Question: 1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt and equity, where

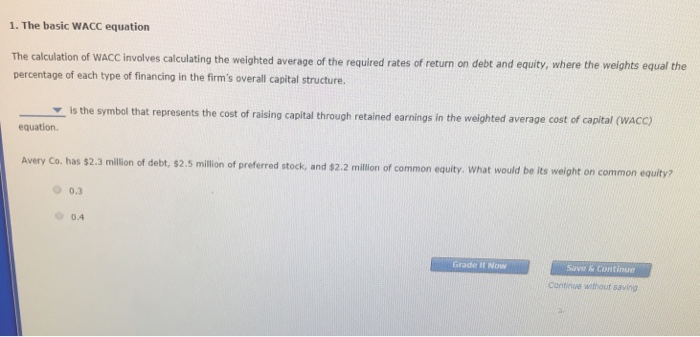

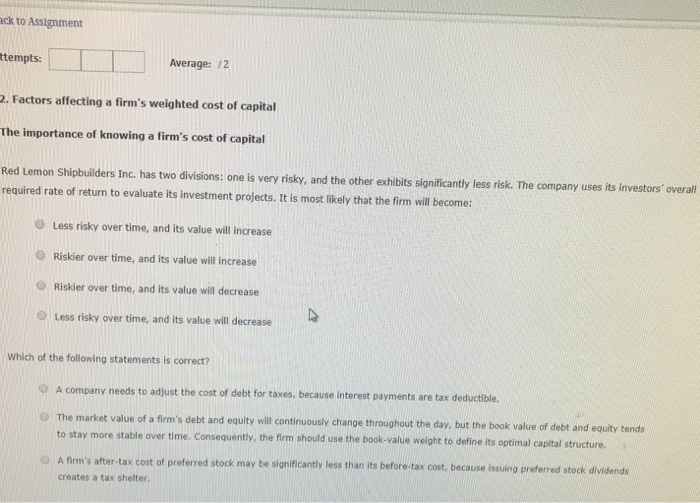

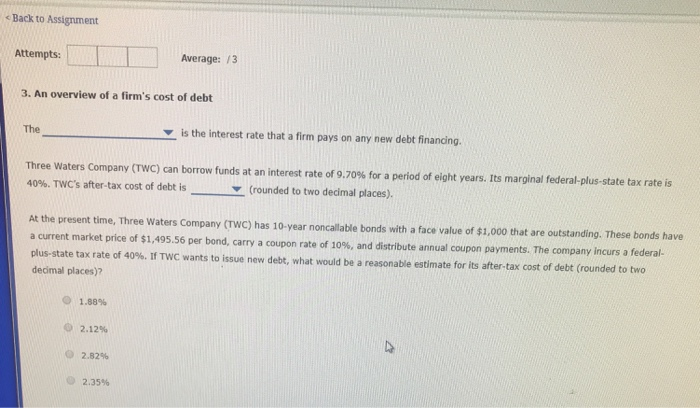

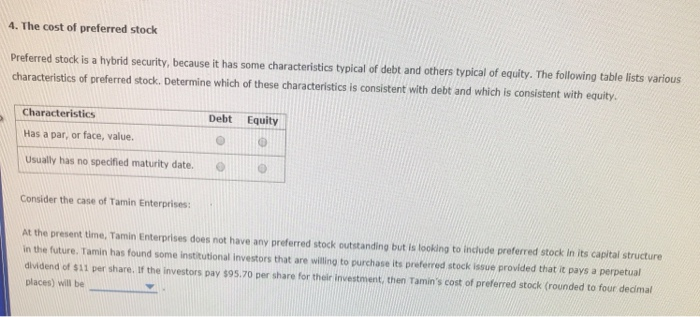

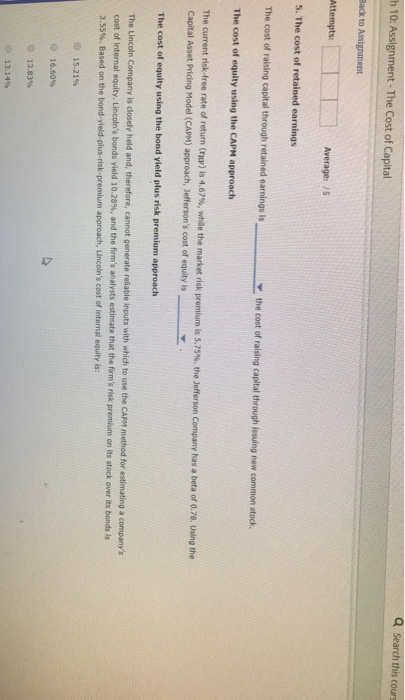

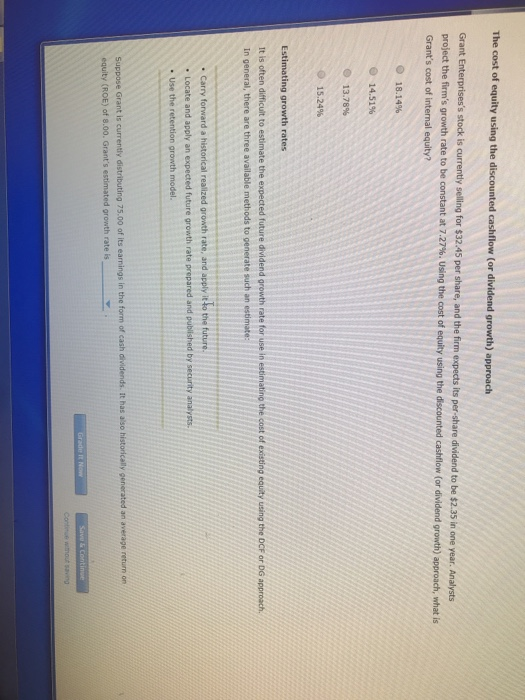

1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt and equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. t represents the cost of raising capital through retained earnings in the weighted average cost of capital (wACC) equation. Avery Co. has $2.3 million of debt, $2.5 million of preferred stock, and $2.2 millin of common equity, what w od stock, and s2.2 million of common equity. What would be its weight on common equity? 0.3 0.4 Grade It Now Save &Continue Continue without saving ack to Assignment ttempts: Average: /2 2. Factors affecting a firm's weighted cost of capital The importance of knowing a firm's cost of capital Red Lemon Shipbuilders Inc. has two divisions: one is very risky, and the other exhibits significantly less risk. The company uses its in required rate of return to evaluate its investment projects. It is most likely that the firm will become: O Less risky over time, and its value will increase O Riskier over time, and its value will increase O Riskier over time, and its value will decrease O Less risky over time, and its value will decrease Which of the following statements is correct? A company needs to adjust the cost of debt for taxes, because interest pavments are tax deductible. market value of a firm's debt and equity will continuously change throughout the dav, but the book value of debt and equity tends to stay more stable over time. Consequently, the firm should use the book-value weight to define its optimal capital structure. O The less than its before-tax cost, because issuing preferred stock dividends creates a tax shelter Back to Assignment Average: /3 Attempts: 3. An overview of a firm's cost of debt is the interest rate that a firm pays on any new debt financing. The Three Waters Company (TWC) can borrow funds at an interest rate of 9.70% for a period of eight years. Its marginal federal-plus-state tax rate is after-tax cost of debt isrounded to two decimal places). At the present time, Three Waters Company (TWc) has 10-year noncallable bonds with a face value of $1,000 that are ou a current market price of $1,495.56 per bond, carry a coupon rate of 10%, and distribute annual coupon payments. The company incurs a federal- plus-state tax rate of 40%. If TWC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? 1.88% 2.12% 2.82% 2.35% h 10: Assignment-The Cost of Capital Average: S 5. The cost of retained earnings The cost of raising capital through retained earnings is v the cost of raising capital through issuing new common stock The cost of equity using the CAPM approach The current risk-free rate of return (ny) is 4.67%, whae the market risk premium is 5.75%, the Jefferson Company has a beta of 0.78. Using the Capital Asset Pricing Model (CAPM) approach, Jefferson's cost of equity isY The cost of equity using the bond yield plus risk premium approach The Lincoln Company is dosely held and cost of internal equity. Lincoln's bonds yield 10.28%, and the firm's analysts estimate that the firm's risk premium on its stock over its bonds is 3,55%. Based on the bond-yield-plus-risk-premium approach, uncoln's cost of internal equity is: d, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a companys 15.21% 16.60% 13.83% 13.14% Grant Enterprises's stock is currently project the firm's growth rate to be constant at 7.27%. the cost of equity using the discounted cashflow (or dividend growth) approach, what is Estimating growth rates . Carry . Locate and apply an expected future growth rate prepared and published by security analysts. 1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt and equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. t represents the cost of raising capital through retained earnings in the weighted average cost of capital (wACC) equation. Avery Co. has $2.3 million of debt, $2.5 million of preferred stock, and $2.2 millin of common equity, what w od stock, and s2.2 million of common equity. What would be its weight on common equity? 0.3 0.4 Grade It Now Save &Continue Continue without saving ack to Assignment ttempts: Average: /2 2. Factors affecting a firm's weighted cost of capital The importance of knowing a firm's cost of capital Red Lemon Shipbuilders Inc. has two divisions: one is very risky, and the other exhibits significantly less risk. The company uses its in required rate of return to evaluate its investment projects. It is most likely that the firm will become: O Less risky over time, and its value will increase O Riskier over time, and its value will increase O Riskier over time, and its value will decrease O Less risky over time, and its value will decrease Which of the following statements is correct? A company needs to adjust the cost of debt for taxes, because interest pavments are tax deductible. market value of a firm's debt and equity will continuously change throughout the dav, but the book value of debt and equity tends to stay more stable over time. Consequently, the firm should use the book-value weight to define its optimal capital structure. O The less than its before-tax cost, because issuing preferred stock dividends creates a tax shelter Back to Assignment Average: /3 Attempts: 3. An overview of a firm's cost of debt is the interest rate that a firm pays on any new debt financing. The Three Waters Company (TWC) can borrow funds at an interest rate of 9.70% for a period of eight years. Its marginal federal-plus-state tax rate is after-tax cost of debt isrounded to two decimal places). At the present time, Three Waters Company (TWc) has 10-year noncallable bonds with a face value of $1,000 that are ou a current market price of $1,495.56 per bond, carry a coupon rate of 10%, and distribute annual coupon payments. The company incurs a federal- plus-state tax rate of 40%. If TWC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? 1.88% 2.12% 2.82% 2.35% h 10: Assignment-The Cost of Capital Average: S 5. The cost of retained earnings The cost of raising capital through retained earnings is v the cost of raising capital through issuing new common stock The cost of equity using the CAPM approach The current risk-free rate of return (ny) is 4.67%, whae the market risk premium is 5.75%, the Jefferson Company has a beta of 0.78. Using the Capital Asset Pricing Model (CAPM) approach, Jefferson's cost of equity isY The cost of equity using the bond yield plus risk premium approach The Lincoln Company is dosely held and cost of internal equity. Lincoln's bonds yield 10.28%, and the firm's analysts estimate that the firm's risk premium on its stock over its bonds is 3,55%. Based on the bond-yield-plus-risk-premium approach, uncoln's cost of internal equity is: d, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a companys 15.21% 16.60% 13.83% 13.14% Grant Enterprises's stock is currently project the firm's growth rate to be constant at 7.27%. the cost of equity using the discounted cashflow (or dividend growth) approach, what is Estimating growth rates . Carry . Locate and apply an expected future growth rate prepared and published by security analysts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts