Question: 2. The following graph represents the hedging options for an accounts payable in British pounds. Give the correct hedging decision for each of the following

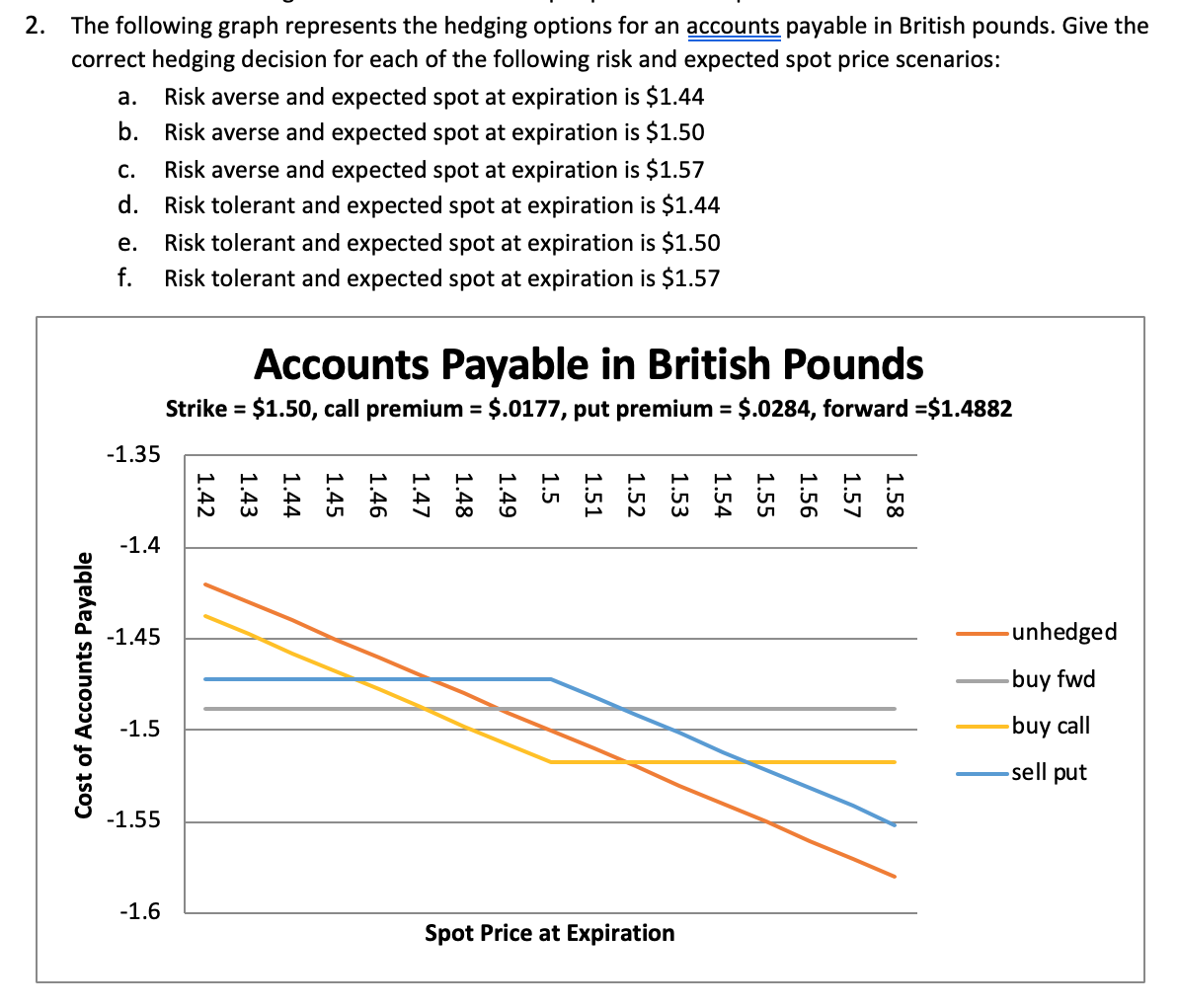

2. The following graph represents the hedging options for an accounts payable in British pounds. Give the correct hedging decision for each of the following risk and expected spot price scenarios: a. Risk averse and expected spot at expiration is $1.44 b. Risk averse and expected spot at expiration is $1.50 C. Risk averse and expected spot at expiration is $1.57 d. Risk tolerant and expected spot at expiration is $1.44 e. Risk tolerant and expected spot at expiration is $1.50 f. Risk tolerant and expected spot at expiration is $1.57 Accounts Payable in British Pounds Strike = $1.50, call premium = $.0177, put premium = $.0284, forward =$1.4882 -1.35 1.42 1.43 1.44 1.45 1.46 1.47 1.48 1.49 1.5 1.51 1.52 1.53 1.54 1.55 1.56 1.57 1.58 -1.4 -1.45 -unhedged Cost of Accounts Payable buy fwd -1.5 buy call sell put -1.55 -1.6 Spot Price at Expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts