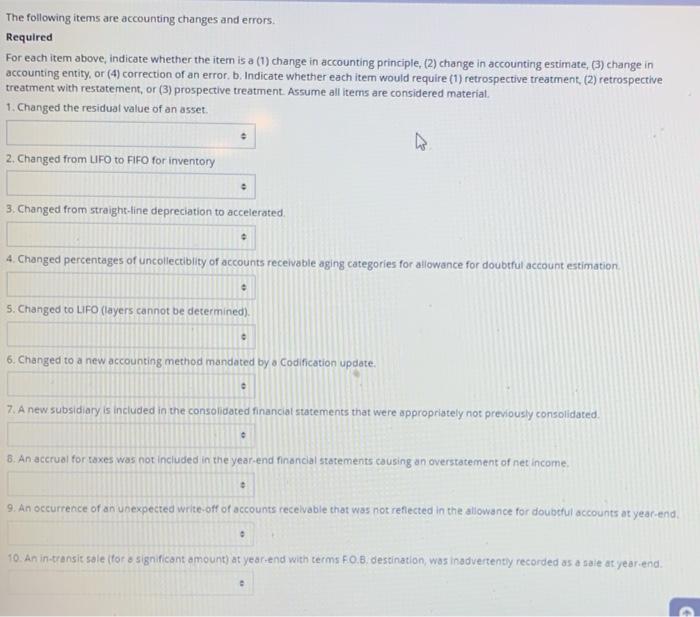

Question: The following items are accounting changes and errors. Required For each item above, indicate whether the itern is a (1) change in accounting principle, (2)

The following items are accounting changes and errors. Required For each item above, indicate whether the itern is a (1) change in accounting principle, (2) change in accounting estimate, (3) change in accounting entity, or (4) correction of an error, b. Indicate whether each item would require (1) retrospective treatment, (2) retrospective treatment with restatement, or (3) prospective treatment. Assume all items are considered material. 1. Changed the residual value of an asset. 2. Changed from UFO to FIFO for inventory 3. Changed from straight-line depreciation to accelerated. 4. Changed percentages of uncollectiblity of accounts receivable aging categories for allowance for doubtful account estimation e 5. Changed to LIFO (layers cannot be determined). . 6. Changed to a new accounting method mandated by o Codification update 7. A new subsidiary is included in the consolidated financial statements that were appropriately not previously consolidated e 8. An accrual for taxes was not included in the year-end financial statements causing an overstatement of net income. 9. An occurrence of an unexpected write-off of accounts receivable that was not reflected in the allowance for doubtful accounts at year-end . 10. An in-transit sale for a significant amount) at year-end with terms F0. B. destination was inadvertently recorded as a sale at year.end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts