Question: 1. The following graph represents the hedging options for an accounts receivable in British pounds. Give the correct hedging decision for each of the following

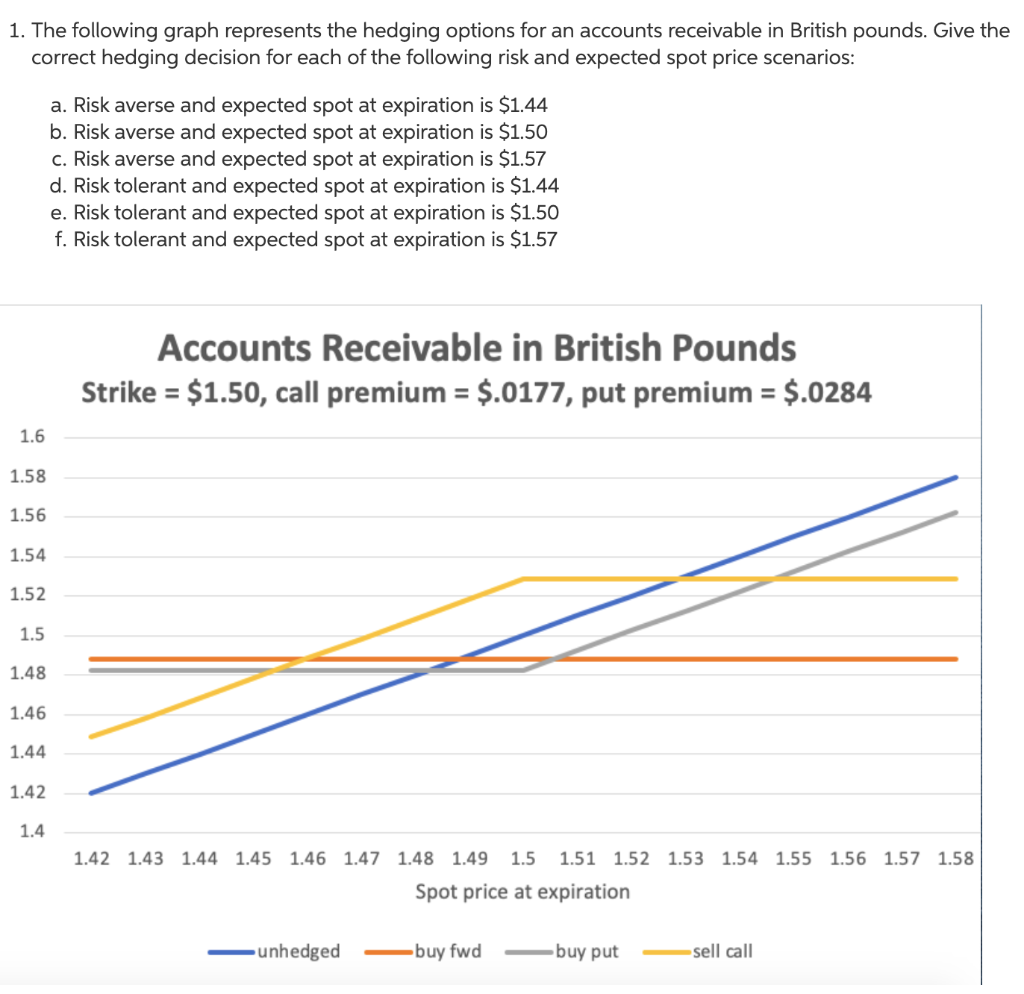

1. The following graph represents the hedging options for an accounts receivable in British pounds. Give the correct hedging decision for each of the following risk and expected spot price scenarios: a. Risk averse and expected spot at expiration is $1.44 b. Risk averse and expected spot at expiration is $1.50 c. Risk averse and expected spot at expiration is $1.57 d. Risk tolerant and expected spot at expiration is $1.44 e. Risk tolerant and expected spot at expiration is $1.50 f. Risk tolerant and expected spot at expiration is $1.57 Accounts Receivable in British Pounds Strike = $1.50, call premium = $.0177, put premium = $.0284 1.6 1.58 1.56 1.54 1.52 1.5 1.48 1.46 1.44 1.42 1.4 1.42 1.43 1.44 1.45 1.46 1.47 1.48 1.49 1.5 1.51 1.52 1.53 1.54 1.55 1.56 1.57 1.58 Spot price at expiration -unhedged -buy fwd buy put sell call 1. The following graph represents the hedging options for an accounts receivable in British pounds. Give the correct hedging decision for each of the following risk and expected spot price scenarios: a. Risk averse and expected spot at expiration is $1.44 b. Risk averse and expected spot at expiration is $1.50 c. Risk averse and expected spot at expiration is $1.57 d. Risk tolerant and expected spot at expiration is $1.44 e. Risk tolerant and expected spot at expiration is $1.50 f. Risk tolerant and expected spot at expiration is $1.57 Accounts Receivable in British Pounds Strike = $1.50, call premium = $.0177, put premium = $.0284 1.6 1.58 1.56 1.54 1.52 1.5 1.48 1.46 1.44 1.42 1.4 1.42 1.43 1.44 1.45 1.46 1.47 1.48 1.49 1.5 1.51 1.52 1.53 1.54 1.55 1.56 1.57 1.58 Spot price at expiration -unhedged -buy fwd buy put sell call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts