variables, omitted unobserved variables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts