Question: 1. The price level, earnings, and return data are given in real terms in units of December 31, 2012, dollars) in Exhibit 2. Why is

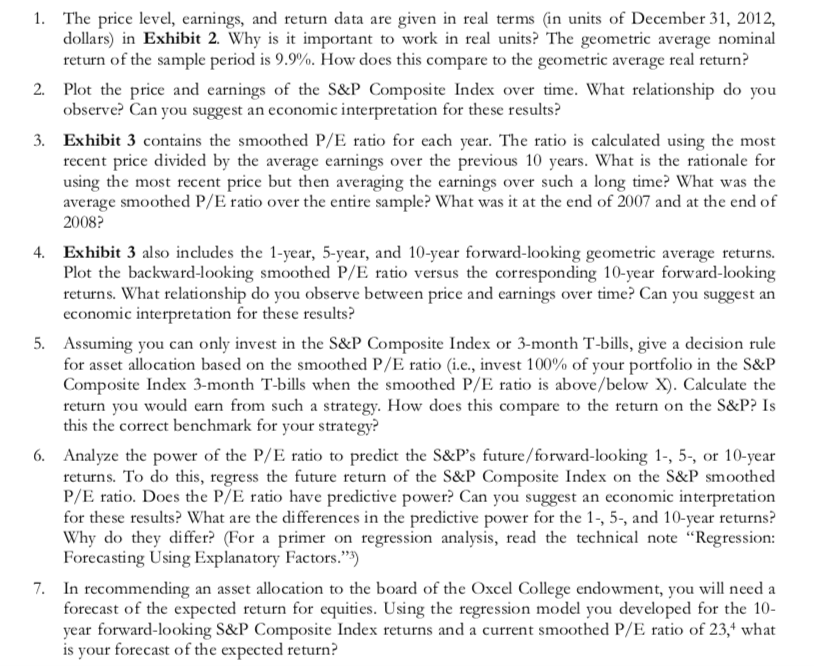

1. The price level, earnings, and return data are given in real terms in units of December 31, 2012, dollars) in Exhibit 2. Why is it important to work in real units? The geometric average nominal return of the sample period is 9.9%. How does this compare to the geometric average real return? 2. Plot the price and earnings of the S&P Composite Index over time. What relationship do you observe? Can you suggest an economic interpretation for these results? 3. Exhibit 3 contains the smoothed P/E ratio for each year. The ratio is calculated using the most using the most recent price but then averaging the earnings over such a long time? What was the average smoothed P/E ratio over the entire sample? What was it at the end of 2007 and at the end of Exhibit 3 also includes the 1-year, 5-year, and 10-year forward-looking geometric average returns. Plot the backward-looking smoothed P/E ratio versus the corresponding 10-year forward-looking returns. What relationship do you observe between price and earnings over time? Can you suggest an economic interpretation for these results? 5. Assuming you can only invest in the S&P Composite Index or 3-month T-bills, give a decision rule for asset allocation based on the smoothed P/E ratio (i.e., invest 100% of your portfolio in the S&P Composite Index 3-month T-bills when the smoothed P/E ratio is above/below X). Calculate the return you would earn from such a strategy. How does this compare to the return on the S&P? Is this the correct benchmark for your strategy? 6. Analyze the power of the P/E ratio to predict the S&P's future/forward-looking 1., 5., or 10-year returns. To do this, regress the future return of the S&P Composite Index on the S&P smoothed P/E ratio. Does the P/E ratio have predictive power? Can you suggest an economic interpretation for these results? What are the differences in the predictive power for the 1., 5., and 10-year returns? Why do they differ? (For a primer on regression analysis, read the technical note "Regression: Forecasting Using Explanatory Factors.") 7. In recommending an asset allocation to the board of the Oxcel College endowment, you will need a forecast of the expected return for equities. Using the regression model you developed for the 10- year forward-looking S&P Composite Index returns and a current smoothed P/E ratio of 23,4 what is your forecast of the expected return? 1. The price level, earnings, and return data are given in real terms in units of December 31, 2012, dollars) in Exhibit 2. Why is it important to work in real units? The geometric average nominal return of the sample period is 9.9%. How does this compare to the geometric average real return? 2. Plot the price and earnings of the S&P Composite Index over time. What relationship do you observe? Can you suggest an economic interpretation for these results? 3. Exhibit 3 contains the smoothed P/E ratio for each year. The ratio is calculated using the most using the most recent price but then averaging the earnings over such a long time? What was the average smoothed P/E ratio over the entire sample? What was it at the end of 2007 and at the end of Exhibit 3 also includes the 1-year, 5-year, and 10-year forward-looking geometric average returns. Plot the backward-looking smoothed P/E ratio versus the corresponding 10-year forward-looking returns. What relationship do you observe between price and earnings over time? Can you suggest an economic interpretation for these results? 5. Assuming you can only invest in the S&P Composite Index or 3-month T-bills, give a decision rule for asset allocation based on the smoothed P/E ratio (i.e., invest 100% of your portfolio in the S&P Composite Index 3-month T-bills when the smoothed P/E ratio is above/below X). Calculate the return you would earn from such a strategy. How does this compare to the return on the S&P? Is this the correct benchmark for your strategy? 6. Analyze the power of the P/E ratio to predict the S&P's future/forward-looking 1., 5., or 10-year returns. To do this, regress the future return of the S&P Composite Index on the S&P smoothed P/E ratio. Does the P/E ratio have predictive power? Can you suggest an economic interpretation for these results? What are the differences in the predictive power for the 1., 5., and 10-year returns? Why do they differ? (For a primer on regression analysis, read the technical note "Regression: Forecasting Using Explanatory Factors.") 7. In recommending an asset allocation to the board of the Oxcel College endowment, you will need a forecast of the expected return for equities. Using the regression model you developed for the 10- year forward-looking S&P Composite Index returns and a current smoothed P/E ratio of 23,4 what is your forecast of the expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts