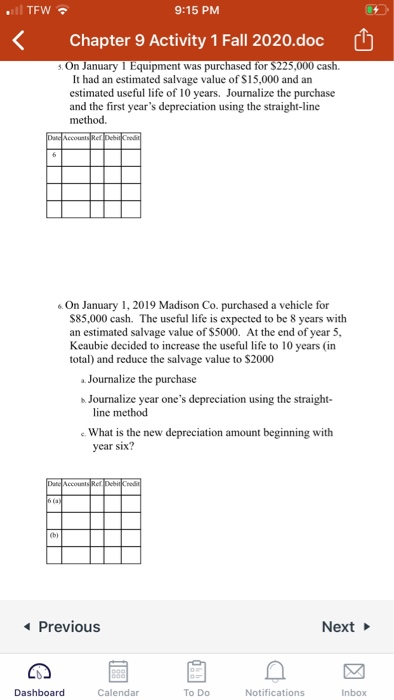

Question: 1 TEW 9:15 PM Chapter 9 Activity 1 Fall 2020.doc s.On January 1 Equipment was purchased for $225,000 cash. It had an estimated salvage value

1 TEW 9:15 PM Chapter 9 Activity 1 Fall 2020.doc s.On January 1 Equipment was purchased for $225,000 cash. It had an estimated salvage value of $15,000 and an estimated useful life of 10 years. Journalize the purchase and the first year's depreciation using the straight-line method. Date Accounts Retired 6 6.On January 1, 2019 Madison Co. purchased a vehicle for $85,000 cash. The useful life is expected to be 8 years with an estimated salvage value of $5000. At the end of year 5, Keaubie decided to increase the useful life to 10 years (in total) and reduce the salvage value to $2000 - Journalize the purchase Journalize year one's depreciation using the straight- line method What is the new depreciation amount beginning with year six? Date Accounts Retro lo al (bi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts