Question: 1. The following items are accounting changes and errors. 1) Changed the residual value of an asset. 2) Changed percentages of uncollectibility of accounts receivable

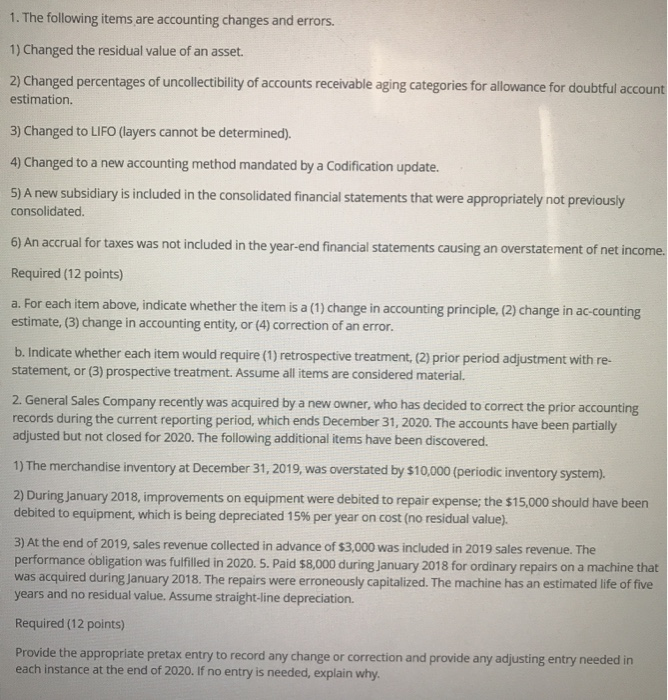

1. The following items are accounting changes and errors. 1) Changed the residual value of an asset. 2) Changed percentages of uncollectibility of accounts receivable aging categories for allowance for doubtful account estimation 3) Changed to LIFO (layers cannot be determined). 4) Changed to a new accounting method mandated by a Codification update. 5) A new subsidiary is included in the consolidated financial statements that were appropriately not previously consolidated. 6) An accrual for taxes was not included in the year-end financial statements causing an overstatement of net income. Required (12 points) a. For each item above, indicate whether the item is a (1) change in accounting principle, (2) change in ac-counting estimate, (3) change in accounting entity, or (4) correction of an error. b. Indicate whether each item would require (1) retrospective treatment, (2) prior period adjustment with re- statement, or (3) prospective treatment. Assume all items are considered material. 2. General Sales Company recently was acquired by a new owner, who has decided to correct the prior accounting records during the current reporting period, which ends December 31, 2020. The accounts have been partially adjusted but not closed for 2020. The following additional items have been discovered. 1) The merchandise inventory at December 31, 2019, was overstated by $10,000 (periodic inventory system). 2) During January 2018, improvements on equipment were debited to repair expense; the $15,000 should have been debited to equipment, which is being depreciated 15% per year on cost (no residual value). 3) At the end of 2019, sales revenue collected in advance of $3,000 was included in 2019 sales revenue. The performance obligation was fulfilled in 2020. 5. Paid $8,000 during January 2018 for ordinary repairs on a machine that was acquired during January 2018. The repairs were erroneously capitalized. The machine has an estimated life of five years and no residual value. Assume straight-line depreciation. Required (12 points) Provide the appropriate pretax entry to record any change or correction and provide any adjusting entry needed in each instance at the end of 2020. If no entry is needed, explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts