Question: 1 TFW LTE 9:15 PM Chapter 9 Activity 1 Fall 2020.doc Instructions: Journalize cach transaction below: Had oil changed and tires rotated on Truck for

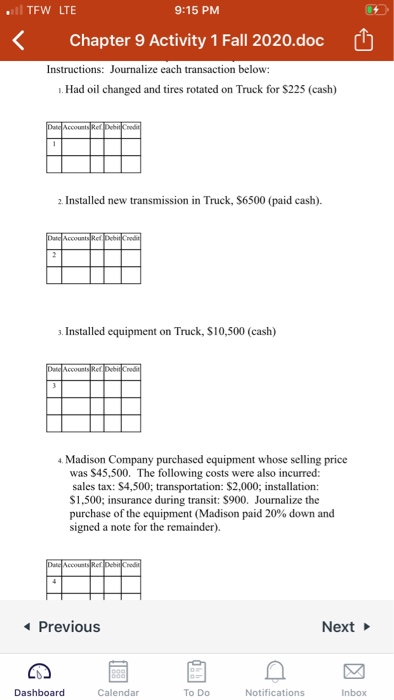

1 TFW LTE 9:15 PM Chapter 9 Activity 1 Fall 2020.doc Instructions: Journalize cach transaction below: Had oil changed and tires rotated on Truck for $225 (cash) Date Accounts Red Debit Credit 1 2. Installed new transmission in Truck, S6500 (paid cash). Date Accounts Red Dot Credit 2 3. Installed equipment on Truck, S10,500 (cash) Date Accounts Red Debit Credit 3 4 Madison Company purchased equipment whose selling price was $45,500. The following costs were also incurred: sales tax: $4,500; transportation: $2,000; installation: $1,500; insurance during transit: $900. Journalize the purchase of the equipment (Madison paid 20% down and signed a note for the remainder). Date AccountRelated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts